The diesel engine, the unyielding workhorse of American cargo for generations, is slipping sooner than industry vision was expecting. What was initially a creeping advance toward cleaner alternatives has now become a mad rush to retool fleets, pushed by coming together forces in technology, rules, and economics. In the space of a couple of years, electric and hybrid trucks have transitioned from prototype testing to commercial mainstays, forcing the trucking industry to confront unprecedented opportunity and challenging technical challenges.

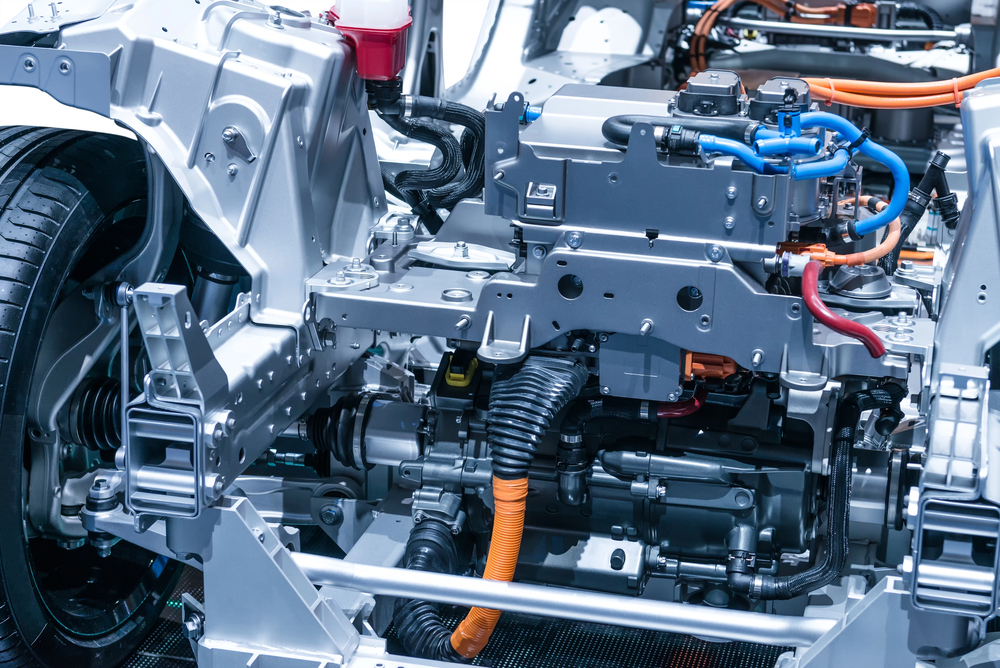

1. The Technology Behind Diesel’s Downfall

Advances in electric and hybrid truck technology have largely removed the performance gap that has kept diesel in its long-standing dominance. New battery-electric trucks (BETs) are now equal in torque and acceleration to diesel Class 8 tractors, at 75–85% well-to-wheel efficiency compared to 30–50% for hydrogen fuel cell or hydrogen combustion systems. Lithium-ion chemistries have improved to over 210 Wh/kg energy density supported by nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) advances backing ranges of 500 miles in U.S. models. Fleet managers are also considering lithium manganese iron phosphate (LMFP) cells, coming to market in 2025, which are reported to provide higher voltage and longer cycle life.

2. Regulation Pressure and Market Pull

The policy climate is pushing adoption along. California’s Advanced Clean Truck Act mandates increasing zero-emission truck sales up through 2035, with six additional states. Federal incentives in the Inflation Reduction Act provide up to $40,000 for every qualified heavy-duty electric truck and add tax credits on charging equipment. States have to add public charging every 50 miles along qualified corridors in the Infrastructure Investment and Jobs Act. All these measures combined with rising diesel prices are shifting the overall cost of ownership to electric. A 375-mile range electric semi was discovered in a study by Lawrence Berkeley National Lab that could cost $1.51 per mile 13% lower than diesel and achieve $200,000 in lifetime savings.

3. Heavy-Duty Battery Innovations

For heavy-duty duty cycles in freight, battery life matters the most. NMC cells deliver higher energy density but shorter cycle life, while LFP chemistries give up some range for longevity, safety, and cost. The. industry is also working on cell-to-pack configurations to eliminate modules, packaging efficiency and range enhancing. 400-volt to 800-volt architectures transition is halving charging times, and thermal management innovations are reducing fire risks. Battery swapping already prevalent in China, where nearly half of BEV heavy trucks sold in 2023 are swap-enabled is potentially shaving downtime from hours to under five minutes, although U.S. adoption will require cross-OEM standardization.

4. The Infrastructure Bottleneck

The most significant barrier to scale is charging infrastructure. Scant few of the 6,700 public DC fast-charging sites in the U.S. are passenger-vehicle-capable, not 33,000–80,000 lb. trucks. Class 8 long-haul trucks can require up to 3.75 MW of charging capacity enough to charge 100 Tesla Model Ys simultaneously. The National Renewable Energy Laboratory (NREL) is finalizing the Megawatt Charging System (MCS) standard for commercial truck support of 30-minute charge sessions. With its eCHIP initiative, NREL is creating DC distribution centers that utilize on-site solar, energy storage, and smart load management to reduce grid strain and charging expenses.

5. Smart Charging and Grid Integration

High-power charging will require sophisticated energy management. NREL’s smart charging platforms can dynamically allocate power by dwell time, prefer vehicles that need rapid turnaround, and draw on on-site renewables to avoid peak electricity tariffs. Projects like FUSE are combining grid planning and transportation planning so that next-generation charging stations can handle 20 MW or more without upsetting local grids.

6. Economics and Fleet Management Implications

Though electric trucks weigh around 2.8 times as much in up-front cost as diesel, declining battery prices more than 80% reduced over the last decade are closing the gap. Maintenance costs are significant: no oil changes, reduced moving parts, and regenerative braking that increases component longevity. Fleet managers are redefining KPIs to monitor charging expense, battery condition, and electricity rate optimization. The shift is also spurring workforce upskilling in high-voltage systems and digital fleet analysis.

7. Supply Chain and Circularity

OEMs are weighing up battery sourcing options from captive production to direct contract with suppliers. Vertical integration offers intellectual property and cost advantage but is costly to set up. Raw materials supply, particularly lithium for LFP chemistries, appears robust until 2030 to fit in well-priced long-term deals. End-of-life battery management is becoming an imperative strategy: closed-loop recycling has the potential to recover high-value metals, cutting raw material emissions by up to 40%. NMC chemistries already provide higher recycling value than LFP, but the development of direct recycling can make LFP economics better.

8. The Competitive Landscape Ahead

More than ten years have passed since OEMs rolled out or revealed medium- and heavy-duty zero-emission models with U.S. long-haul ranges above 700 km. Standard, regional routes will be dominated by battery-electric powertrains, whereas hydrogen will be able to carve niches in ultra-long-haul and high-utilization use cases. For now, mastery of battery technology chemistry, architecture, and integration is the decisive factor for taking market share.

The shift of the trucking industry away from diesel is no longer a distant dream it’s an engineering battle playing out in real time. Those who are able to put vehicle performance, charging systems, and cost competitiveness all together will define the next century of freight transportation.