The size of this latest Tesla proposal was stunning a performance-based equity award to Elon Musk worth as much as $1 trillion tied to a market capitalization of $8.5 trillion and to a deployment of one million fully autonomous Robotaxis. It wasn’t just the largest CEO pay package in corporate history it was a high-stakes bet on engineering execution, AI leadership, and a boardroom willing to concentrate unprecedented power in one person.

1. The Engineering Mountain of One Million Robotaxis

Deploying one million Robotaxis is not a marketing slogan it’s a technical gauntlet. Tesla’s Full Self-Driving platform uses a vision-based neural network architecture, trained on billions of miles of driving data. Safe, scalable autonomy at Level 4 or Level 5 requires breakthroughs in real-time inference efficiency, sensor fusion redundancy, and robust failover systems. Existing FSD iterations still require driver supervision, with regulators in several jurisdictions yet to approve fully driverless operation. The manufacturing challenge is just as formidable one million units would take the equivalent production capacity to Tesla’s entire global output for 2024, retooled for autonomous hardware integration including high-performance onboard compute, redundant braking and steering systems, and long-life battery packs optimized for commercial duty cycles.

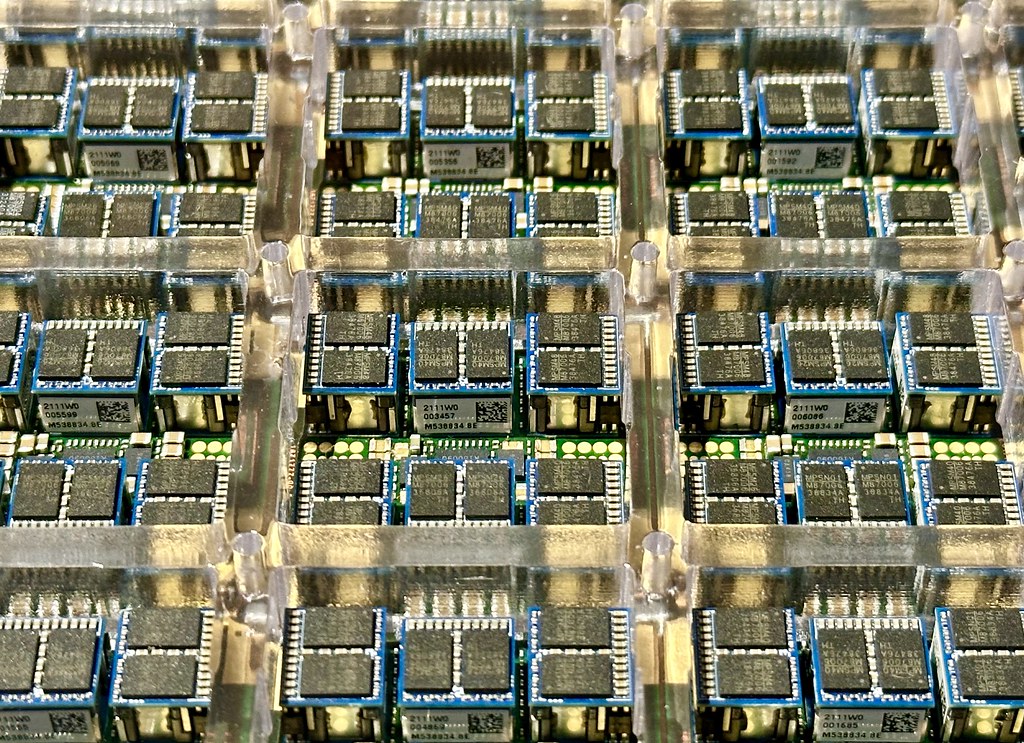

2. AI & Sensor Technology at the Core

Tesla relies on internally developed AI training supercomputer Dojo, which is supposed to process enormous-sized data sets to tune neural nets. The architecture of Dojo rests on a custom-made architecture with D1 chips optimized for machine learning workloads, which can take that process time from weeks down to days. Operationally, the Robotaxi fleet would depend on over-the-air model updates continuously, where each car would do its share of edge computing for local decisions. The sensor configuration is still contentious Tesla has cut out LiDAR, retaining only cameras, ultrasonics, and radar on some models. This minimalist approach cuts the cost but increases the engineering burden of trying to achieve robust perception in bad weather and complex urban environments.

3. Valuation models and the $8.5 trillion target

For Tesla to be worth $8.5 trillion, it can’t just be an automobile company it needs to be seen as a dominant AI mobility platform. One way analysts model such a prospect is by projecting over $100 billion in high-margin revenue streams from Robotaxis, in addition to sales of Optimus humanoid robots and AI services. These forecasts also assume rapid regulatory clearance and minimal accident liabilities, plus near-monopoly market share-conditions decidedly not ensured. Even optimistic forecasts by bullish analysts-like Wedbush’s Dan Ives-predict Tesla’s near-term valuation at a maximum of $2 trillion, which underlines the speculative leap required.

4. Governance Under the Microscope

Delays by the Delaware Court of Chancery in invalidating Musk’s prior $55 billion package did show glaring weaknesses in Tesla’s governance non-independent directors, inadequate disclosures, and lack of real negotiation. Members of the board, some of whom have very close personal and financial relationships with Musk-including his brother Kimbalfailed to provide independence necessary for arms-length decisionmaking. The new $1 trillion plan ratchets up the problems because the award would raise Musk’s stake to about 25%, further concentrating the voting power and capability to influence strategic direction.

5. Shareholder Division and Institutional Pushback

ISS and Glass Lewis, two of the most influential proxy advisers, recommended votes against the plan, citing excessive size, the risk of dilution and the lack of mitigation for key person dependency. On Monday, Norway’s sovereign wealth fund – an owner of 1.12% of Tesla worth $17 billion – voted against the deal, joining opposition from large pension funds including CalPERS. The institutions said Musk’s equity stake in Tesla should already align his incentives with those of shareholders, while the plan does not ensure Musk can focus full time on Tesla amid his other ventures.

6. Political Headwinds and Brand Impact

Musk’s political activism-from leading an organization named the U.S. Department of Government Efficiency to his support of Germany’s far-right AfD party-offended ecologically oriented buyers and chipped away at Tesla’s brand equity. Indeed, estimates in one National Bureau of Economic Research study indicated that the “Musk partisan effect” puts Tesla US sales 67% to 83% higher than they might otherwise be without his political interventions. In the same period, US EV sales for rivals soared as high as 22%, siphoning demand from Tesla.

7. Market Performance and Competitive Pressure

Deliveries for Tesla fell to 1.79 million in 2024 from a year earlier, its first annual decline since 2011. Registrations plunged 76% in key markets such as Germany. Chinese sales of Shanghai-made EVs dropped 49% in February 2025 amid pressure from BYD’s lower prices. Buyer consideration for Tesla in the US fell from 22% ahead of Musk’s acquisition of Twitter to below 8% late in 2024. Meanwhile, rivals are flooding the market with updated models which happen to be cheaper, narrowing Tesla’s technological lead.

8. Investor Calculus: Innovation vs. Risk

Retail investors comprise roughly 30% of Tesla’s shareholder base and have consistently been Musk’s critical support bloc, with governance concerns often taking a backseat to his visionary track record. The messaging from the board is that the pay package is integral in keeping Musk in charge through Tesla’s artificial intelligence expansion-including plans for Optimus and Robotaxi programs. Critics note Musk could earn tens of billions without meeting most targets, and that the structure isn’t necessarily indicative of minimum time commitments he must dedicate to Tesla.

The vote will decide whether Tesla doubles down on a strategy that binds together corporate value and Musk’s personal brand, engineering ambitions, and political footprint. For investors, it’s a decision not just about compensation but also about whether Tesla’s future will be guided by the same high-risk, high-reward calculus that has defined its past.