The China humanoid robotics surge is not a headline; it’s a structural shift in global technology power. While Elon Musk sees humanoid robots as the cornerstone of Tesla’s future valuation, Beijing is executing a national strategy that could see Chinese firms dominate mass production years ahead of U.S. competitors. The intersection of AI, precision engineering, and manufacturing scale is transitioning humanoid robots from futuristic prototypes to industrial and consumer-ready products.

1. Strategic Priority & Market Potential

So, by including “embodied artificial intelligence” in Beijing’s 15th five-year plan, it has signaled that the realm of humanoid robots is now a core national priority. That policy framework puts China at the forefront of AI-driven physical systems, while addressing lower birth rates and a graying workforce. RBC Capital Markets estimates that by 2050, there could be a $9 trillion global humanoid market, which might see China capture more than 60% of it. According to analysts such as Andreas Brauchle from Horváth, “China currently leads the United States during the early commercialization of humanoid robots,” scaling up more in this initial phase.

2. Elon Musk’s Optimus Vision

Musk himself has estimated that humanoid robots could push Tesla’s valuation into the tens of trillions, and Optimus is expected to cost somewhere between $20,000-$30,000 when scaled. A prototype of Optimus Gen 2 features more than 40 degrees of freedom, 11-DoF dexterous hands, and a 2.3 kWh battery to enable nearly all-day operation. Yet even with all the recent advances in gait control, object handling, and balance, Tesla has not started commercial sales, which provides an open window for Chinese companies to gain the upper hand in early market share.

3. China’s Manufacturing and Supply Chain Edge

China’s robotics ecosystem benefits from the dense industrial clusters in Shenzhen and Shanghai, where the colocation of component suppliers, assemblers, and end-users narrows iteration cycles and reduces costs. The harmonic reducer market, critical for humanoid joints, has been disrupted by firms like Green Harmonic, which provides comparable performance to incumbents in Japan and Germany at 30-50% lower prices. Such reducers, together with precision bearings, torque sensors, and integrated joint actuators, are core elements in humanoid locomotion and manipulation.

4. Engineering Complexity: Motion Control and Actuators

Dozens of actuators are needed in a humanoid robot, each tuned for a specific joint. For instance, Tesla’s Optimus uses more than 28 rotary and linear actuators, while hand modules demand ultra-compact, high-torque designs. In high-end humanoids, joint actuators can account for more than 30% of BOM cost. Advanced balance strategies such as Zero Moment Point control, inverted pendulum modeling, and Preview Control of COM are all quite necessary for stability in dynamic environments. High torque density, low energy consumption, and integrated sensing are now requirements.

5. AI-Powered Autonomy

AI motion control systems are rapidly developing. MIT’s current purely vision-based AI controller can even build a map of a robot’s “visuomotor Jacobian field” using cameras only, thus enabling self-improvement without expensive sensors. That might eventually cut costs and enhance adaptability, letting humanoids function in unpredictable settings. Chinese companies are working upon the integration of multi-sensor fusion with AI reasoning models for manipulation and navigation, using real-world deployment data in volume to improve algorithms more rapidly than U.S. players.

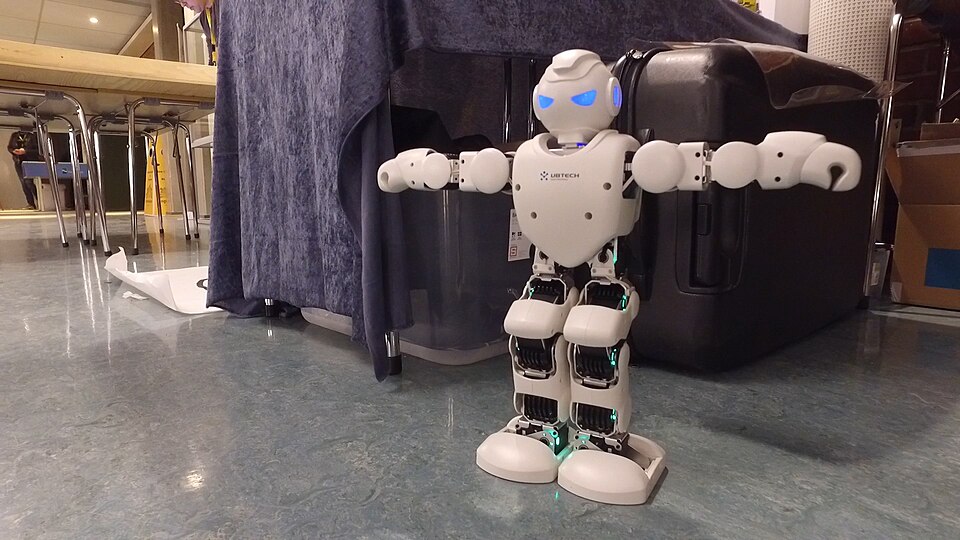

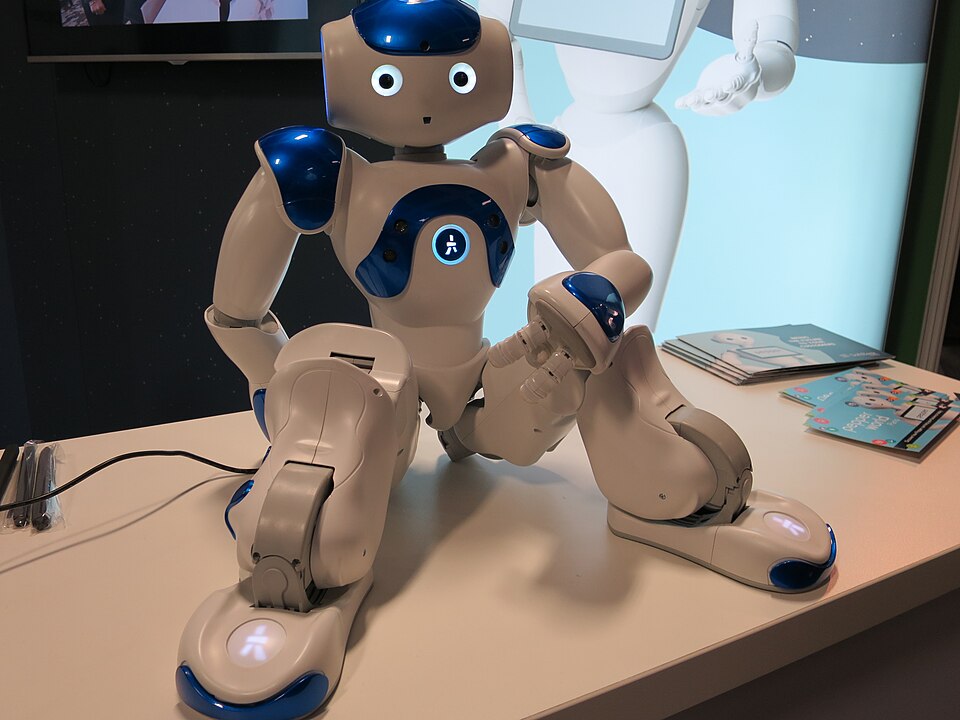

6. Key Chinese Players

UBTech Robotics’ Walker S2 autonomously swaps batteries for 24-hour operation, and the firm hopes to manufacture 10,000 humanoids by 2027. Unitree’s H2 model shows agility unrivaled among modern humanoids; the Expedition A2 from AgiBot positions in joints as precisely as 0.01 mm for electronics manufacturing. Xpeng’s Iron robot and Alibaba’s R1 introduce a wider range of applications into the consumer and service sectors, respectively. These companies enjoy subsidies from local governments and a supply chain that could shrink production costs 20-30% annually.

7. U.S. Advantages and Constraints

American companies have an advantage in AI, autonomy, and vertical integration-owning more of its supply chain to ensure IP and performance. The downside is that restrictive regulations, slow manufacturing adoption, and reliance on Chinese components restrain scaling. Even the most advanced AI chips, such as Nvidia’s Orin, experience competition from domestically produced alternatives, such as the Rockchip RK3588 that now powers some of China’s most advanced humanoids.

8. Bottlenecks and Risks

Other major hitches include China’s reliance on U.S.-made semiconductors; an internal environment often too chaotic for AI to be effectively adaptable; and high prototype costs, presently estimated at $150,000 to $500,000 per unit. The National Development and Reform Commission has warned of a possible investment bubble, with more than 150 companies manufacturing similar models. As Horváth’s Brauchle warns, “The gap between perception and reality increases the risk of an investment bubble,” thereby slowing the momentum of innovation.

9. Geopolitical and Industrial Implications

This would represent a repeat of what has happened in prior structural industrial shifts, from Japan’s rise in automotive to China’s dominance in photovoltaics and 5G. As robotics becomes the “physical AI” layer across industries, the country that scales fastest will enjoy a snowballing advantage due to deployment data, ecosystem maturity, and global market share. The interplay between Musk’s long-term vision and China’s near-term execution is a defining factor for investors and strategists in the next decade of industrial AI.

Accelerated commercialization, combined with manufacturing supremacy, is rewriting the rules of competition. The U.S. now faces a choice: it must accelerate the pace of competition through deregulation, allied supply chain integration, and aggressive scaling, or it will lose leadership in one of the most transformative technologies of the century.