Putting Nvidia’s Jensen Huang, OpenAI’s Sam Altman, and China’s DeepSeek leadership on the cover as TIME’s “Architects of AI” Person of the Year is not merely symbolic. It crystallizes a year in which artificial intelligence has become a lever of geopolitical power, a driver of unprecedented infrastructure buildouts, and a catalyst for societal disruption. From Washington to Beijing, AI policy and industrial strategy are now inextricably linked with national security, energy grids, and the global economy.

1. AI as a Geopolitical Lever

US leadership in AI has rested, for the most part, on its monopoly over leading-edge semiconductors: Frontier chips from Nvidia, thought of by Chris McGuire of the Council on Foreign Relations as “the most complex device made by the most complex machines depending on the most complex supply chains in all of human history,” have been the backbone of military and intelligence use cases ranging from autonomous weapons to real-time battlefield analytics. Policy shifts under President Trump, however, moved policy toward less tight export controls on Nvidia’s H200 chips, closing the projected compute gap between the US and China from an estimated 20–50× advantage to near parity. Chinese firms such as Huawei and DeepSeek have managed to rival US models with architectural efficiencies despite using significantly less advanced hardware, and state-sponsored initiatives such as the AI+ plan intend to achieve 90% AI integration across China’s economy by 2030.

2. The Data Center Arms Race

But compute-hungry AI has done more than drive unit sales: it has triggered a hyperscale construction boom. Amazon, Microsoft, Google and Meta collectively committed $370 billion to new facilities in 2025 alone, with projects such as Meta’s 5-GW Hyperion in Louisiana set to eclipse the energy demands of lower Manhattan. By 2030, U.S. data centers could consume 8% of national electricity according to Goldman Sachs – double their 2023 share. The sheer engineering challenge is further compounded by sustainability concerns: training a single large model can emit 552 tons of CO₂, and inference workloads may account for as much as 90% of lifecycle energy use.

3. Financing the AI Buildout: Debt and Circular Deals

Thus, AI infrastructure hyperscalers have been pushed into complicated financing structures by capital intensity. Special-purpose vehicles, à la Enron-era creativity, enable companies such as Meta to avoid multibillion-dollar data center debt on balance sheets. Further, inflation of valuations papers over real demand via circular investment loops, wherein Nvidia invests in OpenAI, which buys Nvidia chips for Oracle-constructed data centers. CoreWeave serves as emblematic of the sector’s fragility: it operates with $14 billion of debt on $5 billion in revenue, dependent on a smattering of interlinked customers and suppliers. And should those AI ROI projections start to falter, the arrangements could precipitate a 2008-style credit crisis, warn analysts.

4. Energy Innovation and Grid Constraints

The power needs of AI drive innovation in generation and grid integration. Emerging strategies now include colocating the data centers with existing plants, accelerated interconnection via programs such as ERCOT’s Controllable Load Resource, and on-site generation. Next-generation nuclear-including Small Modular Reactors-and geothermal projects are gaining traction, and private capital is also surging 13× year-over-year for advanced nuclear. Fusion research, facilitated by AI-driven simulation, is inching toward commercialization in the 2030s that could resolve the looming energy crunch.

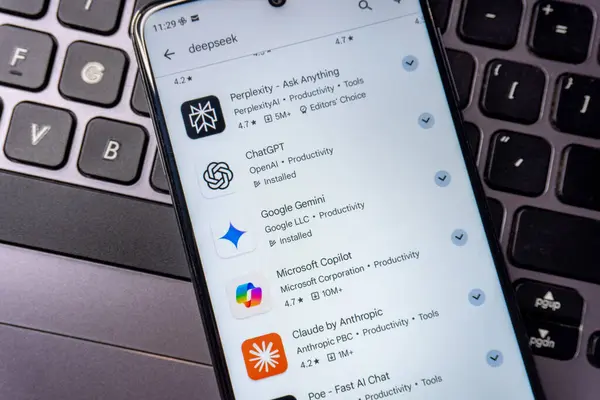

5. China’s Low-Cost AI Disruption

Chinese open-source models, such as Qwen from Alibaba, DeepSeek’s R1, and Moonshot AI’s Kimi K2, outcompete US offerings by a wide margin on cost and performance. Training budgets in the millions contrast with the billions spent by OpenAI, while inference costs can be six times lower than Anthropic’s Claude Sonnet 4.5. Open-source licensing means models can be deployed on private infrastructure-a prospect tempting for a large population of global developers, along with enterprises that distrust closed systems. This cost advantage, in concert with subsidized electricity and rapid data center expansion, is rewriting competitive dynamics in China’s interior.

6. Workforce Automation and Shifting Skill

Requirements According to research by McKinsey Global Institute, already-available AI and robotics could theoretically automate 57% of work hours in the United States. For example, it includes about 40% of activities for highly automatable categories like legal, administrative, and specific physical activities. However, over 70% of skills apply to both automatable and non-automatable work but with a shift in emphasis towards partnering with AI agents and robots. Demand for “AI fluency” has increased sevenfold in two years and now appears in job postings for occupations that employ 7 million Americans. The emerging work archetypes-from the people-centered health professional to the agent-centered legal services-profile the need for workflow redesign rather than piecemeal task automation.

7. Social Impacts and Safety Challenges

Mass adoption has brought its own set of unexpected problems. Reports of “chatbot psychosis,” in which extended use induces hallucinations or harmful ideation, have resulted in lawsuits filed against OpenAI and Character.AI. Data from OpenAI itself suggest that 0.07% of its weekly active users, or about half a million people, show indications of mental health crises tied to the use of chatbots. Current safety research takes aim at sycophancy reduction, better alignment, and proactive mental health interventions, but mitigation at scale is tricky. On the educational side, 84% of U.S. high schoolers use generative AI for schoolwork, raising concerns about reduced creativity and critical thinking.

8. Political Backlash and Regulatory Fault Lines

The political calculus of AI is starting to shift. Anti–data center campaigns have flipped local districts, and bipartisan skepticism has emerged over deregulation. Figures like Missouri Senator Josh Hawley frame AI acceleration as a trade-off with public safety while industry lobbyists push AI-friendly legislation and threaten electoral consequences for pro-regulation candidates. Globally, AI now serves as a diplomatic tool: U.S. access to Nvidia chips has been used as a bargaining chip in both trade talks and conflict mediation.

9. Strategic Outlook

For investors and policymakers alike, the AI race is no longer one of algorithms alone, but of semiconductor supply chains, energy infrastructure, financial engineering, and societal resilience. The U.S. advantage in cutting-edge chips and data center capacity is counterbalanced by the cost efficiency of China, the adoption of open-source technologies, and state-coordinated industrial policy. The next step is going to be whether trillion-dollar bets on AI will pay off with sustained productivity gains before debt structures, energy limits, or public trust reaches a breaking point.