One figure encapsulates the stress in the U.S. fighter jet marketplace: Lockheed Martin logged $1.8 billion in second-quarter losses and owes the IRS $4.6 billion, even as it is about to produce up to 190 F-35s in 2025. For defense industry experts and aerospace investors, the tale of these figures tells of a program caught in the intersection of technological reach, financial pressure, and evolving military priorities.

1. F-35 Delivery Projections and Congressional Tact

Lockheed Martin’s anticipated delivery of 170 to 190 F-35s in 2025 is against the backdrop of variable Department of Defense (DoD) orders and congressional meddling. The Pentagon’s draft budget for 2026 asked only for 47 F-35s, a drastic cut from earlier years, as the Air Force and Navy focus on next-generation platforms.

But congressional committees are resisting: the House Appropriations Committee is debating 69 planes, and the Senate Armed Services Committee favors 57. The National Defense Authorization Act for 2025 would permit the acquisition of 68 F-35s, but holds back 20 jets until the Pentagon sorts out ongoing program problems. This dynamic highlights the F-35 as a political and industrial benchmark, with buying numbers riding on technical advances and budgetary bargains.

2. Financial Tailwinds: Losses and Liabilities

Lockheed’s second-quarter results rocked the industry. The $1.8 billion loss carried a $950 million charge against a classified Skunk Works program, associated with design, integration, and test difficulties compelling the company to remake management and review practices. CFO Evan Scott said, “the further reach-forward charge was estimated based on many future years of fixed-price contract commitments.” The company also has a $4.6 billion IRS dispute regarding a tax accounting approach adjustment, with $100 million in interest accruing as it fights the assessment. These budget headwinds have been added to by F-35 Lots 18 and 19 contract delays and tariff effects, reducing Lockheed’s operating cash flow to a mere $150 million for the quarter.

3. The Technology Refresh 3 Bottleneck and Block 4 Rollout

F-35 delivery schedules were significantly derailed by problems with the Technology Refresh 3 (TR-3) upgrade, which suspended deliveries for a year. TR-3 is the cornerstone of the Block 4 modernization, featuring a new integrated core processor that packs 25 times more computational power than the original. It facilitates advanced sensor fusion, AI-driven decision-making, and high-bandwidth data processing. The hiatus ended in mid-2024, and Lockheed has delivered 207 aircraft since then. CEO Jim Taiclet assured, “Earlier this month, we fielded new software to the fleet in continuing to mature and field next-generation block four capabilities. This is an update that enhances the pilot interface and adds some additional weapons and electronic warfare capabilities.” But certification for full TR-3 capability might not come until as late as early 2026, which is troubling to military and congressional constituents.

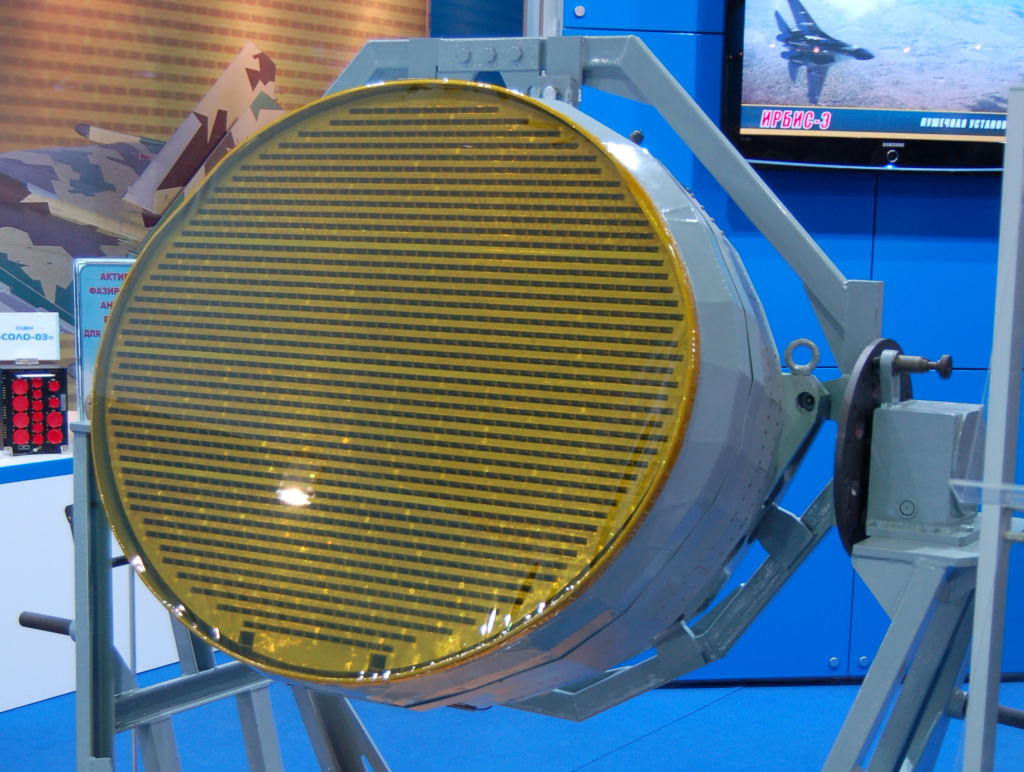

4. Block 4: The Next Leap in Combat Capability

Block 4 is a comprehensive modernization, adding the AN/APG-85 AESA radar for greater detection range and electronic warfare capability, Raytheon’s Next-Generation Distributed Aperture System for enhanced situational awareness, and enhanced electronic support measures. Weapons integration is a focal point: Block 4 supports the use of the AIM-260 Joint Advanced Tactical Missile, MBDA Meteor, AGM-88G AARGM-ER, and the Joint Strike Missile, while boosting internal missile capacity with the Sidekick rack. The update also adds improvements to the AN/ASQ-239 Barracuda electronic warfare system and adds the ThNDR laser-based countermeasure system. Propulsion enhancements through the Pratt & Whitney F135 Engine Core Upgrade provide 50% additional cooling capacity to power such new systems. As Lockheed’s F-35 program manager Chauncey McIntosh puts it, “TR-3 provides the computing resources this plane needs to move us into the next generation.”

5. International Demand and Combat Validation

Amid American procurement instability, global demand for the F-35 is strong. The United Kingdom has said it will be purchasing an additional 12 F-35As, Belgium will be purchasing 11, and Denmark is considering extra purchases. The performance of the aircraft was also recently seen in Operation Midnight Hammer, where F-35s and F-22s spearheaded an attack on Iranian nuclear facilities. Taiclet stressed, “Pilots operating the F-35 Lightning II and F-22 Raptor stealth fighters were at the helm of the operation, delivering the air superiority and defense suppression necessary for the bombers to penetrate Iran’s hardened nuclear targets.” The operation underlined the F-35’s management of assets in air, sea, and space, affirming its place as a unifier of allied airpower.

6. The F-35 as a Bridge to the F-47 and Next-Gen Dominance

With Boeing’s F-47 Next Generation Air Dominance (NGAD) fighter decades away from deployment, Lockheed is marketing the F-35 as the bridge to sixth-generation capability. Taiclet described the company’s pivot: “We’re going to port a lot of our own NGAD R&D over to the F-35 and potentially over to the F-22 as well.” The goal is to deliver 80 percent of sixth-generation effectiveness at 50 percent of the cost per unit, leveraging “fifth-generation-plus” upgrades that include electronic warfare, networking, and autonomy enhancements. This plan is to maintain the F-35 as a “best-value choice” for the U.S. and its allies through until F-47 achieves operational maturity.

7. Advanced Manufacturing and the Digital Thread

The production of the F-35 is a demonstration of Industry 4.0 concepts, with digital twin technology and a “digital thread” strategy bridging design, manufacture, and sustainment. As Don Kinard, Senior Fellow for F-35 Production, stated, “We are moving radically from manual data collection to automated data which lets us observe the whole production process.” Automated drilling, fiber placement, and additive manufacturing have decreased costs while enhancing quality, while real-time data analytics provide predictive maintenance and supply chain optimization. The adoption of digital tools in worldwide facilities in Texas, Italy, and Japan created a dynamic feedback loop, enabling Lockheed to configure production and sustainment to the realities of operations.

This year will put to the test whether Lockheed’s technical remedies, digital innovations, and congressional arms-length bargaining can coalesce to bring to fruition the F-35’s promise both as a weapons platform and as a business opportunity for the world’s largest defense contractor.