“Drones will define the 21st century,” U.S. Army Secretary Daniel Driscoll said recently, underlining a reality that has reconfigured battlefields and balance sheets in equal measure. Few companies epitomize that shift more dramatically than AeroVironment, a pioneer whose stock rose in tandem with the war in Ukraine.

A onetime fringe player of modest market capitalization, AeroVironment rode wartime demand to triple-digit revenue growth and an explosion in its stock price. The very conflict that validated its technology draws deep-pocketed tech titans, agile startups, and entrenched defense majors into the arena. It is now set up for an asymmetric contest in which innovation alone is not enough.

Here’s a listicle looking at nine strategic fronts that will make all the difference in whether AeroVironment can defend its hard-won position, from surges in military procurement to Big Tech geopolitical maneuvering.

1. War-Driven Demand Surge

The war in Ukraine transformed the drones from their previously niche missions of reconnaissance into extremely valuable machines for surveillance, strike, and defense. AeroVironment’s battlefield-proven systems, like its loitering munitions, have become benchmarks in military procurement. This company has seen its revenue grow 143.6% since February 2022, with the stock price up 347.5%.

This spike isn’t unique to Ukraine. The U.S. Army says it wants to buy at least a million drones over the next two to three years, treating them more as expendable ammunition than high-value assets. For AeroVironment, this represents an unparalleled opportunity and a test of its ability to scale.

2. The SkyFoundry Initiative

In order to achieve such ambitious procurement goals, the Army has just launched SkyFoundry-a public-private partnership intended to regenerate the U.S. industrial base by incentivizing the domestic manufacturing of drones, securing sources of rare earth materials, and making low-cost components available for rapid deployment.

SkyFoundry could usher AeroVironment into deeper levels of the military supply chains but opens the door to other commercial drone makers experienced in logistics, such as those serving Amazon deliveries, which may steal its share of the market.

3. Dominance of Platforms by Technology Giants

Alphabet, Tesla, and fellow technology leaders are taking to the skies-but their ambitions reach far beyond the hardware. It’s about the intelligent ecosystems of robotics in the air brought forth by artificial intelligence, autonomous navigation, and vast data networks.

The strategic threat of these companies comes from their capabilities to integrate drones into broader digital platforms. That said, smaller players could be overwhelmed by resources and scaling in manufacturing processes challenging AeroVironment’s first-mover advantage in military-grade UAVs.

4. Vertical Startups and eVTOL Innovation

Niche breakthroughs in eVTOL technology at Joby Aviation are a great example of this trend. Meanwhile, its recent first flight of a hybrid VTOL signals a push into military applications ranging from contested logistics to autonomous wingman roles.

Agility like that lets vertical startups run circles around incumbents in their respective domains. If hybrid eVTOL platforms catch on, then AeroVironment will most likely have to expand its portfolio or else risk being left behind.

5. System Integration Edge of Defense Majors

For example, Lockheed Martin and other large defense contractors bring decades of experience in complex systems integration, such as marrying up drones with their data links, command networks, and other battlefield assets. Long relationships with the Pentagon mean they are well-positioned for multimillion-dollar contracts.

AeroVironment is strong on product innovation, but without equivalent integration capability, the company runs the risk of getting bypassed in comprehensive solution bids.

6. Big Tech as geopolitical actors

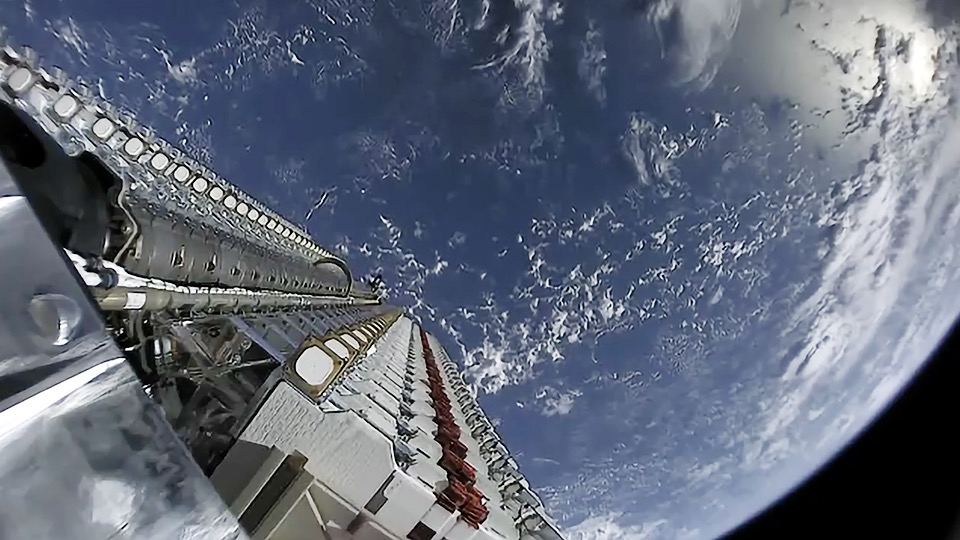

Big tech has also emerged as powerful geopolitical actors in their own right, shaping the conflict directly: Microsoft foiled the cyberattacks, Google restricted sensitive imagery, and SpaceX’s Starlink kept the battlefield online. These kinds of interventions underline how private actors shape military outcomes. AeroVironment has to operate amidst a competitive landscape in which many competitors are quasi-sovereign entities commanding influence around the world.

7. Supply Chain Nationalism

In part, the Army procurement drive is driven by dependence on Chinese manufacturing for critical drone components. Today, more than half of US commercial drone sales come from DJI. If there’s significant geopolitical conflict, AeroVironment’s US-based production could prove to be a strategic asset. However, scaling domestic supply chains to fulfill million-unit orders would require considerable investment and operational agility.

8. Investor Euphoria and Valuation Risk

AeroVironment’s stock has produced phenomenal returns: up 46.6% in the last year, 203.8% over three years, and 222.8% over five. Those gains have outpaced the S&P 500 by wide margins. Such lofty valuations leave little room for error. As the “war dividend” effect normalizes and competition intensifies, sustaining growth will require flawless execution and, perhaps, strategic pivots.

9. The Red Ocean Battlefield

In less than a decade, the drone market has changed from a ‘blue ocean’ of untapped potential to a ‘red ocean’ crowded with aggressive competitors. AeroVironment’s moat-essentially premised on technical focus and early entry-is under siege from capital-rich giants and agile newcomers. Survival will depend upon keeping technological leadership while changing its business model toward full-spectrum competition, including capital, talent, and ecosystem power.

The trajectory of AeroVironment from obscurity to market benchmark is one dependent upon timing and innovation in the field of defense technology. Today, though, it faces a multi-front contest against adversaries with vastly greater resources and influence. Whether the company will adapt to a battlefield defined as much by corporate geopolitics as by military strategy will determine whether its wartime ascent becomes a lasting legacy-or a cautionary tale.