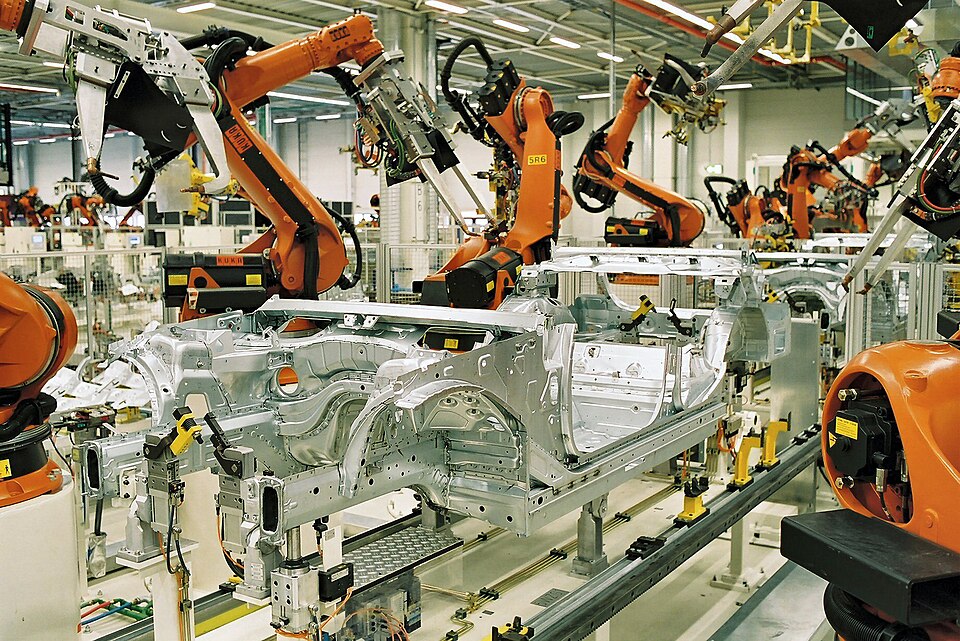

A picture of the average Chinese factory floor might resemble a carefully ballet-lilyan performance where robotic arms turn, weld, and assemble with micrometer accuracy, and self-guiding vehicles move noiselessly through the aisles. This is not a research floor, but rather the status quo of the global leader in manufacturing, which has been humming now for years with more than 2,027,000 industrial robots and accounts for 54% of international installations in the year 2024.

1. Scale and Density: The Metrics of Automation Leadership

China’s supremacy can be measured. In 2024, it added 295,000 new industrial robots, which is over six times the number added by Japan and almost nine times that added by the US. The robot density, measured by robots per 10,000 factory workers, reached 470, leaving the US behind and rapidly approaching Germany and Japan. This is a remarkable feat, considering that China has a massive number of factory workers, numbering 37 million, making it much tougher compared to other countries due to the mere number of installations.

2. Home Production Giants

Chinese robots for the first time comprised 57% of the total installed base in 2024, surpassing foreign brands in their own markets. ESTUN Automation, Siasun, and Efort Intelligent Robot have begun to offer heavy-duty robots capable of lifting over 1,000 kg after initial light-duty assembly robots. ESTUN’s 700 kg payload robot, which entered the market in 2024, sold over 100 copies, and SIASUN’s welding robots have achieved cycle times of only 2.2 seconds per spot weld. Efort’s painting robots complete work in just 80 seconds to paint one vehicle through automated painting systems that combine intelligent processing controls for painting and cleaning.

3. AI as Factory Brain

In the smart factories of companies like the Changping smart factory set up by the Chinese firm Xiaomi, internal AI systems like HyperIMP control and manage the production process via the orchestrated utilization of the 11 robotic production lines in the factory. Artificial intelligence-powered machine vision capabilities enable the detection of micodefects in the production process, ensuring overall production efficiency above 99.99 percent. The AI system enables the prediction and optimization of maintenance in the factory.

4. Manufacturing Engineering -Lights Out

China’s “dark factories” eliminate light, heating and cooling, and other infrastructure focused on human needs, streamlining layouts for robotic production. Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) utilize light beams and infrared sensors to deliver parts in pitch dark environments. At Jetour’s manufacturing plant, for example, these technologies have achieved 40% gains in logistics times and 100-second production times for every car rolled out. Gree Electric’s 5.5G-driven manufacturing facility utilizes AI and IoT technologies for immediate machine learning, increasing productivity by 86%.

5. Core Components: Constructing Robots from the Inside Out

Chinese robots’ supply chains make more than 40% of harmonic reducers used by Chinese robots domestically. The “muscles” of robots, their servo systems, are headed by companies such as Inovance Technology with their rotor production lines being fully automatic and with their stator production lines being 70% automatic. Smart controllers and high-performance drives for robots are increasingly being produced by Chinese companies with production levels exceeding 80% locally.

6. Government Strategy and Subsidies

“Made in China 2025″ and subsequent initiatives and policies have invested heavily in R&D and implementing automation. Subsidies in China and regionally, estimated to be in excess of 10 billion RMB per year, support Smart Manufacturing, particularly in SMEs. These investments spur adoption in industrial data connectivity, MES, PLM, and cybersecurity, to ensure mid-sized manufacturers can implement sophisticated robotics.

7. Labour Market Engineering Challenges

Longitudinal micro-data research indicates a one standard deviation increase in robot usage is associated with a 5 percentage point decrease in the probability of employment and an 8 percent decrease in hourly wages, although significant effects are found particularly in the low-skilled and older workforce. In contrast, younger workers increase their participation in technical training, while older workers increase early retirement rates. This trend is giving way to new job opportunities in the training of AI, robotics, IoT, and cybersecurity engineers who must know PLC programming, vision, and integrative problem-solving skills.

8. Global Supply Chain Impact

China’s automation evolvement is also impacting global supply chains as it is now capable of producing at lower costs and at higher speed. Industries for example related to EV and solar panels have the opportunity to mass produce through lights-out factories at an incredible rate that cannot be handled by any other country, as seen at Zeekr’s EV factory that produces 300,000 vehicles per annum, and it took Tesla over 10 years to reach this point.

9. The Future Pathway: AI-Based Manufacturing Ecosystems

Looking into the future horizon of 2035, China’s manufacturing clusters in the Yangtze River Delta Region and the Greater Bay Area are going to become “computational zones,” where the lines between physical manufacturing and computation blur. AI technology is set to serve as an operating system for industries, which in turn accelerates short-cycle innovation, designs developed in days.

Robotics, in this future, would aim to not only automate but reshape the process of product development, material science, and environmental technology integrating to form waste-free, self-healing industries. The robot revolution in China is a far-from-over achievement a dynamic change in engineering. The integration of scale, AI, component independence, and appropriate policies is laying a foundation for a global benchmarking of efficiency and adaptability of a completely different standard on a worldwide scale.