A hundred years ago, the most ambitious feats of engineering took the form of steel bridges and hydroelectric dams. In 2026, one might just be a rocket company IPOing at over $1 trillion. Not only is SpaceX’s coming IPO destined to be among the largest on record-it is inextricably linked to state-of-the-art aerospace engineering, global telecommunications infrastructure, and the economics of space-based computing.

1. Scale and Valuation

SpaceX is aiming for a mid‑to‑late 2026 listing that would raise more than $25 billion, with some reports placing the raise above $30 billion and a valuation of up to $1.5 trillion. That would eclipse Saudi Aramco’s $29 billion debut in 2019, the only IPO to date to top a trillion‑dollar valuation. Current secondary share sales place the value of SpaceX at more than $800 billion, with employees allowed to sell about $2 billion worth of stock at $420 a share. Revenue at the company is forecasted to increase from $15 billion in 2025 to between $22–$24 billion in 2026, thanks in large part to Starlink.

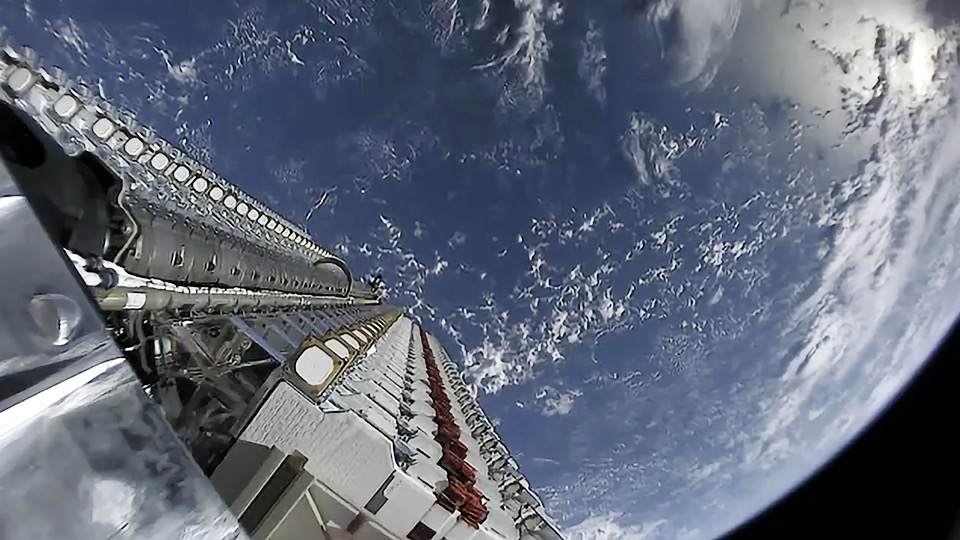

2. Starlink Direct-to-Cell Expansion

Starlink’s design now incorporates a Direct to Cell satellite network at 360 km, optimized for handset‑to‑satellite links. Each craft is essentially a space‑based LTE tower with eNodeB payloads, phased array antennas and regenerative networking, meshed into Starlink’s 8,000‑satellite backbone via inter‑satellite lasers. Without the need for hardware changes, the system supports ordinary LTE phones for text, video calls, navigation and IoT connectivity. Partnerships with T‑Mobile, Optus, Rogers, KDDI and others have seen coverage extended across five continents, serving upwards of six million subscribers. A recent $17 billion spectrum acquisition from EchoStar secured AWS‑4 and PCS‑H bands in the US, along with global MSS rights, opening the door to 20× throughput per satellite and full 5G compatibility.

3. Starship Engineering Milestones

The super heavy‑lift Starship is central to both lunar missions under NASA’s Artemis program and commercial low‑Earth orbit infrastructure. The vehicle’s vast internal volume could serve as a LEO outpost, enabling such missions as long‑duration, satellite deployment, and in‑space manufacturing. The Starship will have an architecture along with the Super Heavy booster, Dragon spacecraft, and Starlink constellation that will be capable of transporting crew, cargo, and communications hardware. Missions in the future will also include cryogenic propellant transfer demonstrations and high‑capacity Starlink launches, where the scale of Starship will enable hundreds of upgraded satellites per launch.

4. Space-Based Data Centers

The IPO money is to be spent on creating orbital data centers that rely heavily on state-of-the-art semiconductor technologies and radiation-hardened chips to operate in extreme conditions, both thermally and in the vacuum. The data centers could also serve as low-latency nodes for communications worldwide without the bottlenecks of the terrestrial ones, thus providing resilient infrastructure for various workloads, including AI, defense, and industrial Iot.

5. Market Impact & IPO Revival

It would act as a further catalyst for the broader revival in the U.S. IPO market after years of stagnation, say analysts. “SpaceX represents one of the most exciting opportunities in the global IPO market,” says Samuel Kerr, head of equity capital markets at Mergermarket. That could be followed by high‑profile offerings from OpenAI, Anthropic, and other late‑stage startups, which may reshape capital flows into advanced technology sectors.

6. Competitive Landscape

Starlink’s broadband and direct‑to‑cell capabilities pressure both terrestrial mobile network operators and rival satellite firms including AST SpaceMobile, Globalstar, Iridium, Viasat, and Kuiper. For instance, AST launches large‑antenna satellites to enable 4G/5G, has built an $8.7 billion market cap, and plans to have 60 satellites in orbit by 2026. But vertically integrated manufacturing, unrivaled spectrum rights, and Starship‑enabled deployment cadence give Starlink a scale advantage that cannot be matched by competitors.

7. NASA Collaboration and Strategic Positioning

Under the NASA CCSC‑2 program, SpaceX continues to develop an integrated LEO architecture comprised of Starship transport, Dragon missions, and Starlink communications. This puts the company in a web of commercial and defense partnerships forging a sustainable low‑Earth orbit economy. Adding versatility to Starship-with its possible use as a habitable platform-the adaptability of Dragon missions to both crew and cargo increases operational flexibility.

8. Leadership and Risk Considerations

Investor debate centers around Elon Musk’s ability to run several trillion‑dollar public companies at the same time. “It’s hard to see how one person could run two $1 trillion+ companies at the same time,” says Dan Coatsworth, head of markets at AJ Bell. The Global Risk Advisory Council’s Reputation Risk Index ranks public association with Musk as a high‑impact reputational risk for brands, reflecting increased scrutiny and possible volatility in public perception.

A SpaceX IPO is more than a financing event; it is the monetization of a vertically integrated aerospace, telecom, and computing ecosystem. The combination of Starlink global communications reach, Starship heavy‑lift capability, and orbital data center ambitions creates a company uniquely positioned at the nexus of multiple trillion‑dollar industries, with consequences that reverberate into many markets well beyond spaceflight.