The inauguration of Panasonic Energy’s $4 billion electric vehicle battery factory in De Soto, Kansas, is not just a ribbon-cutting ceremony it is an orchestrated engineering and economic move to remake the U.S. battery supply chain. The plant, at 4.7 million square feet, is the world’s largest of its type, an enormous complex that would accommodate 225 football fields and still have space to spare. Its size, targets for productivity, and highly advanced manufacturing systems make it a key hub in America’s quest to localize EV battery making and become less dependent on foreign suppliers.

1. A Gigafactory Designed for Scale and Pace

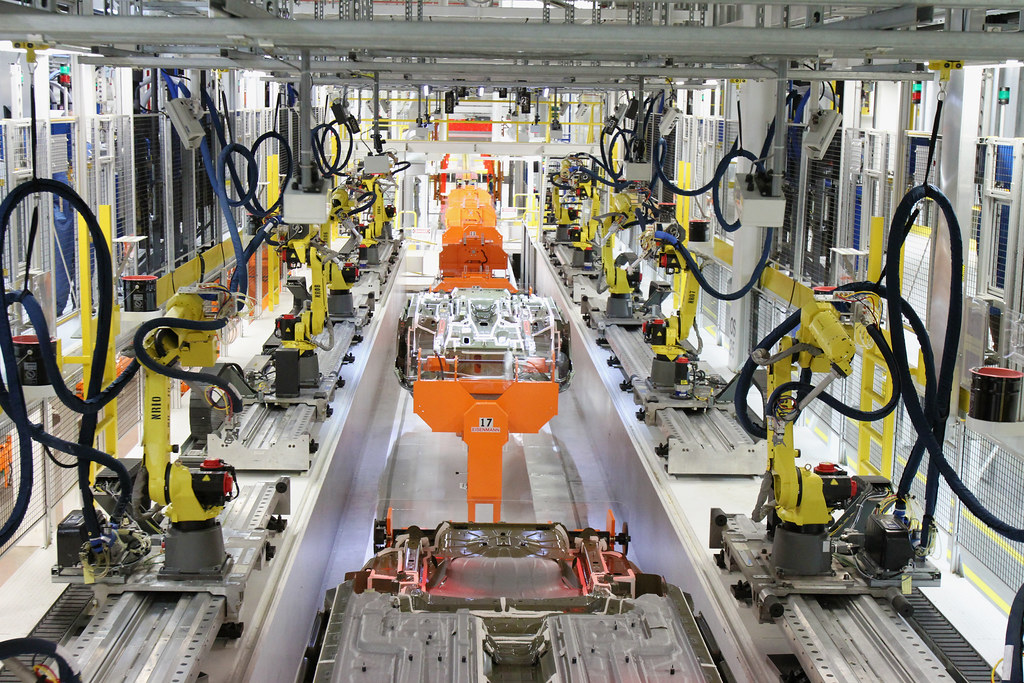

Built on a 300-acre plot of land, the Kansas plant is configured to make cylindrical 2170 lithium-ion cells at a capacity of 32 gigawatt-hours (GWh) per year once it is fully up and running providing enough power to drive about 500,000 EVs. This production, along with Panasonic’s Nevada Gigafactory’s 41 GWh, will drive the company’s U.S. total to around 73 GWh. The facility layout consists of two wings with four battery lines per wing, integrated with their own shipping, packing, and sub-supply vendor areas. The common middle area is large enough to fit three passenger aircraft nose-to-tail. To walk every square foot would take almost 13 days.

2. Engineering Productivity Gains

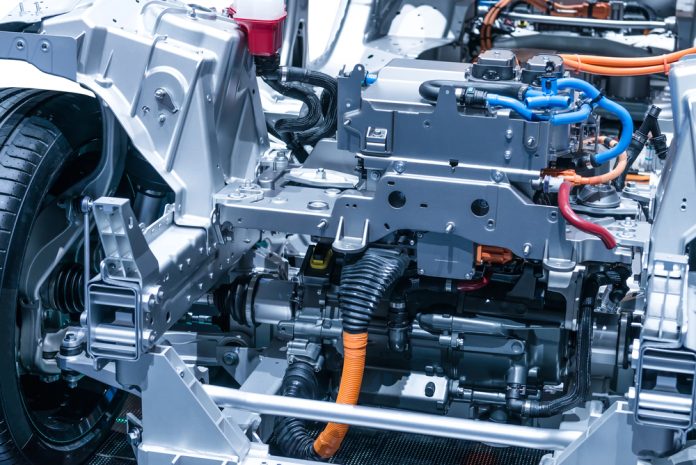

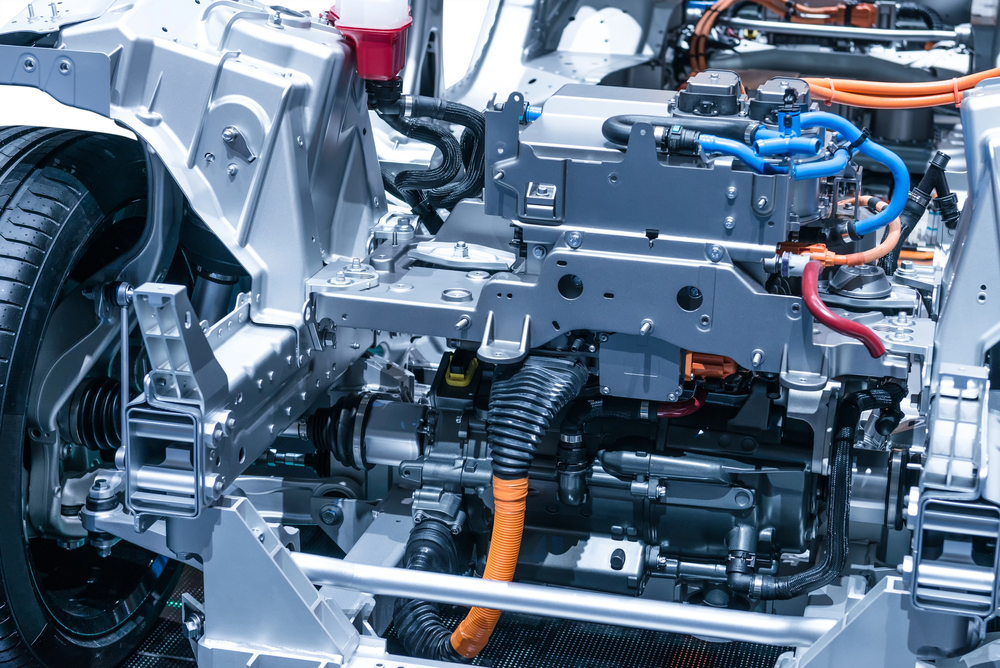

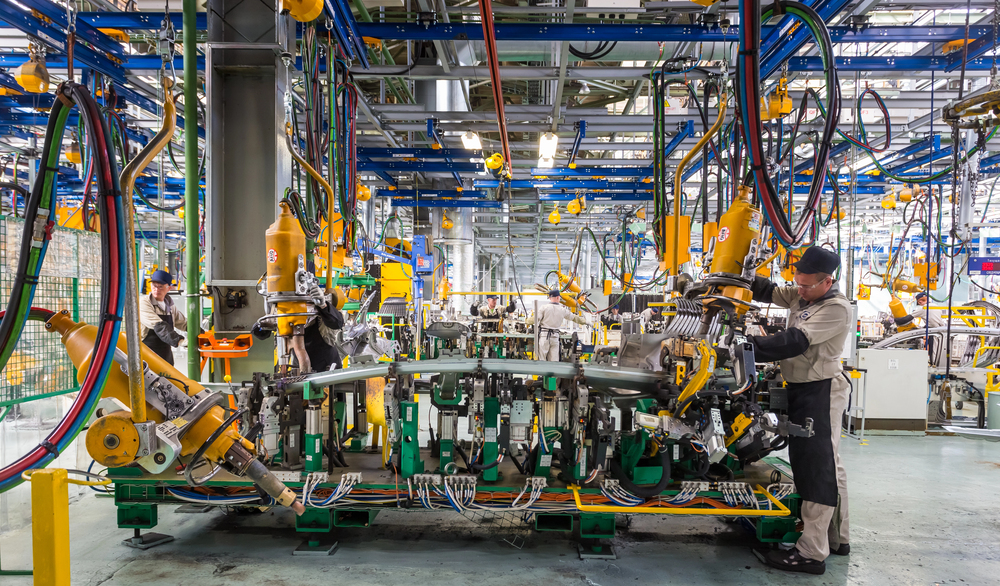

Panasonic has unveiled labor-saving production lines that are to realize 20% greater productivity from its Nevada plant. This is through enhanced automation, maximized material handling, and precision electrode coating systems minimizing waste and maximizing throughput. Panasonic plans to adopt new electrode active materials to increase cell capacity by approximately 5%, further driving energy density above its current industry benchmark of 800 Wh/L.

3. Manufacturing Process and Supply Chain Localization

The facility’s production will be aided by U.S. federal incentives including the 45X advanced manufacturing production tax credit, which provides up to $45 per kilowatt-hour of battery capacity for cells and modules manufactured in the United States. The incentives aim to speed onshoring of critical mineral processing and electrode production, lowering dependence on China’s near-monopoly on processing graphite anodes. Panasonic’s investment is consistent with this policy change, although the firm continues to struggle to find U.S.-based supplies of lithium, nickel, and cobalt.

4. Riding Policy and Market Headwinds

Kansas production comes as the EV market is volatile. Tesla, Panasonic’s biggest customer, has had falloff sales, and EV adoption forecasts in the United States have been reduced after the Trump administration rolled back federal tax credits. The $7,500 incentive to buy an EV is set to run out in September 2025, while annual EV ownership charges proposed by lawmakers may additionally discourage purchasing. Panasonic’s diversification into selling to other manufacturers such as Lucid, Mazda, is a self-protection strategy against sole dependence on Tesla.

5. Economic Impact and Workforce Development

This is the biggest economic development project in Kansas history, expected to generate 4,000 direct manufacturing jobs and another 8,000 in the supply chain. The state’s APEX incentive program will give Panasonic $829.2 million over a 10-year period, accompanied by $229 million in local infrastructure investment. Collaborations with the University of Kansas will create a specialized talent pipeline, coupling research into advanced materials, recycling, and process optimization.

6. Integration of Technology with Renewable Power

In addition to EVs, the plant’s battery output is applicable to grid-scale storage applications, allowing for greater integration efficiency of renewables such as solar and wind. Kansas factory-produced high-capacity lithium-ion cells can be combined with residential energy systems for the reduction of fossil fuel usage and utility bills, further establishing the value of battery production in both decarbonizing transportation and electricity markets.

7. Competitive Positioning in a Global Market

Around the world, Panasonic manufactures more than six million battery cells per day, or 70 per second, and has produced about 19 billion cells with not a single recall. Competition, however, is heating up. Chinese manufacturers are responsible for producing 69% of the world’s EVs, with domestic excess capacity driving utilization levels below 50%. Panasonic’s expansion in the United States is a defensive and offensive strategy defensive to gain traction in a sheltered market, and offensive in targeting automakers who want to meet local sourcing requirements for tax credits.

8. Engineering for Resilience

The Kansas factory’s architecture mirrors some of the Nevada plant’s lessons: modular production lines for fast retooling, merged quality control to ensure cell uniformity, and inherent flexibility to accommodate alternative chemistries like silicon-dominant anodes or solid-state cells. These features are important as new technologies promise to upend traditional lithium-ion hegemony.

The De Soto plant is a case study of how industrial engineering, policy incentives, and supply chain strategy come together in the clean technology age. Its success will depend not just on Panasonic’s capacity to perform at scale but also on the survivability of the US EV market in the face of changing political and economic winds.