In the glare of the exhaust plume of a Falcon 9, SpaceX is preparing to fire up more than just rocket engines-it is setting the stage for what could be the largest IPO in human history. Targeting a $1.5 trillion valuation and anticipating raising $30-40 billion, this offering does not constitute just a capital event. It is a referendum on whether the space economy just became mature enough to be considered the central infrastructure of the 21st century.

1. The Valuation That Stuns Wall Street

The IPO target of SpaceX rivals the peak market capitalization of Saudi Aramco and tops Tesla’s current worth. At roughly 62.5 times projected 2026 revenue of $24 billion, it is a multiple unprecedented in aerospace, where legacy giants have often traded below 1.5x. As analysts summarize the best, “discounted future cash flow + strategic value premium,” it effectively prices the company as the gateway to the orbital economy. Internal secondary share transactions at $420 a share valued the company at more than $800 billion, leaving it to the public market to decide if it will pay nearly double.

2. Three Pillars of the SpaceX Growth Engine

The valuation rests on the basis of three interlocking businesses: launch services, Starlink satellite internet, and planned orbital data centers. Falcon 9’s mature reusability has pushed costs per launch down to around $15-30 million versus $60-100 million for expendables, making launches a profit driver rather than a cost center. Starlink-already with more than 8.5 Mn users and expected to pass 10 Mn by IPO-provides recurring revenue from land, sea, and air unserved or underserved. The most speculative pillar is space-based data centers, which would exploit low orbital temperatures for cooling and laser links for ultra-low-latency data transmission, likely disrupting terrestrial cloud computing.

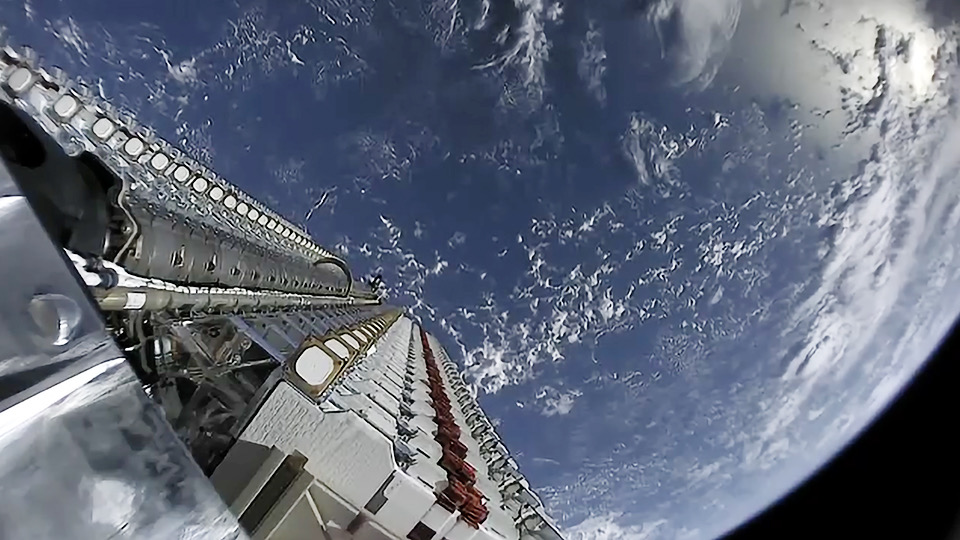

3. Orbital Dominance and Constraints of Starlink

Starlink has approximately 65% of all active satellites in orbit, with 7,600 elements having been launched to date. Laser interconnects deployed within the constellation allow links up to 25 Gbps over distances as long as 4,000 km, but that will not solve a basic physics problem-capacity is still not infinite. Be that as it may, analysts caution that even with very aggressive expansion, addressable markets in dense urban areas are limited and keep the growth focused on rural, maritime, aviation, and defense sectors. There were more than 50,000 collision-avoidance maneuvers performed by the network over six months underpinning the operational complexity of maintaining such a vast constellation of satellites.

4. Reusability: The Profit Catalyst

Falcon 9’s Block 5 boosters have flown as many as 29 times; refurbishment costs are described as “near-zero.” This has driven the cost of payload delivery to $100/kg, versus $1,000/kg for competitors. Eurospace modeling suggests Starlink’s breakeven depends on Falcon 9 launches costing under $30 million, satellites included. External customer launches are priced far higher, driving gross profits of $30 – $60 million per mission and subsidizing Starlink’s deployment.

5. Starship and the $100/kg Frontier

Starship is aiming for an entirely reusable heavy-lift architecture that could drop the per-launch price to $100/kg, opening deep-space missions, giant constellation deployment, and lunar cargo transport. Success would consolidate SpaceX’s position of power across commercial and government markets, where demand is steadily rising for high-capacity, rapid-deployment launch. Regulatory clearance for 25 test flights annually points to momentum toward operational status.

6. Orbital Data Centers: Engineering and Market Potential

The space-based data centers, operating above national jurisdictions, would have the latest in cooling efficiency and security. But they also would have to surmount the most significant challenges: radiation shielding for electronics, high-precision laser communications, and orbital debris mitigation. If successful, they will be key infrastructure for AI processing and global data distribution, tapping into the more-than-$1 trillion cloud market from above the atmosphere.

7. Competitive Landscape and Capital Flows

Competitors like Amazon’s Kuiper, OneWeb, and China’s projected 20,000-satellite constellation thus race for orbital real estate. By comparison, Kuiper has only two satellites up today versus the thousands belonging to Starlink, although it has demonstrated the ability for optical interconnect. Launch capacity still is a bottleneck: the reliance by Kuiper on Arianespace, Blue Origin, and ULA means much higher deployment costs compared with the vertically integrated model of SpaceX. Sovereign wealth funds of UAE and Saudi Arabia are more than likely participants in the IPO, attracted by the strategic nature of the orbital infrastructure.

8. Risks Behind the Hype

Regulatory pressures on spectrum allocation, astronomical interference, and space sustainability are increasing. The risk of the Kessler syndrome will continue to increase as the number of active satellites could reach 100,000 by the 2030s. Technological uncertainty remains on the full operationalization of Starship and the feasibility of orbital data centers. Investors are sharply divided: for growth funds, SpaceX is the ultimate disruptor, while value investors balk at paying for decades of growth upfront.

9. The Space Economy Context

Forecasts by McKinsey and Morgan Stanley place the space economy at $1 trillion by 2040, fueled by falling launch costs, broadband adoption, and government demand. Launch prices have fallen by a factor of forty since the 1980s, with Citi projecting a best-case $30/kg by 2040. Yet private investment has cooled amid the macroeconomic headwinds, while consolidation is reshaping the industry after a decade-long expansion.

An IPO of SpaceX is, therefore, more than a liquidity event-a stress test for the thesis that control of low-Earth orbit will define economic and strategic power in the decades ahead. The verdict of the market will determine whether the figure of $1.5 trillion is a rational bet on orbital infrastructure or the apex of a speculative bubble.