In one awards cycle alone, the United States Space Development Agency has committed an estimated $3.5 billion to this next wave of missile-tracking satellite systems-such significant outlay as to clearly denote a major infusion in the American space-based defense policy. More precisely, the Golden Dome Program within the larger Pentagon infrastructure really represents so much more than adding capability to the existing infrastructure in terms of satellite presence.

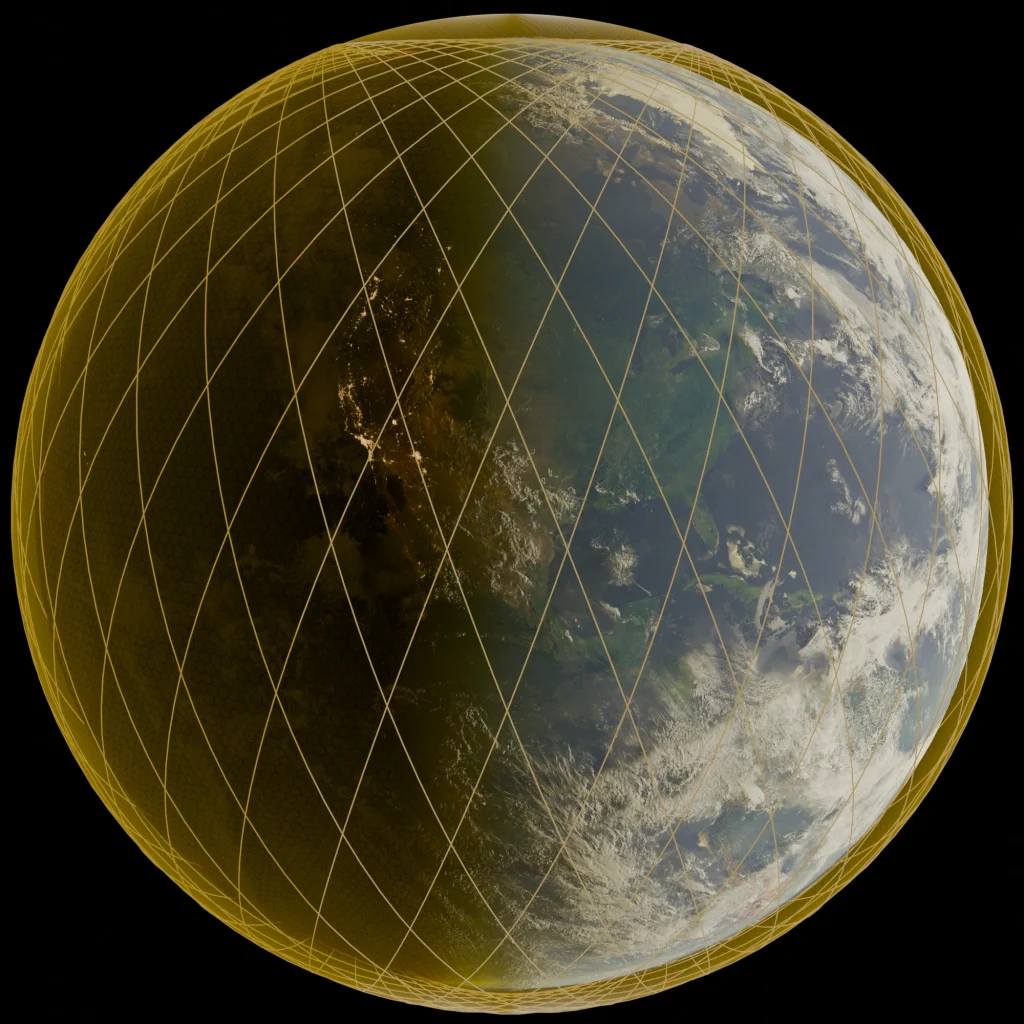

The contracts spread across four big defense companies will launch 72 satellites to low earth orbit by fiscal year 2029. Its design capability for a response to various threats, such as ballistic missiles and hypersonic glide vehicles, is implemented in the layer defense system-space, air, ground, and sea components. This will be a forerunner of what the future holds for missile defense systems insofar as flexibility and resilience go hand in glove with success.

1. Line-item breakdown of the $3.5 Billion Contract

The SDA has awarded firm-fixed price contracts, worth $1.1 billion, to Lockheed Martin, L3Harris Technologies, Northrop Grumman, and Rocket Lab USA. The deal involves the delivery of 18 satellites, but the largest contract of $1.1 billion has been given to Lockheed Martin. The next in line is that of L3Harris Technologies, with a contract worth $843 million. The companies include Rocket Lab USA with a contract worth $805 million, while the next one is Northrop Grumman with a contract of $764 million.

2. Tracking Layer Tranche 3’s Strategic Role

Tranche 3 comprises part of the Proliferated Warfighter Space Architecture, an ever-growing constellation in low Earth orbit. Its Tracking Layer will notify early warnings of missile launches in seconds, track missiles through flight, and offer targeting information to weapons defenses. SDA Acting Director Gurpartap Sandhoo hastened to underscore that “the constellation would represent a balanced approach for both missile warning and tracking, and an equal number of the constellation’s payloads would be dedicated to advanced missile defense mission sets to temporally pace the threats.”

3. Hypersonic Countering and Maneuvering

However, hypersonic glide vehicles flying at above Mach number 5 with unpredictable trajectories pose the challenge. The infrared sensors on the coming satellites shall be fitted with broad and medium fields of vision, optical communication terminals, and Ka-band payload with backups in the S-band. Such systems are specifically meant for the detection of weaker and hypersonically boosted missiles with the ability to allow precise targeting of the hypersonics so they can be intercepted before hitting their targets.

4. Integration Golden Dome

The architecture for the Golden Dome missile shield architecture “calls for a worldwide web of satellite sensor and interceptor and command and control assets.” SDA’s Tracking Layer will constitute the sensing infrastructure, which will enable early detection and continuous tracking. As Masao Dahlgren, with the SDA, has underlined, “without an ability to sensor from space, you can’t defend against hypersonics.” The Tranche 3 satellites therefore represent an integral part of the space infrastructure of the Golden Dome missile shield system.

5. Spiral Development for Rapid Capability Refresh

SDA’s strategy is to launch new tranches of satellites every two years or so, integrating newer technologies. The intent of “spiral development” is to ensure that SDA remains ahead of its adversaries in terms of development, building resiliency in the system by spreading the satellites in space, along with continuous improvements in detection and tracking.

6. Industrial Capacity and Scaling of Production

The delivery schedule associated with Meeting Tranche 3 production involves more production lines and facilities. L3Harris has achieved full rate production at the Palm Bay, FL facility while Lockheed Martin is utilizing their Terran Orbital buses and Colorado processing center. The involvement of Rocket Lab with their Lightning bus and Phoenix infrared sensor payload represents their development from a launch services company to a fully integrated space prime contractor. Northrop Grumman draws upon their OPIR experiences.

7. Differentiation of Technical Payload

Half of those satellites are going to carry payloads from the MWTD program, which will be able to generate tracks suitable for fire control tasks related to missile defense; the remaining satellites relate to the MW/MT mission sets. Adding StarLite space protection sensors from Rocket Lab brings in defensive protection against directed-energy threats.

8. Operational Timeline & Deployment

The first launches under Tranche 3 are expected to take place in the fourth quarter of FY 2029. The satellites will be distributed among eight planes for near-constant global coverage. This will ensure maximum line-of-sight tracking as well as redundancy, an element that is crucial to maintaining custody of high-speed targets across all stages of flight.

9. Policy and Strategic Implications

The huge investment in proliferated LEO tracking shows that the U.S. means business, but also provides a beginning in the shift away from its current dependency on a small set of high-value assets to a resilient architecture. It also complicates the targeting calculus for adversaries. For a policy analyst, the scope of Tranche 3 and the modular architecture of Golden Dome suggest very strongly that space is recognized by them as a determining domain in the next decade for missile defense.

The $3.5 billion contracts for Tranche 3 satellites are a great deal more than a mere procurement milestone- instead, they provide a blueprint for the U.S. approach toward space domain operations. Scale, sensing, and network resilience fused together place the building blocks into position, which promises to be the missile defense system of the future: sufficient to handle the threats of today and the threats of tomorrow. For the defense community, this work provides its own model for innovation and deterrence.