Who needs finding the car to be any easier than finding a Supercharger? It’s not just tweaks in the interface; the latest software update folds in navigation logic directly from its Robotaxi platform, expands its reach in the charging ecosystem via BMW’s NACS adoption, and sharpens the competitive edge in its Waymo autonomy race through both sensor philosophy and silicon firepower.

1. Vehicle Locator Brings Robotaxi Navigation to Owners

Thanks to App Update v4.51.5, Teslas now embed a real‑time Vehicle Locator directly on the home screen. Without the mental gymnastics required to align a static map, owners get a live directional arrow powered by the phone’s accelerometer that rotates to point toward the car. The app shows exact distance in feet or meters, taking any guesswork off sprawling garages or amidst post‑event parking chaos. This interface is clearly ported from Tesla’s Robotaxi app and underlines how software for consumers and fleets are coming together. Other refinements in this update include Photobooth selfies from interior cameras, Dog Mode Live Activity that features lock‑screen cabin snapshots, and Dashcam telemetry overlays with speed, steering angle, and FSD status.

2. BMW Joins NACS Supercharger Ecosystem

BMW is the 15th manufacturer to join Tesla’s more-than 25,000 North American Superchargers in 2025, continuing a key marker in the industry’s transition to the NACS standard. Compatible models include the i4 (2022–2026), i5 (2024–2025, plus 2026 via software update), i7 (2023–2026), and iX (2022–2025, plus 2026 via update).

Owners can immediately charge without waiting for BMW’s own branded NACS‑to‑CCS1 adapter, which is due Q2 2026, using third-party adapters or Tesla’s Magic Dock locations. Charging sessions integrate with the My BMW app through Shell Recharge, including Plug & Charge capability on capable stalls without needing the Tesla app.

3. NACS Technology and Cross‑Network Integration

The compact form factor and DC fast‑charging capability up to 1 MW make the NACS connector an excellent fit for both passenger EVs today and future heavy‑duty platforms. Its usage by legacy OEMs like BMW reflects growing interoperability, while Tesla’s Supercharger V4 hardware has higher current capacity with longer cables-a design that greatly improves compatibility with varied port placements. This form of cross-network integration is crucial in reducing range anxiety and assimilating the charging experience among brands.

4. Tesla vs. Waymo: Diverging Approaches to Autonomy

Competition Tesla’s vision‑only Full Self‑Driving stack is in many respects the polar opposite of Waymo’s fusion of cameras, LiDAR, radar, and HD maps. Elon Musk has said that “LiDAR is a fool’s errand,” as sensor contention-where LiDAR disagrees with radar or those disagree with cameras-create ambiguity and risk. Waymo pushes back with a safety record built upon redundancy, touting 96 million rider‑only miles and data pointing to significant reductions in property damage and injury claims.

5. Technical Breakdown: Vision‑Only vs. LiDAR Fusion

Systems based on vision alone, such as Tesla’s, rely on high-resolution RGB cameras feeding end-to-end neural networks mapping directly from video to control outputs. The architecture, introduced in FSD v12 eliminated over 300,000 lines of C++ control code for a single video transformer. This buys scalability-tens of billions of fleet miles annually-and hardware simplicity. LiDAR fusion systems, as used by Waymo, provide centimeter-level depth accuracy and robustness to low-visibility conditions but add substantial cost, complexity, and dependency on pre-mapped operational domains.

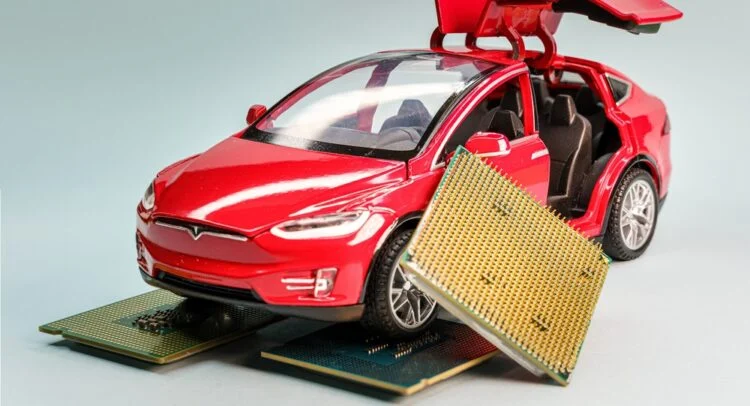

6. AI5 Chip – Silicon for the Next Autonomy Leap

Tesla’s next AI5 chip, manufactured both by Samsung at 2 nm and TSMC at 3 nm, will be targeted at real‑world inference for autonomy and robotics. Musk called it “an enormous leap” over AI4; it offers 40× the compute, 9× the memory, and 3× efficiency per Watt. Limited units are expected to emerge in 2026, while volume production will be in 2027. AI5 will be at the heart of not just FSD but also the Optimus humanoid robot-a further expression of Tesla’s vertically integrated approach to AI hardware.

7. Manufacturing and Foundry

Strategy Manufacturing will be split between Samsung’s Taylor, Texas fab and TSMC’s Arizona facility; each company will do a separate translation of Tesla’s design targeting identical software behavior. Meanwhile, Samsung indicated that it is ramping up its high‑NA EUV tooling in preparation for demand at the 2 nm node, as an alternate to the more mature TSMC N3E process. In any case, Tesla is adopting a dual foundry strategy as a hedge against supply risk, with the added benefit of benchmarking performance across process nodes well in advance of the AI6’s expected 2028 debut.

8. Implications for Robotaxi Scaling Tesla’s

Austin robotaxi pilot still uses safety monitors, but Musk has pledged fully driverless operation there by year‑end. The mix of vision‑only autonomy, over‑the‑air activation across the existing fleet and the AI5 compute uplift places Tesla well for rapid scaling-if safety metrics can match or exceed multi‑sensor rivals. Waymo’s expansion to 173 square miles in Austin and entry into New York City illustrate the competitive pressure in urban markets. Convergence of consumer app feature sets with fleet‑grade navigation, the ongoing expansion of the NACS charging umbrella, and ramping custom AI silicon set up 2026 as an inflection point for Tesla’s ecosystem both on the charging pad and the autonomy front.