As Abhi Tripathi, a former SpaceX mission operations director, puts it, “Once Musk realized Starlink satellites could be architected into a distributed network of data centers, the writing was on the wall.” That epiphany seems to have sparked one of the most audacious initial public offering plans in history a deal that may raise more than $30 billion and value SpaceX in a range of $1 trillion to $1.5 trillion.

1. IPO Scale and Market Context

SpaceX has started talking to banks to float shares as early as mid‑2026, with some reports suggesting a possible June or July launch window. On the targeted valuation, its listing would rank alongside Saudi Aramco’s 2019 debut, which raised $29 billion at a $1.7 trillion market cap. SpaceX’s plan could top that in capital raised, says Bloomberg, placing it among the largest IPOs in history. The offering would be a strategic about-face for Elon Musk, who has zealously kept SpaceX out of the public markets to avoid shareholders pressing it toward profits that conflict with his vision for settling Mars.

2. Starlink as the Revenue Engine

The main driver of SpaceX’s valuation is Starlink, its low Earth orbit satellite broadband network. Starlink has transitioned from a capital‑intensive project to a global telecom platform serving more than 8 million subscribers in over 150 countries. In 2024, Starlink generated an estimated $8.2 billion-around 63% of SpaceX’s $13.1 billion revenue. A forecast of $15 billion in revenue in 2025, with a further increase to $22-$24 billion in 2026, also came mostly from Starlink. Lowering capex intensity, expanding margins, and other diversifications into aviation, maritime, mobility, and government markets are additional valuation supports pointed out by analysts.

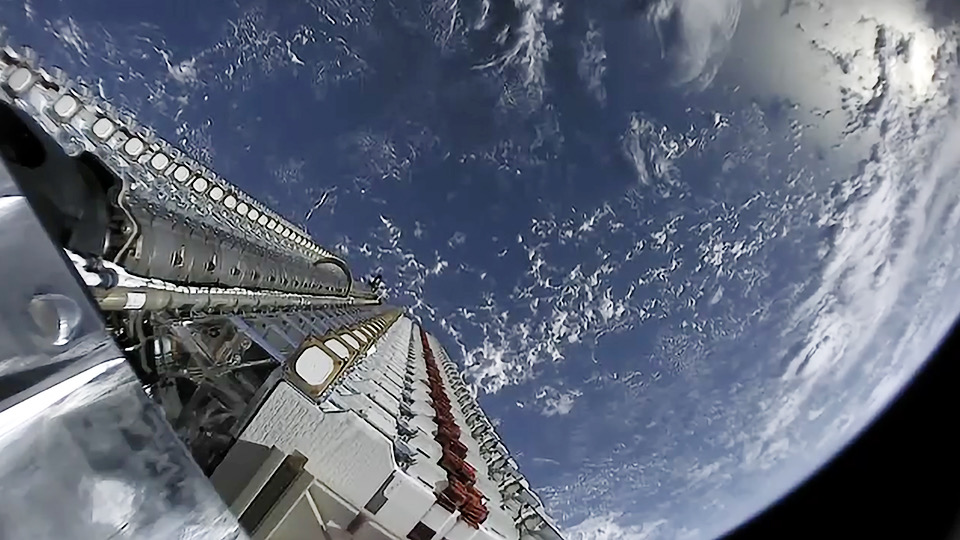

3. Technical Architecture and Scalability

The architecture of Starlink employs thousands of satellites in low Earth orbit, connected via laser crosslinks that minimize latency. Scalability of the system relies on rapid production and deployment of satellites, which are made possible by the vertically integrated manufacturing and launch capabilities of SpaceX. Based on this, the open‑source model from ARK Invest estimates a bandwidth plateau near 130 million Gbps, while pricing converges toward $0.20 per Mbps per month, a level approximately 75% below current U.S. averages. Satellite performance, in Gbps/kg, is the most sensitive factor driving both revenue and capex in their simulation.

4. The Role of Starship in Lowering Orbital Access Costs

Central to Starlink’s economics is Starship, SpaceX’s fully reusable 404‑foot launch system. Wright’s Law analysis suggests that for every cumulative doubling of upmass to orbit, Starship’s turnaround time could decline by ~27%. Higher reusability reduces per‑launch costs, enabling faster constellation build‑out and freeing capital for other ventures. In 2025, SpaceX launched Starship five times, twice successfully, and aims to start testing its third iteration in Q1 2026. The system’s payload capacity also underpins Musk’s Mars logistics plan, which requires an estimated 10,000 launches to deliver 1 million tons of supplies.

5. Orbital Data Centers and AI Infrastructure

A big source of deployment for proceeds from an IPO will go toward developing space‑based data centers, including buying high‑performance chips. Musk has described scaling Starlink satellites into orbital compute nodes to keep up with the rocketing energy demands of AI. Additional launches are, in his estimation, the quickest path to increasing power and processing within four years. Other players, including Alphabet and Nvidia‑backed Starcloud, are considering similar ideas, but SpaceX’s launch dominance and global spectrum acquisitions such as its $20 billion deal with EchoStar give it a commanding lead in direct‑to‑cell and data‑center deployment.

6. Spectrum and Direct‑to‑Mobile Expansion

According to Musk, the move is a key one that “greatly” expands its addressable market as SpaceX acquires global direct‑to‑cell spectrum. It has announced agreements with carriers such as T‑Mobile US to offer mobile connectivity without terrestrial towers and make Starlink part of mainstream telecom infrastructure. The firm has filed a trademark for “Starlink Mobile”, suggesting it may enter as a carrier in its own right. This could transform Starlink from a broadband provider into a full-scale mobile network operator with orbital infrastructure advantages.

7. Valuation Models and Investor Outlook

ARK Invest’s Monte Carlo simulation projects a $2.5 trillion enterprise value by 2030, with bear and bull cases at $1.7 trillion and $3.1 trillion respectively. Their model treats SpaceX as a flywheel: cash funds rockets and satellites, which generate bandwidth and customers whose payments finance further expansion – eventually shifting resources to Mars. Risks include execution challenges in Starship reusability, competitive broadband markets, and speculative returns from Mars activities.

8. Lessons from Aramco’s IPO

The Aramco precedent puts valuation discipline and transparency in sharp focus. Aramco had to retreat to domestic markets after global investors balked at its $2 trillion target for an IPO. For SpaceX, investor confidence depends on Starlink’s unit economics, the viability of orbital data centers, and the cost trajectory of Starship. Whereas oil depletes, space infrastructure offers growth, but both are exposed to geopolitical sensitivities and long-term demand uncertainties.

9. Investor Access and Liquidity Pathways

Until the IPO, access to SpaceX continues to be available on a private secondaries basis through structured vehicles and select funds such as the XOVR ETF and Baron Partners Fund. These channels have requirements for accreditation, fees, and constraints on liquidity. A potential Starlink IPO, which some analysts have estimated could occur as early as 2026, could expand participation and provide direct exposure to one of the fastest-growing global telecommunication platforms.

A hypothetical $1.5 trillion valuation for SpaceX speaks not only to its dominance in launch but to a bet that orbital infrastructure will form the backbone of global communications and AI compute. For investors, the IPO is one of the rare entry points into a frontier technology leader and a test of how public markets will underwrite Musk’s combined visions of planetary connectivity and interplanetary settlement.