China now controls about 70 percent of the processing of rare earths and more than 90 percent of magnet manufacturing-a dominance that has become a potent geopolitical lever. Two days ahead of his meeting with Chinese President Xi Jinping in South Korea, President Donald Trump and Japanese Prime Minister Sanae Takaichi signed a rare earth and critical minerals framework agreement in Tokyo, marking a conscious effort to push back against Beijing’s grip on these crucial resources. The deal comes at a time when there are increased Chinese export restrictions and growing apprehensions over supply chain vulnerability across defense to semiconductors.

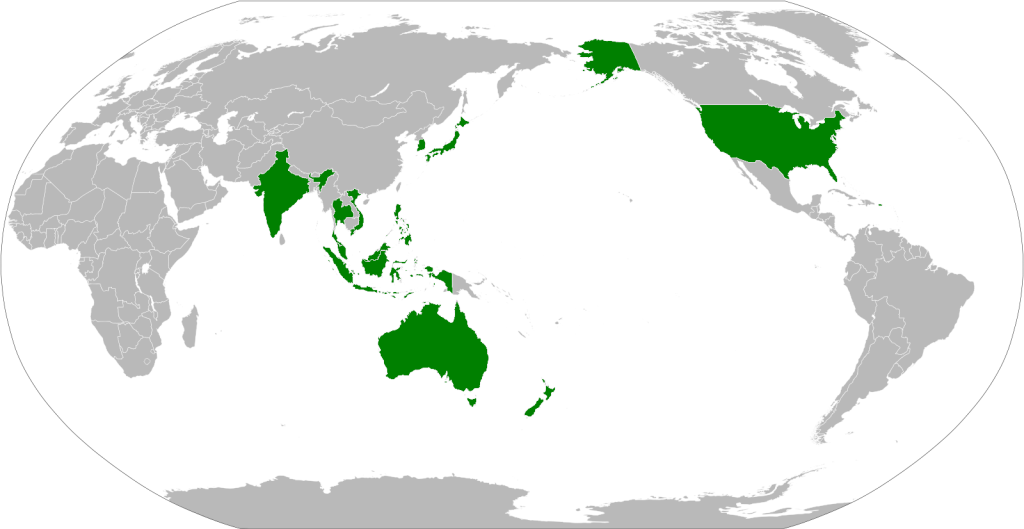

The agreement is more than a symbolic gesture: Binding two key Indo-Pacific allies into concerted action on extraction, recycling, stockpiling, and investment in mineral supply chains, it aligns both with similar US partnerships forged recently with Australia, Malaysia, and other regional players. For Japan’s newly installed prime minister, too, this is a high-stakes diplomatic debut-a test of the ability to navigate Washington’s demands, regional security challenges, and the shadow of China’s economic and military rise.

1. A Framework to Challenge China’s Rare Earth Dominance

The US-Japan agreement provides for cooperation across the rare earth value chain, from mining and refining to recycling and stockpiling. Although there are no direct financial commitments, the statement pledges to jointly identify projects and mobilize public-private investment to reduce reliance on China. That makes it similar to recent deals the US has made with Australia and Malaysia, but the addition of Tokyo is more strategically significant due to Japan’s advanced manufacturing base and its role in defense technology supply chains.

2. Price Floors and Market Stabilization

Implicit in the framework was price floors for critical minerals-a way, it said, to reflect the true cost of responsible extraction. Analysts drew comparisons with the $110/kg floor that the US Department of War put into its agreement with MP Materials for NdPr. The idea is to prevent predatory pricing from Chinese producers and stabilize the market for allied suppliers so that long-term investments in processing capacity are made without the constant fear of market collapse.

3. Accelerated Japanese Defense Spending

Prime Minister Takaichi vowed to hit Japan’s 2 percent GDP defense spending goal by March a full four years ahead of schedule. That acceleration mirrors US pressure for greater allied defense contributions and reflects Tokyo’s security concerns over China, North Korea, and Russia. The move is part of a broader five-year military buildup that includes long-range strike capabilities, a notable shift from Japan’s postwar defense-only principle.

4. Strategic Timing Before Xi Meeting

The inking of the deal just before Trump’s face-to-face with Xi is a calculated signal. US negotiators have sought a one-year reprieve from China’s mineral restrictions, but the president has cautioned that no arrangement will be final until leaders meet. The Japan pact strengthens Washington’s negotiating position by showing a widening network of supply chain alliances beyond Beijing’s reach.

5. China’s Escalating Export Controls

Beijing’s most recent decisions require export licenses for goods containing even trace amounts of certain rare earths, applying its foreign direct product rule to magnets and semiconductor materials. These controls target foreign defense supply chains and advanced technology sectors, with automatic denials for military use. The restrictions deepen vulnerabilities in the US defense industrial base, affecting platforms that range from F-35 jets to Tomahawk missiles.

6. Rapid Response Group for Supply Shocks

The agreement covers the formation of a joint Rapid Response Group to deal with supply chain disruptions. The mechanism is supposed to co-ordinate stockpile releases, diverting shipments and mobilising alternative sources in the event of geopolitical or market shocks – a capability increasingly important given China’s readiness to weaponise export controls.

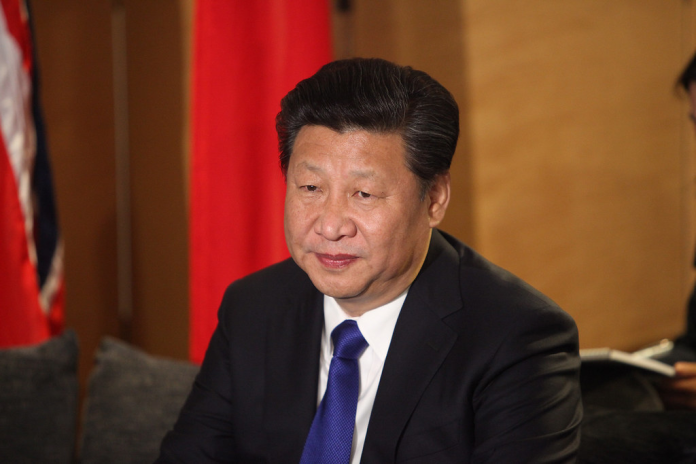

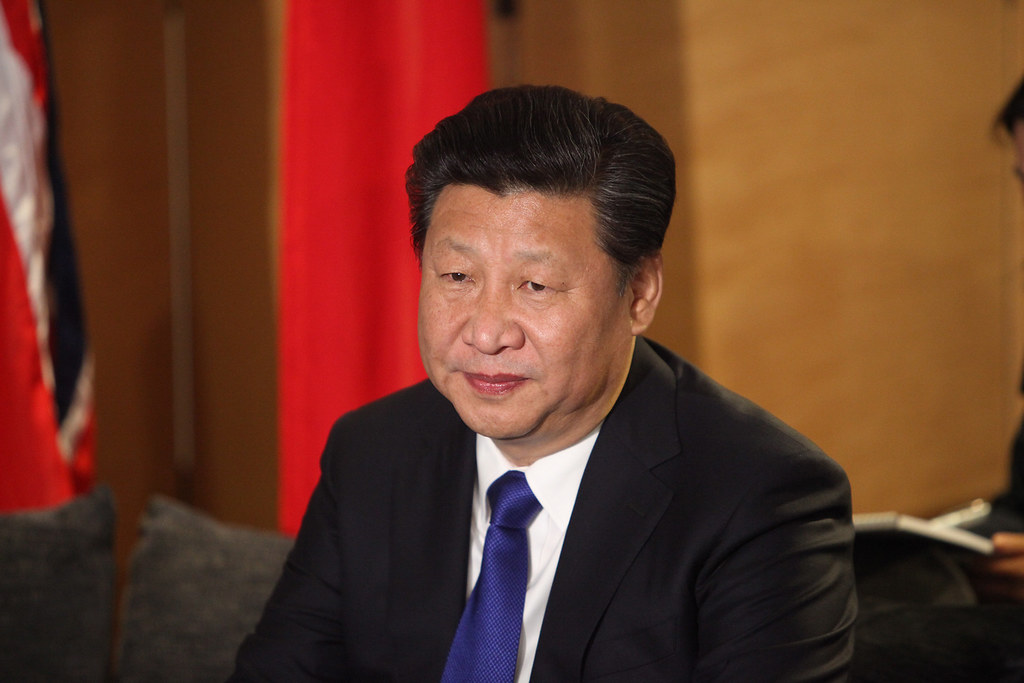

7. Diplomatic Optics and Personal Rapport

Takaichi’s first meeting was replete with overtures of personal friendship with Trump-from the signed golf bag to the Nobel Peace Prize nomination. Such gestures are not new in Japanese diplomacy, especially given that Shinzo Abe followed similar instincts in his own outreach to Trump, as a way to build trust that might pay dividends in policy compromise. For Trump, too, the meeting represented a test of whether Takaichi might be his go-to interlocutor in Asia.

8. Humanitarian Dimension: North Korea Abductions

Beyond minerals, the leaders met with the families of Japanese citizens abducted by North Korea in the 1970s and 1980s. The families called on Trump to bring up the issue with Kim Jong Un if a meeting takes place. Takaichi signaled readiness to personally engage Pyongyang, framing the issue as a test for Japan’s resolve and humanitarian priorities alongside its strategic agenda.

9. Regional Supply Chain Diversification

By binding Japan into rare earth cooperation, Washington is furthering a broader Indo-Pacific diversification strategy. Deals inked with Malaysia, Thailand, Vietnam, and Cambodia include pledges to prioritize US buyers over Chinese firms, as well as to refrain from export bans. Some are non-binding MOUs, but taken together they represent a regional hedge against Chinese control – one that will take several years of capital investment and environmental safeguards to materialize.

The rare earth deal between Washington and Tokyo is both a tactical play in the US-China rivalry and a litmus test of Japan’s new leadership. It reinforces a network of allied supply chains, embeds mechanisms for market stability, and accelerates Japan’s defense posture-all on the eve of high-stakes talks with Beijing. Yet the road to true resource independence is long, requiring sustained investment, environmental management, and political will. For now, the agreement signals that the US and Japan are prepared to confront China’s leverage with coordinated strategy, shared risk, and a vision of a more secure industrial future.