When Wall Street’s best minds start comparing today’s AI-driven stock mania to the dot-com bubble, it’s not mere nostalgia speaking it’s a cautionary tale. During the late 1990s, investors wagered heavily on the internet’s promise and saw trillions vanish when reality could not keep up with runaway hopes. Today, a similar saga is being repeated but on an even greater scale, with greater stakes and more gigantic numbers, and with much more complex technological moorings.

1. Valuations That Surpass the Dot-Com Epoch

Apollo Global Management chief economist Torsten Slok has made a blunt evaluation: “The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s.” The 12-month forward price-to-earnings (P/E) ratios for the AI-driven giants such as Nvidia, Microsoft, and Alphabet are now higher than at the peak of the dot-com frenzy. Slok’s calculation puts the top 10 S&P 500 stocks at a forward P/E multiple of about 25, a premium that surpasses even the most outlandish valuations of the dot.com boom era. This market value concentration is not just record-breaking but also indicates an extraordinary lack of connection to the fundamental profitability of these stocks.

2. The Concentration Risk: S&P 500’s AI-Driven Surge

The recent rise of the S&P 500 is disproportionately led by a small number of tech giants. The big winners include Nvidia, Microsoft, Apple, Amazon, Meta, Alphabet, and Tesla, which represent the lion’s share of the rise, producing a valuation gap between the top 10 and the remainder of the index even greater than it was during the dot-com bubble. This extreme dependence on a handful of AI-hungry companies brings enormous concentration risk to shareholders, as the fate of the larger market is now tied to the ongoing outperformance and untested profitability of these behemoths.

3. Survivorship and the Post-Bubble Environment

The leaders within the industry are growing more vocal in warning about the dangers of an AI bubble. Robin Li, Baidu CEO, has forecasted that “only around one percent of AI companies will survive if and when the bubble does burst.” The implication is obvious: whereas at present there is an abundance of capital available to fund AI initiatives in the market, most of them will not survive the inevitable correction. This culling is likely to result in a more stable, utility-based AI industry, where applications will be judged on their hard-won value rather than on hype.

4. The Hidden Costs: Energy and Compute Requirements

The enthusiam driving AI valuations tends to ignore the intimidating engineering and operational requirements that underlie the large-scale deployment of AI. The International Energy Agency reports that the demand for electricity from data centers globally may double in the period from 2022 to 2026, largely driven by the adoption of AI. It’s true, says MIT’s Vijay Gadepally, that “As we go from text to video to image, these AI models are becoming bigger and bigger, and so is their energy footprint.”

Generative AI models like GPT-4 demand a huge amount of computational power, and the training and inference phases both take humongous amounts of electricity. Data centers already account for 1% to 2% of global energy demand, a figure poised to skyrocket as AI workloads proliferate.

5. Data Center Engineering: Scaling for AI’s Appetite

The scramble to build data centers capable of supporting AI’s exponential growth is reshaping the infrastructure landscape. The U.S. data center market is projected to more than double by 2030, with power needs rising from 17 gigawatts to over 35 gigawatts. More aggressive predictions exist, forecasting a close to four times expansion to 83.5 GW by 2028. The rush has unleashed a land grab, power, and specialized equipment, with hyperscalers and cloud providers taking the reins. Density demands of AI workloads have never been higher, with the next generation of facilities designed to handle 100kW per rack or higher compared to legacy designs. Liquid cooling and large-capacity clusters are increasingly common.

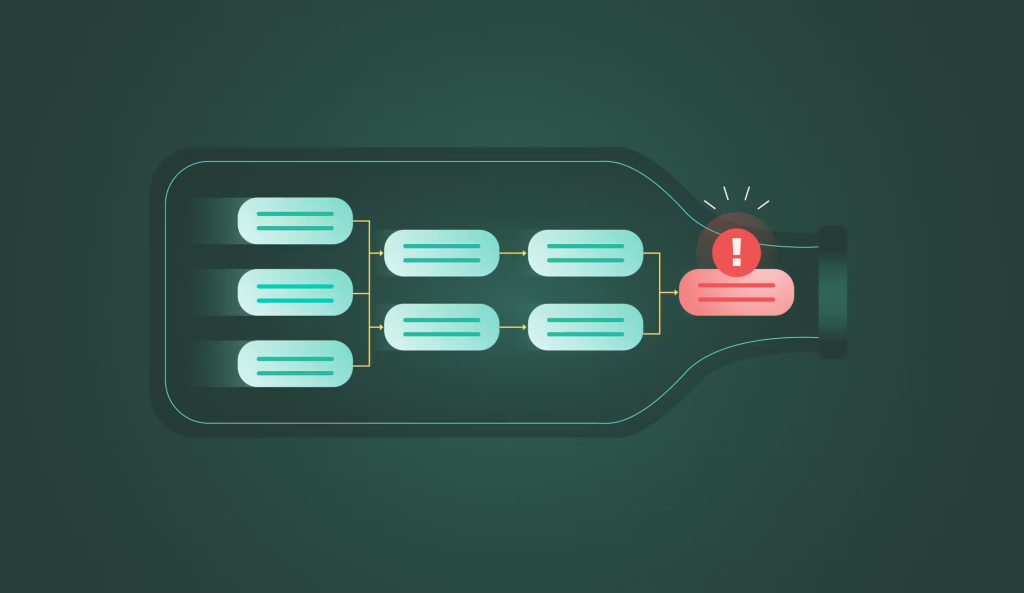

6. Hardware Bottlenecks and Supply Chain Risks

The hardware powering AI’s ascent GPUs, high-bandwidth memory (HBM), and advanced SSDs is in critically short supply. Nvidia’s H100 and AMD’s MI300 GPUs are backlogged for a year or more, with hyperscalers dominating allocations. HBM3 memory, essential for AI accelerators, faces six- to twelve-month lead times, and prices have surged 20–30% year-over-year. The supply chain is also stretched by regional concentration in Asia, where a disaster such as the 2024 Taiwan earthquake revealed vulnerabilities in global semiconductor supply chains. Geopolitical tensions and tariff risks loom large to exacerbate these blockages, driving up costs and lead times for key components.

7. The Sustainability Dilemma

As AI data centers become ubiquitous, their carbon footprint is coming under increased scrutiny. Meta and Microsoft are building new nuclear reactors, and Google plans to deploy $75 billion worth of AI infrastructure in 2025 alone. However, the carbon footprint of data center electricity is 48% above the U.S. average, and fossil fuels continue to supply a majority of it. Efforts to engineer hardware more efficiently and transition to renewables are commonly negated by the sheer volume of new deployments a time-honored “rebound effect.” As Anne-Laure Ligozat indicates, “This tends to cancel out any potential energy savings. My main argument is that AI should be used sparingly.”

The AI revolution is not merely a tale of record valuations and technological potential. It is a story of record energy consumption, infrastructural bottlenecks, and systemic perils that stretch far beyond the tech titans’ balance sheets. To investors, knowing the engineering realities of the AI boom is as important as following the next earnings report.