It started with the humble observation from Elon Musk: “Commercial Starlink is by far our largest contributor to revenue.” In 2025, that’s no longer just a note of pride-it’s a defining shift in SpaceX’s business model. The satellite broadband arm has surpassed launch services as the primary driver of growth, pushing projected annual revenue to around $15 billion and setting the stage for one of the largest IPOs in corporate history.

1. Starlink’s Low Earth Orbit Advantage

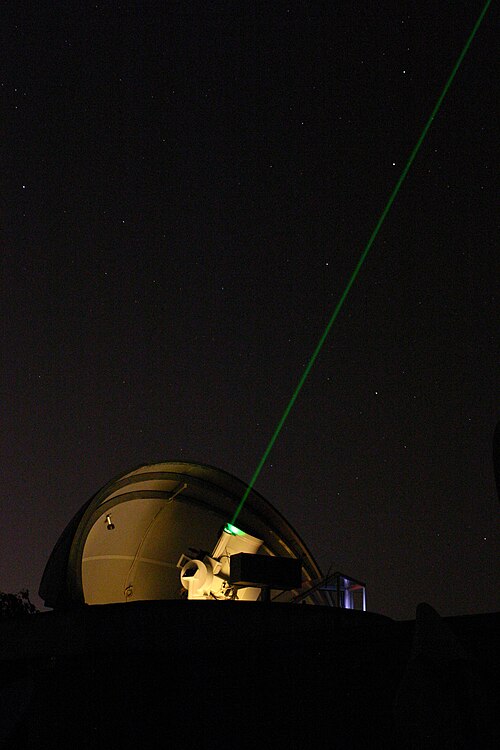

The Starlink constellation now is composed of more than 9,000 operational satellites, making it the most to occupy low Earth orbit, with its closest competitors-like Amazon’s Kuiper-having put only two prototypes into orbit so far. At altitudes between 340 and 630 km, Starlink’s satellites employ optical interconnects-basically, laser links that relay data between fast-moving spacecraft-to enable high-speed transfers to ground stations. That architecture limits latency and extends coverage to include maritime, aviation, and remote terrestrial markets. Capacity constraints remain, however; based on an estimated limit for overall bandwidth, analysts speculate that the system will probably serve no more than about 1% of U.S. households, underscoring the need for continuous satellite upgrades.

2. Engineering Economics of Reusable Rockets

The ability of SpaceX to deploy Starlink at scale is based on reusability for the Falcon 9. With boosters reused over 20 times and fairings recovered and flown again, the full launch cost is modeled at less than $30 million for internal Starlink missions-less than half the advertised $62 million commercial price. The rapid refurbishment cycles and high launch cadence mean this capital efficiency has enabled Starlink to expand without the crippling capex that hinders its competitors. External launches, which are priced well above internal costs, generate margins of $30-60 million per mission, subsidizing Starlink’s deployment.

3. Spectrum Battles and Regulatory Navigation

Operating so far in the Ku- and Ka-bands, Starlink has filed to access higher frequency V- and E-bands to support next-generation satellites. Among the resistance came from incumbents Dish and Globalstar, forcing FCC adjudication over the risks of “harmful interference”. In one ruling, the FCC has so far sided with SpaceX, invoking the public interest in rapid broadband deployment. In another, it denied Starlink’s application for certain MSS bands-thereby initiating a rulemaking process that remains pending. The outcome will frame not just Starlink’s expansion but wider rules of engagement for LEO sharing.

4. Orbital Debris and Collision Avoidance

No less than 50,000 collision-avoidance maneuvers by Starlink satellites over six months bring home the stark operational reality of dense LEO traffic. Satellite counts could increase as high as 100,000 globally, placing significant risk on the potential for Kessler syndrome-a cascade of orbital collisions. Service reliability depends upon autonomous maneuvering protocols by SpaceX, GPS positioning, and star tracker systems.

5. Financial Trajectory and Valuation Surge

Internal estimates put revenue at $15–$16 billion in 2025, with the lion’s share coming from Starlink. That figure could rise to $22–$24 billion in 2026, say forecasts from Bloomberg and ARK Invest, supporting a possible valuation of $1.5 trillion if there were an IPO. Secondary sales of shares have already implied valuations of over $800 billion, putting a price of close to $420 a share. Cash in the bank is more than comfortably over $3 billion at SpaceX, sufficient for it to keep on investing in Starship and Starlink without needing any near-term external capital.

6. IPO Strategy and Investor Access

Apparently, SpaceX is targeting an IPO in mid-to-late 2026, targeting over $30 billion in what would be the largest IPO in history. Saudi Aramco’s $29 billion debut will likely be topped. Although there have been consistent reports since 2020 of a potential Starlink spin-off, it seems current plans are to list the whole company. Right now, investor exposure is limited to secondary markets, select ETFs such as XOVR, and mutual funds with private-company holdings. A public listing would finally open up direct access to one of the fastest-scaling telecom platforms in history.

7. Competitive Landscape

Amazon’s Kuiper faces steep launch costs, relying on contracts with Arianespace, Blue Origin, and ULA that could total $6–$10 billion for far fewer satellites than Starlink. Without the low-cost launch advantage of SpaceX, the breakeven timeline for Kuiper may lag. OneWeb, Eutelsat, and emerging Chinese constellations join the list; none will match Starlink’s integration of manufacturing, launch, and service delivery.

8. Next-Generation Infrastructure: Space-Based Data Centers

Beyond broadband, Musk has started to suggest a pivot toward orbital computing. Space-based data centers, using expanded Starlink networks for power, could smooth energy constraints in AI processing with low-cost, reliable power and global connectivity. Of course, this would take significant satellite launches in the coming four years, further leveraging SpaceX’s reusability economics.

9. Policy and Global Connectivity Implications

The expansion into unserved and underserved regions, as called for by the Outer Space Treaty for the benefit of all nations, amplifies issues of equitable spectrum allocation and environmental stewardship. International coordination through organizations such as the ITU, with national regulators like the FCC’s Space Bureau, is going to be crucial for balancing commercial ambitions against concerns about sustainability.

SpaceX’s transition from launch provider to vertically integrated aerospace-telecom giant has now become a case study in how engineering innovation leads to dominance. Reusability slashes deployment costs, spectrum battles are defining its operational reach, and IPO plans are firmly on the cards-the company is well on course to rewrite both the economics and infrastructure of global connectivity.