“In modern air combat, engines win wars as much as pilots do.” That philosophy underpins the latest $1.61 billion sustainment contract awarded to Pratt & Whitney, an RTX business, for the F-35 Lightning II’s F135 propulsion systems. The agreement is more than a simple maintenance deal but one that positions RTX for its long-term strategic placement within the fighter jet market.

The award, issued by the Naval Air Systems Command, has come at a time of growing geopolitical tensions and a global push for fifth-generation aircraft. It secures multiyear support for U.S. and allied fleets, ensuring readiness in a program that has been plagued by delays, modernization challenges, and escalating costs. For defense investors, this contract is a window to both the opportunities and risks that are shaping the future of the F-35 ecosystem.

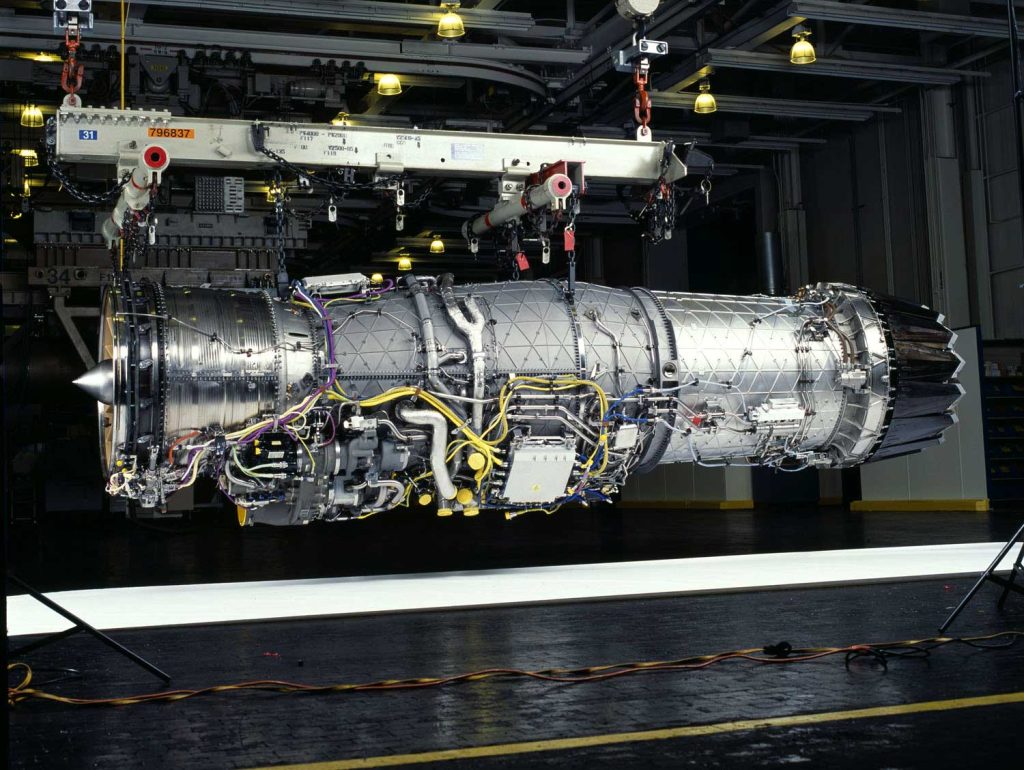

1. Scope of the $1.61B Sustainment Contract

The F135 sustainment agreement includes depot-level maintenance, repair, spare parts procurement, engineering support, software updates, and configuration management services. While supporting operational sites around the world, Pratt & Whitney will operate in key U.S. facilities in East Hartford, CT; Oklahoma City, OK; and Indianapolis, IN. “F-35 operators worldwide depend on the F135 for the power and performance their missions demand,” said Kinda Eastwood, vice president of F135 Sustainment, underlining the operational importance of this sustainment network.

2. Global reach of F135 Sustainment Network

The Pratt & Whitney sustainment infrastructure comprises 39 bases and 12 ships globally, but work is also done in allied nations such as Japan, Norway, Netherlands, Italy, United Kingdom, and Australia. This global depot network ensures the allied forces maintain readiness to meet current and future threats, while positioning RTX to leverage its infrastructure for future upgrades like the Engine Core Upgrade.

3. Fighter Aircraft Market Growth Outlook

The fighter aircraft market is projected to grow at a CAGR of 4.24% from 2025 to 2030, with nations investing in advanced combat jets. Growth will, therefore, drive demand for high-performance engines like the F135. RTX’s competitive advantage arises from the installed base of over 7,500 in-service military engines operated by 30 armed forces worldwide.

4. Interplay with F-35 Modernization Challenges

This sustainment award comes as the F-35 program continues to grapple with delays on both its Block 4 and TR-3 modernization efforts. The cost of Block 4 itself has increased by more than $6 billion, according to the Government Accountability Office, pushing its completion until at least 2031. Some of these capabilities rely on the F135 Engine Core Upgrade, which itself is unlikely to enter production before 2031, making sustainment critical to bridging gaps in capability.

5. Engine Core Upgrade and PTMU Timelines

The ECU will focus on improving thrust, range, and cooling capacity to accommodate advanced avionics. The $1.3 billion risk reduction currently underway will not see production start before 2031, while PTMU is even further behind and not expected to see production before 2033. Both of these timelines put into perspective why the reliability of the current fleet of F135s is crucial strategically.

6. Competitive Landscape in the Fighter Jet Market

Northrop Grumman, Lockheed Martin, and Boeing all stand to gain as the market grows. In the case of Lockheed Martin, that means the F-35 itself, while Boeing’s F/A-18 and F-15 programs remain indispensable to both U.S. and allied fleets; Northrop Grumman’s B-21 Raider supplies competitive depth. Each has its own particular set of modernization and production challenges, but all are similarly well-placed to capture demand from rising defense budgets.

7. Simulation and Testing Enhancements

The Joint Simulation Environment, supported by the Georgia Tech Research Institute, provides the F-35 with validated virtual battlespace testing. It reduces safety risks and costs compared with open-air trials, while also working out sensor fusion and tactics. With the Department of Defense using JSE data for making acquisition decisions, such sustainment contracts as RTX’s make sure the engines are mission-ready for both simulated and real-world operations.

8. Bottlenecks in Production and Delivery

Aircraft and engine delivery issues have continued to slip further behind schedule both at Lockheed Martin and at Pratt & Whitney. In 2024, all 123 F135 engines delivered were delivered late with a 238-day average delay. Supply chain problems, quality control issues, and subcontractor delays continue to reinforce the production challenges. Sustainment funding is a mitigant to the readiness impacts of these bottlenecks.

9. Strategic Implications for Investors

For investors focused on defense, the contract underlines RTX’s status as a keystone supplier in the F-35 program. Modernization delays do present some risk, but the sustainment market provides mostly long-term, stable revenue streams. The deal also speaks to continued U.S. and allied commitment to the F-35 fleet, a condition which bodes well for demand in propulsion support well into the next decade. The $1.61 billion Pratt & Whitney Sustainment Contract is more than just a maintenance agreement; it’s the strategic anchor in a program facing modernization headwinds and global demand pressures. For RTX, it locks in a key source of revenue while positioning the company for future upgrade cycles. It underlines for the defense sector the enduring importance of propulsion readiness in sustaining fifth-generation air dominance.