The hanging question in the Wall Street is straightforward: will the SpaceX IPO become the next Tesla moonshot or drain the Musk premium that has so far carried the EV manufacturer to the stratosphere in terms of its valuation?

The current Tesla boom is not much to do with the fundamental elements of automobiles. The shares have surged above 110 percent since April and have reached new heights despite declining sales, dwindling profitability and increased competition in the electric vehicle market. Tesla is currently trading at a very high multiplier of 214 times forward earnings, just second only to Warner Bros Discovery among the S&P 500. The excitement behind the rally is investor confidence in Elon Musk and his aspirations in artificial intelligence and robotics driverless cars, humanoid robots and a future switch to a mobility service model.

1. The SpaceX History of IPO Ambitions.

SpaceX, a space exploration firm that is privately owned by Musk, is gearing towards an IPO that is capable of becoming one of the largest in history. The company has already carried out insider shares worth 800 billion dollars though bankers and analysts reckon it will be publicly listed in 2026 with valuations as high as 1.5 trillion. That would put SpaceX over 60 times current-year sales- a multiple in the aerospace industry unmatched. The 42% stake would immediately increase Musk by hundreds of billions and may make him the first trillionaire in the world.

2. Creating Synergy of Tesla and SpaceX.

Tesla and SpaceX missions are inextricably linked. Optimus humanoid robots of Tesla are projected to work in the extraterrestrial conditions in the Mars colonization project. The Starlink satellite network, which already has more than 9,000 satellites orbiting around the planet, may offer Tesla access to a global, low-latency network that will enable autonomous vehicles to drive freely and enable them to communicate directly to their cells. This technological cross-pollination makes stronger the story that the enterprises by Musk are part of an integrated innovation system.

3. Starlink Automotive Advantage

Starlink has already deployed consumer-grade communications with Starshield, and the potential to enhance its military-grade is substantial, although the current deployment is corroborating consumer automotive applications. By incorporating Starlink into the Full Self-Driving (FSD) platform by Tesla, the company would be able to stop relying on terrestrial networks, thus allowing it to have a high level of navigation and data exchange even in isolated locations. In the case of robotaxis, this may be continuous coverage of service, which is important in scaling autonomous fleets.

4. Tesla’s Robotaxi Milestones

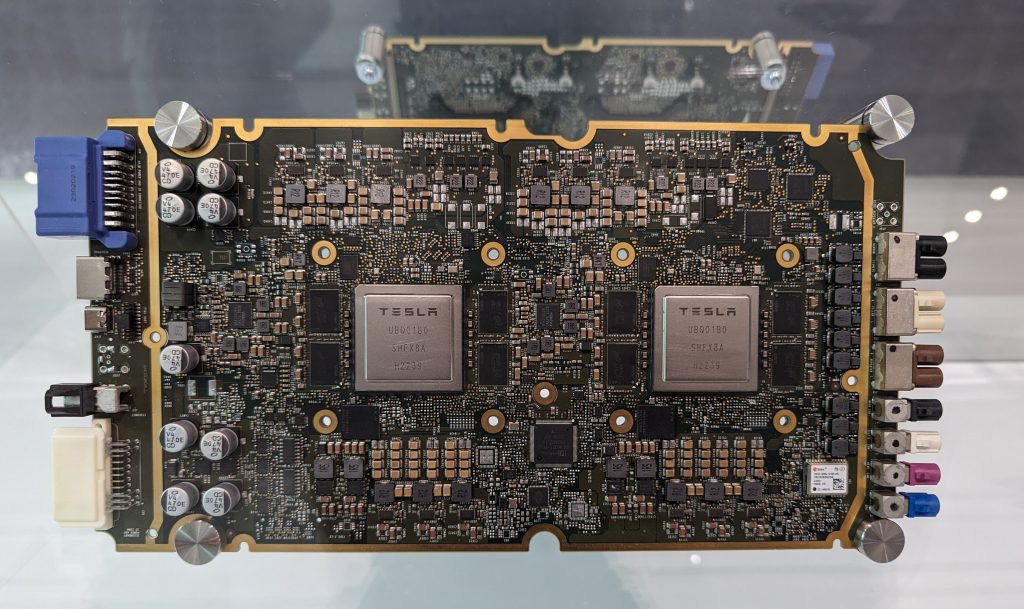

In December 2025 Tesla started experimenting with fully autonomous robotaxis in Austin, with no human safety monitors in the front seats. The fleet is approximately 31 vehicles and consists of a camera-based sensor package with a neural network processor with no LiDAR, which helps save money and streamline construction. Morgan Stanley estimates that Tesla has the potential to scale to 1 million robotaxis worldwide in 2035 and proposes San Francisco, Phoenix and Las Vegas as the first places to start expansion in 2026.

5. Artificial Intelligence infrastructure and future-system development.

The FSD software of Tesla has enjoyed the massive investments in AI training infrastructure, such as tens of thousands of GPUs in its Gigafactory in Texas. Such upgrades have made possible milestones like an autonomous 30 minutes delivery run with no human intervention. The regulatory approval is still a challenge, and every technical initiative is increasing the confidence of investors in the ability of Tesla to transform itself into an AI-based mobility platform, rather than a car manufacturer.

6. The Effect of IPO on the Market Dynamics of Tesla.

Analysts disagree whether SpaceX IPO will be a drain on Tesla or will enhance its attractiveness. Dmitry Shlyapnikov, the head of Horizon Investments, predicts the possible selling pressure when Tesla investors seeking exposure to the ideas of Elon diversify into SpaceX. On the other hand, Adam Sarhan of 50 Park Investments observes that in case one of the companies of Musk have reached a significant milestone, it will tend to boost the morale of the others.

7. The Engineering Capabilities of spaceX are what make it worth the money.

The SpaceX pace of operations is unparalleled: it has over 160 Falcon 9 launches planned in 2025, over 500 successful booster landings, and one booster which has been flown 32 times with a turnaround period of as little as three weeks. The company plans to roll out modified Starlink satellites to be used as AI data centers in space, and go further to establish satellite factories on the Moon to send over >100 terawatts/year of AI processing into space with electromagnetic railguns. These are the ambitions through which it has been justified to have such a high IPO value.

8. Investment Attitude and Risk Analysis.

The Tesla valuation previously attained technical overbought levels which has initiated short-term corrections. The valuation simply does not make sense to portfolio managers such as Vikram Rai, unless there are more significant fundamentals. However, long-term believers, including Brian Mulberry of Zacks Investment Management, project a 30 35 percent-a-year earnings increase in the next three years, which will be generated through AI and robotics innovation.

9. The Musk Premium Across Ventures.

It is the combination of the Tesla AI story and the SpaceX market privatization that has given Musk a fortune worth more than 680 billion dollars. It is also an AI company, xAI, which is believed to be worth billions of dollars, which contributes to another premium that is being paid by the investors of Musk. The success of Musk in incorporating such ventures into a consistent technological vision will determine whether this premium will be maintained after the IPO.

Whether the Tesla valuation can be maintained with its AI and robotics course of action, or whether the SpaceX public launch will become a new standard of how investors invest in each of the entities of the Musk empire, will be tested in the years to come. To date, Tesla is the sole publicly-traded gateway to his vision, although it might not be so soon.