It’s not every day that a CEO compensation plan makes engineering history before it makes financial history. Yet Tesla’s newly approved $1 trillion pay package for Elon Musk does exactly that, tying the richest man in the world’s future earnings to a decade-long roadmap of engineering milestones that could redefine the automotive and robotics industries. More than 75% of voting shareholders backed the plan, despite vocal opposition from major institutional investors and proxy advisory firms.

1. The Scale and Structure of the Pay Package

The plan gives Musk as many as 423.7 million more Tesla shares-over $1 trillion if Tesla’s market capitalization reaches $8.5 trillion-in 12 tranches over ten years. Each tranche would be contingent on reaching both market cap targets and operational goals. The first unlock comes when Tesla reaches $2 trillion, while the remaining tranches are tied to $500 billion increments to $6.5 trillion, then $1 trillion increments to the final $8.5 trillion target. Musk’s stake would rise from 13% today to roughly 25%, cementing his control through voting rights.

2. Engineering Milestones as Compensation Triggers

At the heart of Tesla’s operational targets are 20 million vehicles delivered, 1 million robotaxis deployed, 1 million Optimus humanoid robots sold, and 10 million active Full Self-Driving subscriptions. Targets for profitability range from $50 billion to $400 billion in annual adjusted profit. These involve scaling manufacturing, developing AI-driven autonomy, and integrating robotics into industrial and consumer environments-all issues very dependent on breakthroughs in battery technology, AI safety, and autonomous navigation systems.

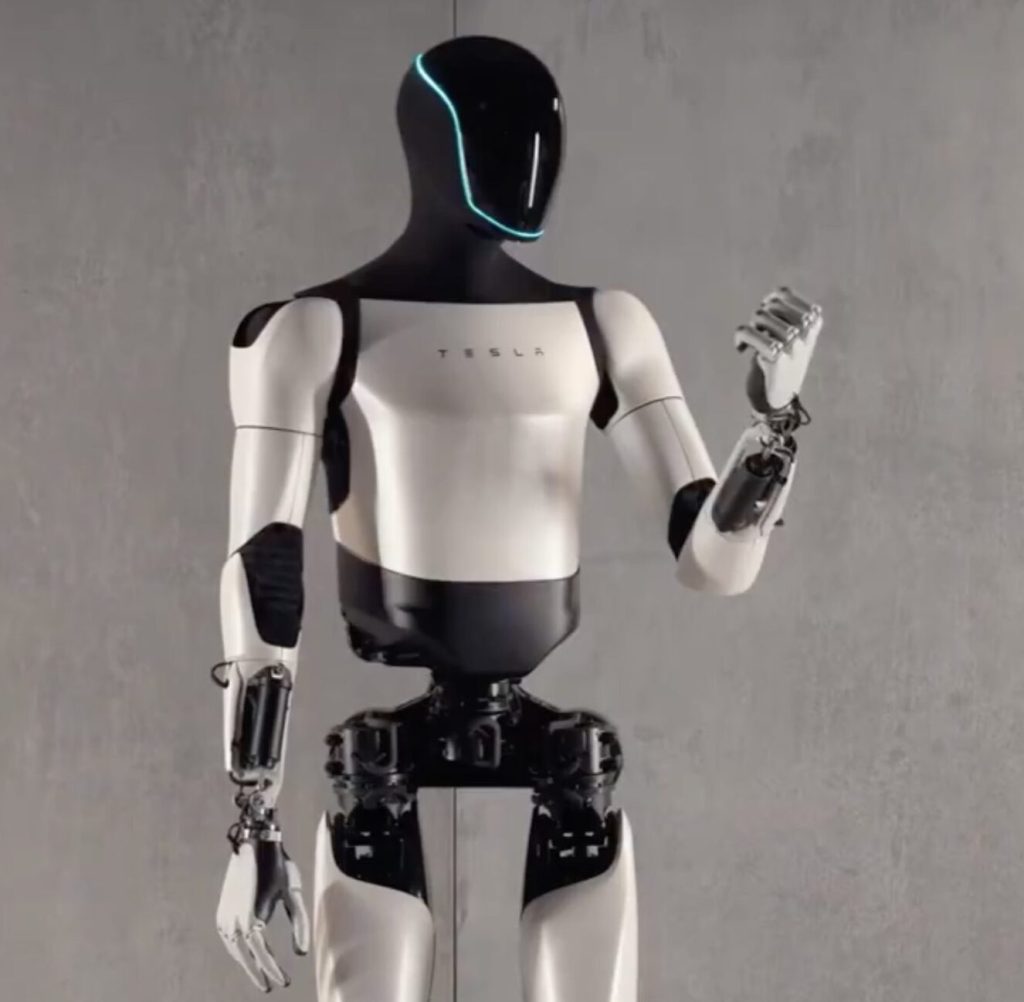

3. The Robotics and AI Pivot

Musk spent more of the shareholder meeting discussing Optimus, Tesla’s autonomous humanoid robot, than its lineup of EVs. The robot leverages the same AI stack as Tesla’s vehicles to undertake “unsafe, repetitive or boring tasks” in both factories and homes. Musk claimed Optimus could be manufactured for $20,000 each, which could make it “bigger than cell phones” as a market force. There’s no word on a commercial release date, and prototypes still need a great deal of refinement in locomotion, manipulation, and situational awareness-all areas where Boston Dynamics and other robotics firms have many years of research head start.

4. Full Self-Driving and Robotaxi Challenges

Tesla’s FSD Supervised system has been under regulatory scrutiny since incidents involving traffic violations and collisions occurred. To finally reach unsupervised autonomy, the sensor fusion must be robust, fail-safe decision-making algorithms fault-proof, and evolving transportation laws followed. The robotaxi goal of 1 million units in commercial operation requires much more than technical readiness infrastructure deployment, fleet management systems, and public trust in AI-driven mobility.

5. Governance Tensions and Proxy Advisor Opposition

ISS and Glass Lewis recommended that stockholders vote against the package, citing “an unprecedented size approximately 33.5 times larger than Musk’s 2018 award” and dilution risk to existing shareholders. Musk called them “corporate terrorists” because passive investors regularly follow their recommendations. The companies collectively dominate in excess of 90% of the proxy advisory market, guiding hundreds of institutional investors with their research and voting guidance.

6. Resistance to Sovereign Wealth Funds

Norway’s $2 trillion sovereign wealth fund – Tesla’s sixth-biggest investor outside of the CEO – voted against the plan, citing a “lack of mitigation of key person risk.” That position speaks to a critical issue of governance Tesla remains incredibly dependent upon Musk at the helm. That is in line with wider corporate governance best practices advising against strategic control being concentrated in one person without considerations for future succession.

7. Legal Background and Delaware Aftermath

The package was proposed amid ongoing litigation over Musk’s voided $56 billion 2018 pay deal, invalidated by a Delaware judge because the board lacked independence. Tesla has since reincorporated in Texas, where shareholder challenges to board decisions face higher legal hurdles. The Delaware Supreme Court is reviewing the case-its decision could affect corporate domicile trends among high-growth tech firms.

8. Market Capitalization Ambitions

Reaching $8.5 trillion would mean more than a 466% increase from today’s valuation for Tesla-outpacing even the largest valuation ever achieved by Nvidia at $5 trillion recently. Such a journey would need continuous innovation in EVs, AI, and robotics, together with aggressive market expansion. Engineering scalability, supply chain resilience, and geopolitical stability would be extremely important in such ambitious growth.

9. Investor Sentiment and Retail Influence

While large funds resisted, Tesla’s unusually high proportion of retail investors furnished the decisive support. Many echoed Tesla’s investor relations statement that Musk “gets nothing unless he makes the company more valuable.” This framing in terms of performance resonated with shareholders betting on Tesla’s transformation into an AI-driven conglomerate.

10. Strategic Risk and Reward

The design of the package ties Musk’s personal fortune to the success of engineering projects that are years from commercial maturity. The lack of any constraints on his political activities or a minimum time commitment to Tesla further adds to the uncertainty. To supporters, though, Musk is “Tesla’s biggest asset” in navigating the AI revolution, and his history of reaching milestones ahead of schedule will repeat itself.

The vote cements Musk’s control at a pivotal moment when Tesla’s identity is shifting from an EV pioneer to a robotics and AI powerhouse. Whether the engineering feats embedded in the compensation plan materialize will determine if this becomes the most lucrative-and most transformative-CEO pay deal in corporate history.