“For the first time in three and a half years, Russia’s really getting hurt,” said Timothy Ash of Chatham House. That assessment, delivered as sanctions tighten and fiscal strain deepens, captures a shift in the most decisive front of the war in Ukraine: the economy. The Kremlin’s narrative on resilience is fraying amidst bad debt, energy disruptions, and shrinking fiscal buffers.

But its most dangerous enemy is within: a highly indebted and militarised economy full of structural weaknesses. Weaknesses ranging from rapidly increasing debt for arms makers to a rising reliance on China feed into what some analysts label an economic “time bomb.”

Following are some of the most serious economic and strategic fault lines now threatening the Vladimir Putin war machine, in light of recent battlefield developments, sanctions policy, and shifting geopolitics with regard to energy.

1. Phantom Enemies Mask Internal Weakness

The FSB’s recent accusation that exiled oligarch Mikhail Khodorkovsky had plotted a coup was only the most recent reprise of the Soviet-era tactic of inventing threats to justify repression. In the words of Dr. Stephen Blank from the Foreign Policy Research Institute, “Putin always has to have some entity out there” to frame as an existential danger. This distracts from the real danger: economic frailty resulting from overextension and sanctions.

2. The $190 Billion Defence Debt Overhang

All told, Russian banks have extended arms manufacturers some $190 billion about 37 percent of the state budget often without due credit checks. That “dark pool of debt” could be the source of record defaults, says Craig Kennedy at Harvard’s Davis Center. At least three major banks are already preparing bailout requests, signaling that the financing model for the war is unsustainable.

3. Ukrainian drone strikes at Russian oil infrastructure

In the past year, Ukraine has hit 21 of Russia’s 38 key refineries. Attacks speeded up in August and September. The BBC Verify team have established that some deep inside Russia – like the Gazprom Neftekhim Salavat plant, more than 1,100 km from Ukraine – have been hit multiple times. The forced shutdowns have created fuel shortages and driven up wholesale petrol prices by 40% since January, undermining civilian supply and military logistics.

4. Sanctions on Rosneft and Lukoil Bite Deep

The new US sanctions freeze the assets of Rosneft and Lukoil, bar American dealings, and threaten secondary sanctions on foreign banks that facilitate their sales. Combined, the companies export about 3.1 million barrels a day-nearly half of Russia’s crude exports. Early signs emerged that Chinese and Indian refiners are curbing purchases, which could constrict a quarter of Russia’s budget revenue.

5. Secondary Sanctions as a Force Multiplier

These sanctions reach beyond Russian producers to include intermediaries, insurers, and financiers. The threat, according to analysts, often convinces some Asian buyers to halt imports. It increases transaction costs and therefore further complicates logistics, reducing Moscow’s capacity to use oil revenues as a cushion to buffer fiscal shocks.

6. Fiscal Deficit and the Erosion of the National Wealth Fund

The budget deficit reached 2.2 percent of GDP in the first seven months of 2025, with oil tax revenues down 34 percent year on year. Liquid assets in the National Wealth Fund have slumped from almost 10 trillion rubles before the war to 4.2 trillion, with Russian economists warning it could be depleted by 2026, removing a key buffer to economic crisis.

7. Structural Limits of the War Economy

Military spending now consumes almost 40 percent of the federal budget, but much of the output-tanks, shells, drones-gets destroyed quickly at the front. That keeps the workers busy but generates no lasting assets. It’s what analysts call a disposable-goods economy: busy, yet poorer each year, with civilian sectors in recession and private investment squeezed.

8. Labour Shortages and Demographic Strain

As of late 2024, Russia was short 2.2 million workers, and 70 percent of firms reported shortages. War casualties, injuries, and emigration have reduced the working-age population. Demobilising hundreds of thousands of contract soldiers after the war might also lead to labor market shocks, particularly in defence-dependent regions.

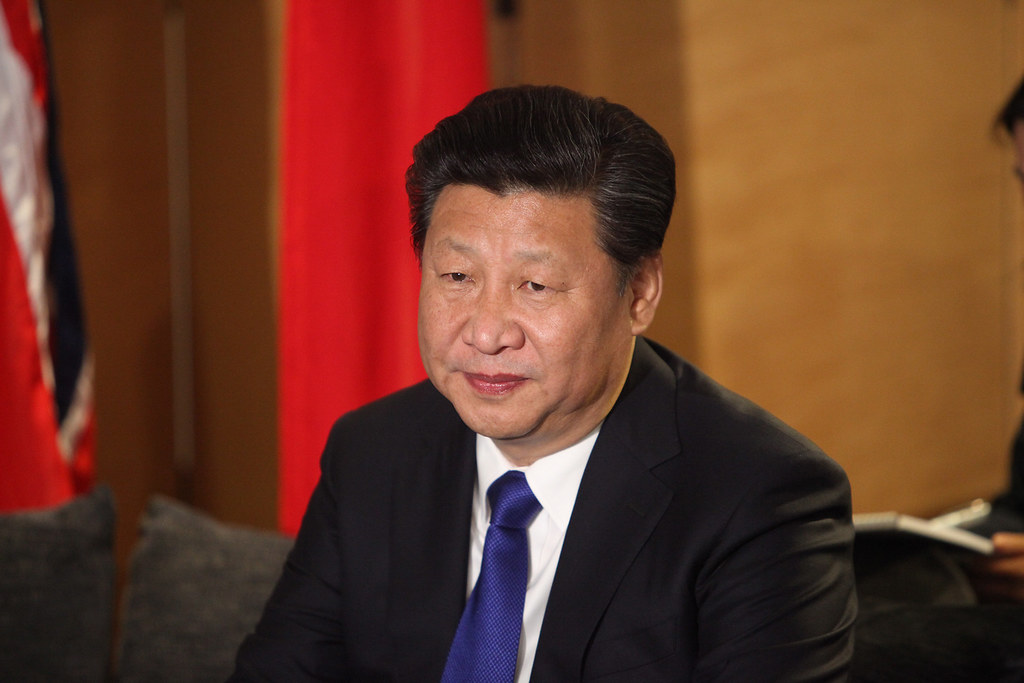

9. Growing Dependence on China

Beijing has become Moscow’s most important economic partner, paying a discount for oil in exchange for machine tools, electronics, and consumer goods. Khodorkovsky warns that “Xi Jinping could collapse the Russian economy and end the war tomorrow if he chose to.” The asymmetry provides China with pricing and terms leverage, further eroding Russia’s strategic autonomy. It is within this framework that the extent to which Russia will be capable of projecting power depends less on battlefield maneuvers than on how it will navigate these converging economic pressures.

All of these fault lines-debt, sanctions, strikes, deficits, structural imbalances, labor shortages, and dependence on China-are part of a combination weakening the regime’s capacity to sustain a protracted war. The implication for policymakers is obvious: sustained, enforced economic pressure may achieve what military stalemate has not-forcing the Kremlin to confront the limits of its war economy.