It was a deal negotiation that defied the norm: in place of tariffs or direct prohibitions, Washington negotiated a direct share of corporate profits. Nvidia and AMD’s commitment to paying 15 percent of their China AI chip sales as royalties to the U.S. government in exchange for export permits represents an unprecedented convergence of technology policy, trade policy, and national security.

1. A Quid Pro Quo Without Precedent

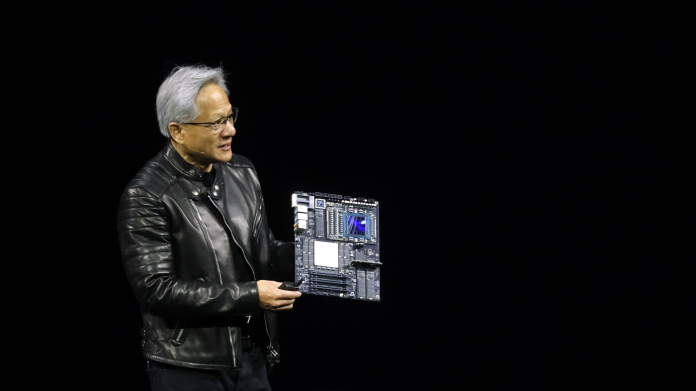

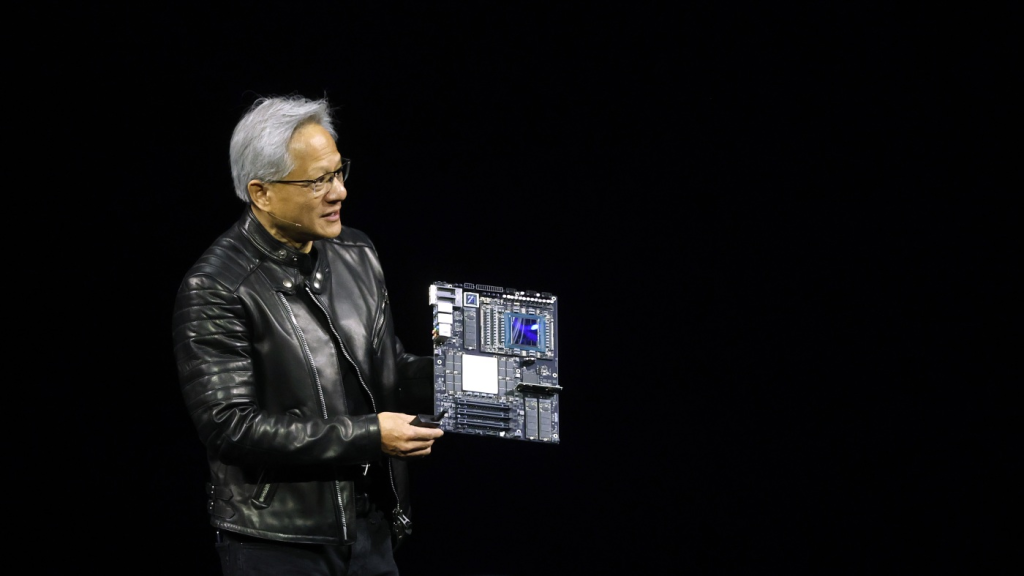

The deal came after Nvidia CEO Jensen Huang had a meeting with President Donald Trump at the White House. Trump said the request was originally 20 percent, but Huang came down to 15. “If I’m going to do that, I want you to pay us as a country something, because I’m giving you a release,” Trump added. The licenses include Nvidia’s H20 and AMD’s MI308 processors both miniature versions of their high-end AI chips, intended to meet export controls. Bernstein Research analysts predict Nvidia can sell around 1.5 million units of H20 chips in China during the current year, raking in around $23 billion in revenue. The share of the U.S. government could be well over $3 billion.

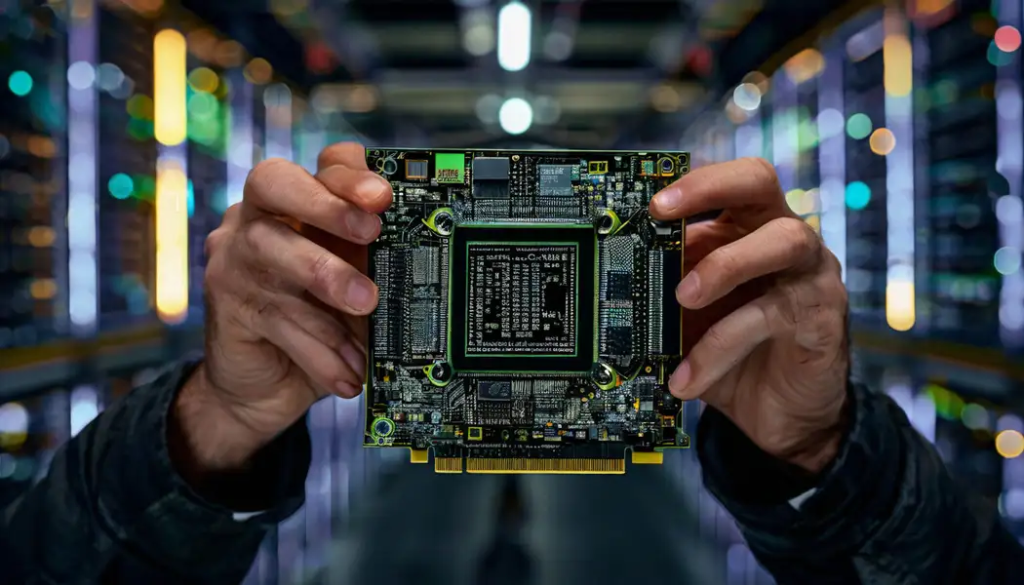

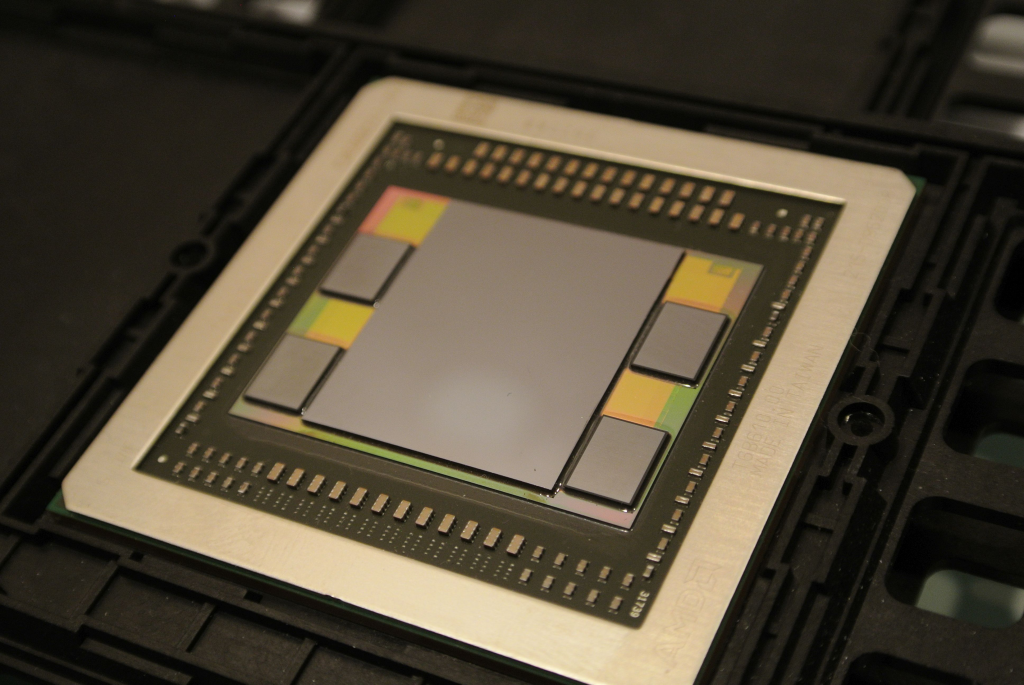

2. The H20 Chip: Designed to Conform

Nvidia’s H20 is a high-end AI accelerator designed to circumvent the October 2023 U.S. processing power and interconnect bandwidth export limits. Although less powerful than the H100 or the Blackwell B200, it maintains sophisticated tensor cores and high-bandwidth memory integration, making it worth using for inference workloads and mid-scale model training. Experts say the H20’s design strikes a balance between compliance and competitive performance, presenting Chinese customers with a legal but powerful alternative to embargoed chips.

3. Security Accusations and Denials

The launch of the deal was complicated by accusations made by Chinese state media that the H20 has “backdoors” and “remote shutdown” facilities. The report Yuyuan Tantian, which is a CCTV affiliate, claimed that “when a kind of chip is neither eco-friendly, nor cutting-edge, nor secure, as consumers, we definitely have the right not to purchase it.” Nvidia has outright rejected such functions, adding that “inserting backdoors and kill switches into chips would be a present to hackers and adversarial actors.”

4. Export Controls as Strategic Leverage

Since October 2022, there have been U.S. export controls on high-performance semiconductors aimed at throttling China’s AI and defense advances. These have involved new ECCNs for high-end GPUs, increased Foreign Direct Product Rule coverage, and end-use limitations on advanced node semiconductor manufacturing. Even the H20 itself was a result of these restrictions released after Biden-era regulations withheld higher-end chips, and subsequently curtailed under Trump before this revenue-sharing flip.

5. Economic and Legal Questions

The U.S. Constitution prohibits export taxes, so the administration has asserted the 15 percent as a condition of a license, rather than a tax. “It’s difficult to find any historical precedent for this type of arrangement,” said Sarah Kreps, director of the Tech Policy Institute at Cornell University. Critics such as Representative Raja Krishnamoorthi caution it threatens to turn export controls into a dangerous abuse… that erodes our national security.

6. China’s Countermoves and HBM Demands

Negotiators from Beijing have tied broader trade negotiations to relaxing limits on high-bandwidth memory chips used in AI accelerators. Such chips, frequently coupled with GPUs such as the H20, facilitate speedy data transfer for training large models. U.S. restrictions on HBM have stymied Chinese companies such as Huawei from creating indigenous AI hardware, further ratcheting up pressure for concessions.

7. The Blackwell Question

Trump has kept on the table the option to license Nvidia’s Blackwell chips its cutting-edge AI processors if performance is reduced by 30 to 50 percent and the U.S. government is offered a greater share of revenue. “The Blackwell is superduper advance Nobody has it. They won’t have it for five years,” Trump said. The administration’s approach illustrates a tiered export philosophy: permit middle-tier technology for economic benefit, keep best-of-the-best capability out of Chinese control.

8. Market Stakes and Strategic Calculus

China represented 13 percent of Nvidia’s revenues in 2024. Together, Nvidia and AMD would generate as much as $35 billion per year from the licensed chips, paying Washington about $5 billion. For the firms, the agreement reopens the world’s second-largest GPU market, though on thinner margins and under greater scrutiny. For America, it turns export controls into a dual-use weapon capping leading technology while capitalizing on allowable sales.

9. Masayoshi Son’s Parallel AI Gambit

As Washington finances chip exportation, SoftBank’s Masayoshi Son is wagering on the next frontier: artificial superintelligence by the decade. His bets run the gamut of the AI stack from Arm’s chip architectures to a prospective $32.7 billion investment in OpenAI setting up SoftBank to profit from the very infrastructure and applications chips like the H20 make possible. Son’s thinking is predicated on a conviction that mastery of both the hardware and the software layers will determine the winners in the AI era.

10. The Geopolitical Supply Chain

The American semiconductor revival its share of the market up from 20.9 percent in 2021 to 35.2 percent in late 2024 has rested on the foundation of AI demand. Nevertheless, as of mid-2025, Taiwan provides more than a third of U.S. chip imports, with monthly highs of more than 50 percent. The reliance increases the strategic importance of firms such as TSMC, which produces Nvidia’s high-end GPUs, and highlights the geopolitical risk inherent in each export license.

The 15 percent deal is one experiment, perhaps, but it is at the intersection of AI competition, trade diplomacy, and semiconductor engineering. Its success or failure will be sized in not just billions of dollars, but in who holds the key compute defining the next decade of artificial intelligence.