“Better the devil you know than the angel you don’t.” For too many early adopters of electric cars, this old proverb has become more relevant than ever. The promise of green, silent, and state-of-the-art driving has clashed with the reality of spotty infrastructure, shifting technology, and prices that don’t always live up to the hype.

In the last year alone, surveys conducted by McKinsey, Edmunds, and others have disclosed a surprising trend: a major percentage of EV owners particularly in the US are looking to switch back to gasoline. As the overall market continues to expand, the frustration among some drivers provides a counterpoint to the conventional narrative of unstoppable electrification.

This list crystallizes the most incisive lessons from those who went back to internal combustion, combining individual testimony with the newest figures and cross-country comparisons. It’s not a case against EVs, but more of an examination of the disconnects still between promise and practice.

1. Charging Reliability Is Still a Weak Link

In the United States, non-residential charging equipment functions only reliably approximately 78% of the time. That is to say that an estimated one in five charges fails something that would be intolerable at fuel pumps. For those drivers in suburbs and rural areas where merely 41% and 17% live within one mile of a public charger, the unreliability only adds to the inconvenience.

Despite recent gains Paren Inc.’s Q1 2025 report indicates non-Tesla fast-charger reliability at 82.6% there is still a wide margin to the virtually flawless uptime of gas stations. Busy, high-utilization urban markets such as Los Angeles or Miami perform better, yet for most, the unreliability of having a functioning charger makes routine trips into logistical challenges.

2. The Hidden Costs Can Outweigh the Savings

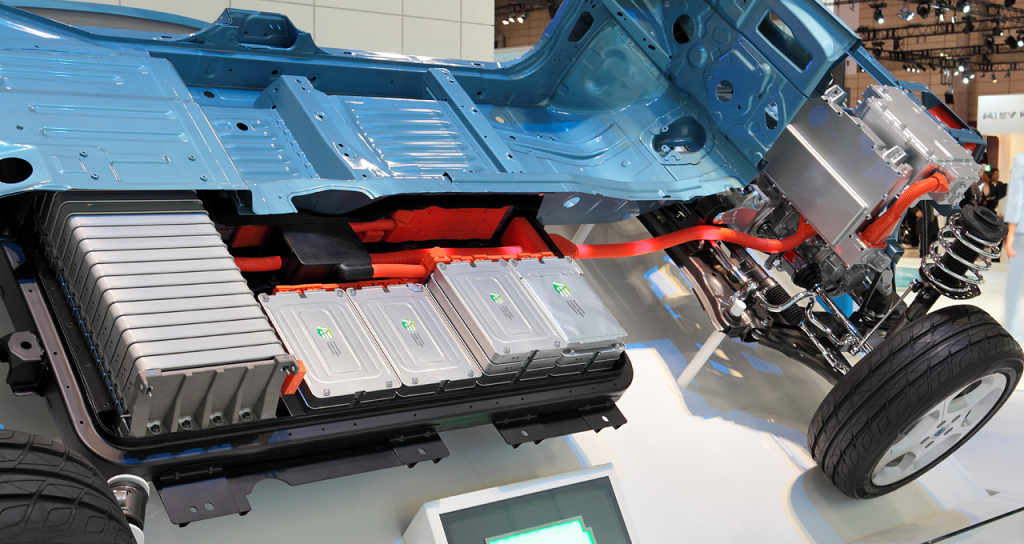

Although EVs hold out the promise of lower operating expenses, the cost of ownership can be a shock. Thirty-four percent of U.S. EV owners surveyed by McKinsey said high ownership expenses were a motivation to trade back up to gasoline. Battery replacement beyond warranty though occasional runs from $5,000 to $16,000, with some models such as the BMW i3 or VW e-Golf commanding much steeper prices.

Worldwide, battery pack costs have dropped from more than $400/kWh in 2012 to roughly $111/kWh in 2024, and LFP cells in China have dropped to $56/kWh. But American drivers tend not yet to realize these economies in replacement expenses, at least in part because of scarce third-party supply.

3. Convenience Still Favors Gasoline

For most, EV adoption complicated things instead of simplifying them. Gasoline’s three-minute fill-up was replaced by sessions involving planning, waiting, and hoping the charger is operational. Without home charging or access to Tesla’s Supercharger network, public charging becomes a nagging pain.

Price instability and resale value declines, fueled by recent reductions in EV prices, have also made the experience bitter for some. The ease of driving into any station, paying, and departing is a tough standard for EVs to live up to until infrastructure and interoperability advance.

4. Younger Families Feel the Strain

Against stereotypes, frustration is not limited to older drivers. In the United States, the median age of those who are likely to switch back is about 36, usually with young children in tow. For these families, the fitting together of long-distance planning, charger side trips, and backseat frustration transforms car travel into stress management.

Thirty-two percent indicated that EVs changed their driving habits too much on long road trips, and 34% cited costs as the reason. When families are balancing time, budgets, and logistics, these outweigh environmental or technological attractions.

5. Battery Degradation Is Slower But Still a Concern

The silver lining: average yearly decline has gone from 2.3% in 2019 to 1.8% in 2024, Geotab reports. At that pace, much of the EV batteries might remain useful for 20 years. But range loss with age is still a psychological barrier, and particularly for used-EV customers.

In McKinsey’s 2025 survey, 26% of U.S. purchasers listed costly battery replacement as their greatest EV concern beating range worry (24%) and availability of charging (23%). Even when breakdowns are uncommon, the fear of impending high-cost repairs can affect buying behavior.

6. Geography Shapes the Experience

EV adoption is deeply uneven. In California, about 25% of new cars are electric; in Wisconsin, it’s 1%. Norway’s near-90% EV share is supported by dense charging networks, generous incentives, and long-term policy stability conditions far from universal in the U.S.

Urban-rural divides are stark: McKinsey reported EV purchase intent at 51% in US cities, compared to 18% in rural areas. Gaps in infrastructure, climate, and political will all shape whether or not EV ownership is seamless or frustrating.

7. Conflicting Data Clouds the Picture

Surveys vary widely. McKinsey’s U.S. survey indicates 46% of EV owners might switch back to gas, but other international surveys report fewer than 2% would do so. Methodology, sample size, and question wording all contribute to such differences.

The politicization of EVs in the United States also clouds perception. As Environmental Defense Fund’s Elyse Martin points out, “EVs are receiving negative publicity due to extremist politicians… and special interest groups who profit from cars which run on fossil fuel.” The media tends to overstate unusual problems, such as EV fires, while statistics indicate gas cars are many times more likely to catch fire.

8. Mainstream Buyers and Early Adopters Live in Different Worlds

Tesla’s early adopters endured limited infrastructure and premium prices for novelty and performance. Mainstream buyers today lower- or middle-income in many cases demand simple, affordable cars with as little hassle as possible. In the absence of home charging or access to high-quality networks, they face the pain points early adopters did.

Once switched off, these customers are more difficult to win back. Bad first impressions delay adoption more than any technical constraint.

9. Infrastructure Investment Is Slow to Deliver

The U.S. installed 20% more public charging stations in 2024, at just below 200,000. Yet the $5 billion National Electric Vehicle Infrastructure program has been slow to gain traction: as of late 2024, only around $30 million had been allocated to working chargers, with only 382 ports operational out of 4,000 paid for.

State officials attribute multifaceted site selection, utility delays, and equipment shortages. As one Virginia DOT manager explained, “Every site is a snowflake.” Until the rollout gains momentum, the disconnect between policy ambition and driver experience will continue.

The return to gasoline isn’t a wholesale dismissal of EVs it’s an acknowledgement of where the technology, infrastructure, and economics are at the moment. For others, the trade-offs remain too high. Narrowing the gap will take not only improved batteries or quicker chargers, but more of a coordinated attempt to make electric driving as convenient, economical, and dependable as the internal combustion paradigm. Otherwise, the journey to complete electrification will be a two-way road.