A promise may be the insignia on a recipient: a sparseness of tolerances, metallurgy, a factory culture in which defects were regarded as individual dishonour. The gun business of the U.S. has ever since agreed with the ownership turnover, high velocity merchandise, the supply chain that is able to traverse continents even prior to a round of the chamber being chambered.

Shoppers have been also taught to be less patient. There is not much of a rush to make do when in 2023 alone some 5,845,019 guns have been imported into the U.S. so no one is in a hurry to make their own when a particular line of models is being said to be of roughly machined, roughly fitted, or with concerns about its safety systems. What has been learned is a less verbal twist in the counter: brand name is no longer the only thing that can be closed with but it is not the thing that can be closed with anymore.

1. Remington

The credibility problem of Remington that exists at the present is the one, which is associated with two objects that can be felt immediately by the shooters triggers and finish. The most famous bolt gun in the brand was referred to as the infamous one in relation to controversy of the Walker Fire Control system whereby it was argued that some of the rifles could even shoot without pulling a trigger. The issue had ceased to be internet mythology, in 2017, a case alleging the so-called trigger defects was surrounded by a final court order in accordance with a case in which more than 7 million guns were involved.

This history will be here to remain because it preconditioned buyers to consider production times as opposed to brand families. Even seasoned shoppers who are aware of the presence of a Remington long gun on the rack would look at some marks, look at the trigger group, and mechanical consistency in general before stroking the rollmark like using it as a reassurance.

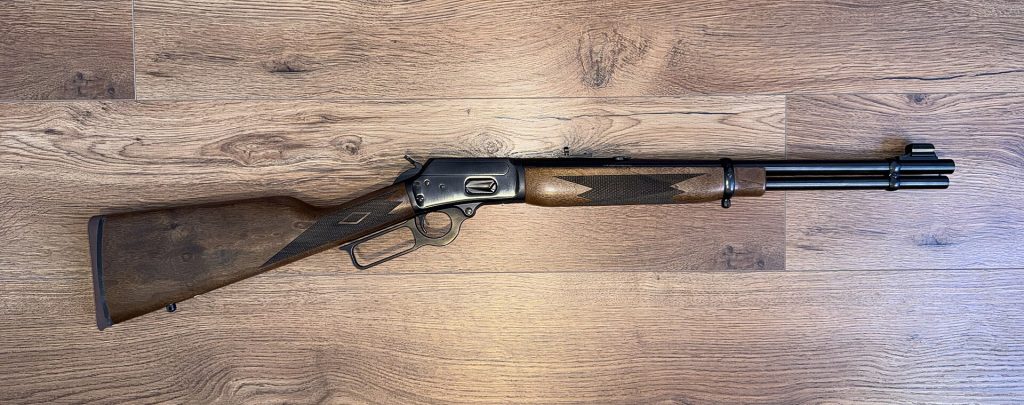

2. Marlin

This gap of trust between Marlin was made in a too specific manner: owners of lever-guns were accustomed to a given phase of manufacture of a factory transfer, when more complaints were made to the tool marks, wood-to-metal fit, and taking in actions that were no longer comparable to the old rifles. This reputation is difficult to reverse because the group of products that is lever action is one that receives treatment and emotional expectation.

Newer Ruger rifles were reported to be of better material by other shooters who owned Ruger and when Ruger presented its financial reports in the first quarter of 2011, reported the sale of new firearms, including new Ruger rifles as well as Marlin lever-action models, amounting to 40.7 million in total. The technical recover is possible and the buying behavior is still fearful.

3. Colt

Colt always has a good connotation i.e. clean gun, good operation, and the kind of finish that is just before the first range session. As up-to-date examples are being delivered to mixed performance, the disappointment is more appalling because the customer had invested at least emotionally in having the idea of Colt being the norm. The outcome is the model by model reality. Has Colt lost its stingingness compar To Which Colt QC reputation where run?

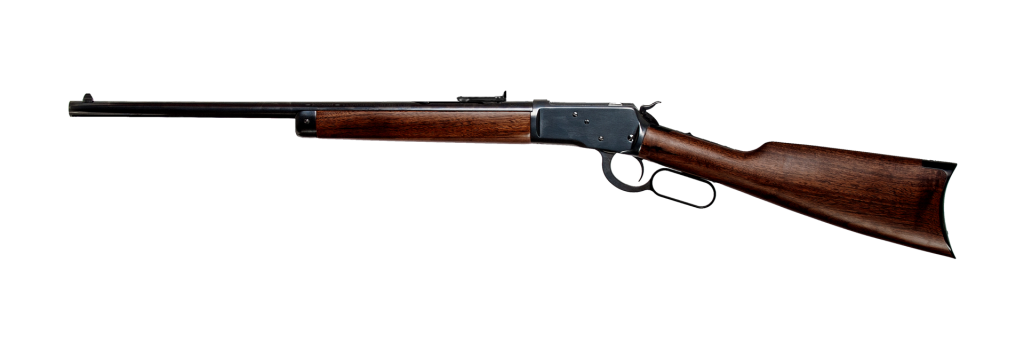

4. Winchester

Winchester does not face an issue that the traditional rifles stopped being traditional but it is that the brand heritage might cloud the diversity of the contemporary production is across lines and production setups. The installation of behavior in-store suggests that: customers tend to scrutinize provenance and provenance prior to being able to make assumptions that the rifle that they are holding was of the same family legacy as the name they were given implies. That split glory as history, as recognized, as halo present, as fluctuating propels the buyers out of the sphere of nostalgia and into the sphere of documentation.

5. Mossberg

Mossberg has remained in its traditional roots of the pump shotguns and the company is again a high volume producer; in the industry data, 253,633 shotguns were produced in 2023. Scale is one of the aspects of the brand appeal, but it also means that the expansion of the line will be viewed in the nearest future.

At the time that Mossberg broadened its product range to cover more low-end priced rifles and pistols, a small number of buyers were already segregating the uniformity of the 500/590 range to new categories when the components and quality can be different. The brand name is still strong but it is no longer used as a blanket cover across the entire menu.

6. Smith & Wesson

The image of Smith and Wesson now represents a number of different identities at once: the tradition of revolver feel and finish, and a modern, high-output manufacturer whose products can be counted upon to perform their functions without necessarily being so polished as the same articles used to be in earlier times. That differentiation is significant in that many consumers are not simply considering how well it works; they are considering their sense of whether the gun feels like the brand story they have been told.

People can also experience the strain that the manufacturing industry currently face in the softer times in terms of public disclosures; it is projected that Smith and Wesson are to produce 474.7 million in net sales in the fiscal 2025. In practice the buyers are growing more and more differentiated between shop and will it run and does it feel like the old standard.

7. Savage Arms

Savage developed a following of customers based on precision-per-dollar specifically with the entry-level hunting rifles. Part of the new-fangled criticism, however, has been of a new sort of inquiry: trust in the safety systems in real practice. The other one that has been extensively reported on which involved an Axis II that had an internal test terminology such as; MID SAFE and FIRES ON SAFE and claimed that it had more than 800, 000 rifles on the street.

Any allegations of the conduct of a safety do something irreversible to the consumer behavior, in spite of the legal consequences. They distort what the buyers are looking at, how they are holding a rifle at the counter, and is the concept of good value accuracy what it purports to be the whole store.

8. Thompson/Center

Thompson/Center was losing its reputation in a different way: it was not a solitary window of infamous flaws but rather an inconsistency in a continuity. We created contender and encore, which were modular platforms, creating a deep level of loyalty since they were flexible, unlike most mainstream brands.

Once the ownership switch and production freeze transform barrels, small parts and frames into a treasure hunt, the brand ceases to be used as a default referral. Reliability incorporates support and supply, although the hardware may still be respected.

9. Kimber

Kimber remains a case study in variability colliding with expectation. The brand draws both enthusiastic owners and vocal critics, with complaints often focusing on finicky behavior, extractor problems, and customer-service frustration. The pattern that sticks is inconsistency: experiences differ enough that the name alone no longer signals what the individual pistol will do. In categories where buyers prize boring predictability, brand polarization can be its own form of reputational loss.

Across these brands, the common thread is not nostalgia; it is process. When manufacturing choices shift through ownership changes, factory moves, or aggressive expansion brand equity can outlast the decisions that originally earned it. In a market flooded with alternatives, “sure thing” reputations increasingly get replaced by narrower questions: which model, from which period, with what track record. The logo remains a starting point, not the final answer.”