Can a $373 million contract change the trajectory of the world’s most advanced fighter jet program? For Lockheed Martin, the new award for the F-35 Joint Strike Fighter goes beyond a simple procurement line item; it is a strategic move in a program that is facing cost pressures, delayed modernization, and changing operational demands. The decision by the Naval Air Systems Command to support extensive retrofit work is a clear indication that the organization plans to keep the aircraft as the leading combat tool for U.S. services and ally operators.

This change order covers the sources of materials, the tooling, and the special equipment required for the installation of upgrade kits for the different variants, including the short take-off and vertical landing F-35B and the carrier-based F-35C. It also provides for depot-level support and advanced processes such as laser shock peening. Besides, the completion of the work is expected to be in December 2026, which is a clear indication of both the dimension of the technical problem and the great urgency of giving the fleet enhanced performance.

1. Scope of the $373M Retrofit Effort

The contract modification provides money for the purchase of materials, special tooling, and test equipment to build and install retrofit kits across F-35 fleets of the Air Force, Marine Corps, Navy, and international. Included are program management, non-recurring engineering, aircraft induction, contractor field modifications, and depot site support. Most importantly, it facilitates F-35B/F-35C laser shock peening operations and regional depot installations significant for prolonging airframe life without lightening the payload or fuel capacity. All the work is to be carried out in Fort Worth, Texas, under the supervision of the Naval Air Systems Command.

2. Laser Shock Peening: Extending F-35B Service Life

The Fleet Readiness Center East’s $6 million laser peening facility is one of only two in the world that can carry out this process on F-35Bs. Extremely intense laser bursts convert the bulkhead and airframe to compressive stress from among the fatigue and corrosion causes. As Capt. Mark E. Nieto said, this is a “strategic asset” for the Marine Corps, through which aircraft are enabled to utilize their total life limit fully. The method reinforces the most vital parts of the structure without making the aircraft heavier, hence the latter’s performance is preserved while less maintenance is required in the long run.

3. Block 4 Modernization Challenges

The F-35’s Block 4 upgrade worth $16.5 billion is a project intending to open the door for the Lockheed Martin fighter to have new weapons, radar, and electronic warfare capabilities. However, its completion date has been postponed to 2031, i.e., five years later than the original plan, and this is due to the complexity of the technology involved as well as the change of priorities. The Department of Defense has defined Block 4 as a significant subprogram with fewer capabilities and some deferred to future efforts. Costs that haven’t been fully worked out add to the uncertainty, and the program’s target is to be at a steadier pace than previous modernization cycles.

4. Technology Refresh 3 Delays

TR-3, a $1.9 billion hardware and software suite enabling many Block 4 capabilities, has been encountering supply chain bottlenecks and software stability issues. The main processor for the integrated core is still not mature; the testing of the Next Generation Distributed Aperture System is not complete, and there are glitches in the radar display, thus the delivery of combat-capable versions has been pushed to 2026. To avert the buildup of storage, the program has taken in a temporary manner 174 non-combat-capable TR-3 aircraft for training purposes, and the withholding is $5 million per unit until full capability is installed.

5. Persistent Production and Supply Chain Strains

All 110 aircraft that Lockheed Martin was supposed to deliver in 2024 were delivered late, with an average delay of 238 days, which is up from 61 days in 2023. The final assembly has been stalled due to parts shortages there were more than 4,000 in February 2025 with the most significant components like wing flaps causing the delay of the completion phase. The Defense Contract Management Agency has issued directives for correction, but the shortages, especially those related to TR-3, that will affect deliveries until 2025 are expected. Besides, these limitations also have an impact on sustainment as the availability of spare parts remains a readiness bottleneck.

6. Incentive Fee Misalignment

The Government Accountability Office revealed that contractors were awarded millions of dollars as on-time delivery incentives while the actual deliveries were up to 60 days late. The GAO suggested that the structures for fee reevaluation be put in place so that the rewards are more in line with the actual schedule performance. If such changes are not made, the program will be at a risk of reinforcing those behaviors which are not in compliance with operational timelines and thus readiness of the warfighter will be undermined.

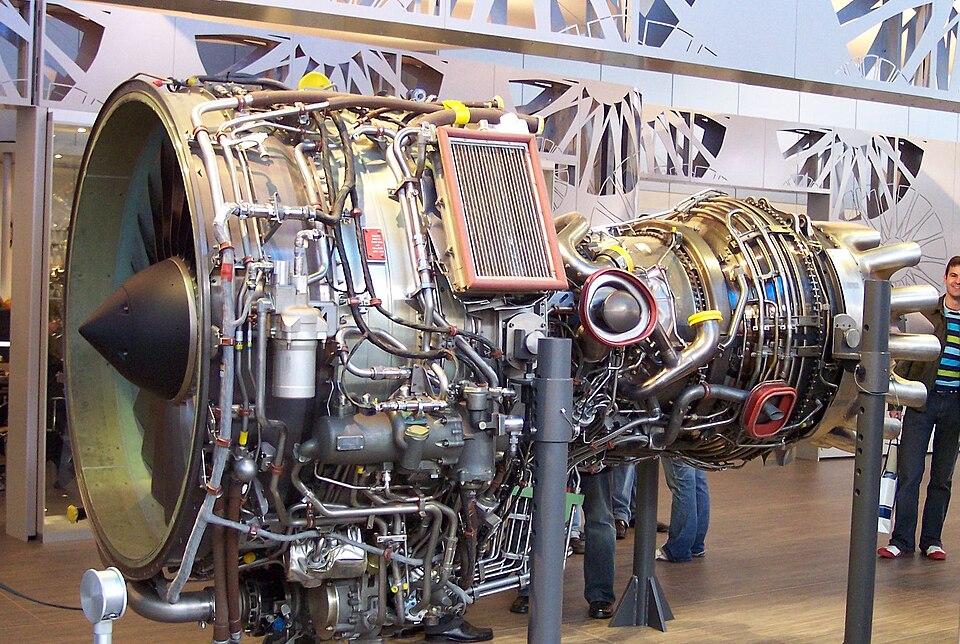

7. Engine and Thermal Management Upgrades

Pratt & Whitney’s Engine Core Upgrade (ECU) is aimed at meeting the higher power and cooling demands caused by Block 4 and later systems. As per FY2025, the estimated cost of the ECU is $527 million, and the main objective is to extend engine overhaul intervals to 2,000 hours while simultaneously countering $38 billion in life-cycle cost increases brought about by accelerated wear. Besides, a Power and Thermal Management System modernization whose development cost is between $3.7 and $4.5 billion is under consideration to support the next generation of electronics.

8. International and Partner Integration

Seven allied nations are cost-sharing partners in the F-35 program, while others purchase via Foreign Military Sales. Among recent contracts, there is an $8.2 million modification for Australia’s F-35 program. As Edward “Stevie” Smith of Lockheed Martin put it, the plane “fits extremely well with this administration’s policy of our allies and partners being able to fight their own battles together with our U.S. servicemen.” The retrofit work will be done with partner air forces, thus ensuring continued interoperability.

9. Financial and Market Position

Lockheed Martin is still the largest defense contractor in the world with a market capitalization of $108.79 billion and a revenue of $73.35 billion. Although operating margins are fairly good at 8.18%, the debt-to-equity ratio of 3.59 indicates that the company is highly leveraged. More than 74% of the company is owned by institutions, however, there has been insider selling. The Aeronautics segment will be able to maintain its leadership role with the help of the $373M retrofit contract, even as the company makes its way through the larger aerospace market that is shifting towards affordability and efficiency.

The $373 million F-35 retrofit contract is more than a routine maintenance undertaking it’s a strategic move to keep the platform that is central to U.S. and allied airpower viable and even enhance it. The initiatives, ranging from laser shock peening to engine upgrades, are about addressing the immediate readiness needs while also ensuring long-term capability growth. However, the continuing delay of the modernization, fragile supply chain, and incentive misalignment issues, among others, make the case for the need of strict program management discipline. For defense investors and aerospace professionals, the contract performance will be a clear sign of whether Lockheed Martin can blend technical ambition with delivery performance effectively in the coming years.