Where Microsoft’s AI momentum has stalled, Google’s Gemini is increasingly in overdrive, and the gap between them is no longer a question of user preference; it’s a deeply technical and infrastructural reality. While Copilot still enjoys the fruits of Microsoft’s vast enterprise footprint, hands‑on comparisons and market data reveal Gemini outperforming on core tasks, backed up by a fundamentally different hardware and integration strategy that underpins it.

1. Performance Gap in Core AI Tasks

User testing across creative, analytical, and operational workflows reveals an edge for Gemini in both polish and reliability. Powered by Gemini 2.5 Pro, Google’s assistant handles up to 1 million tokens of context, allowing seamless analysis of huge datasets or multi‑document projects. Meanwhile, the upper limit for Copilot’s GPT‑4 Turbo is 128K tokens, constraining extended reasoning. In document drafting, Gemini’s “Help me write” in Google Docs cleverly integrates smart chips that pull relevant Drive content, whereas Copilot’s orchestration via Microsoft Graph is strong but is often hampered by missing basic capabilities-such as natural‑language meeting scheduling in Outlook mobile.

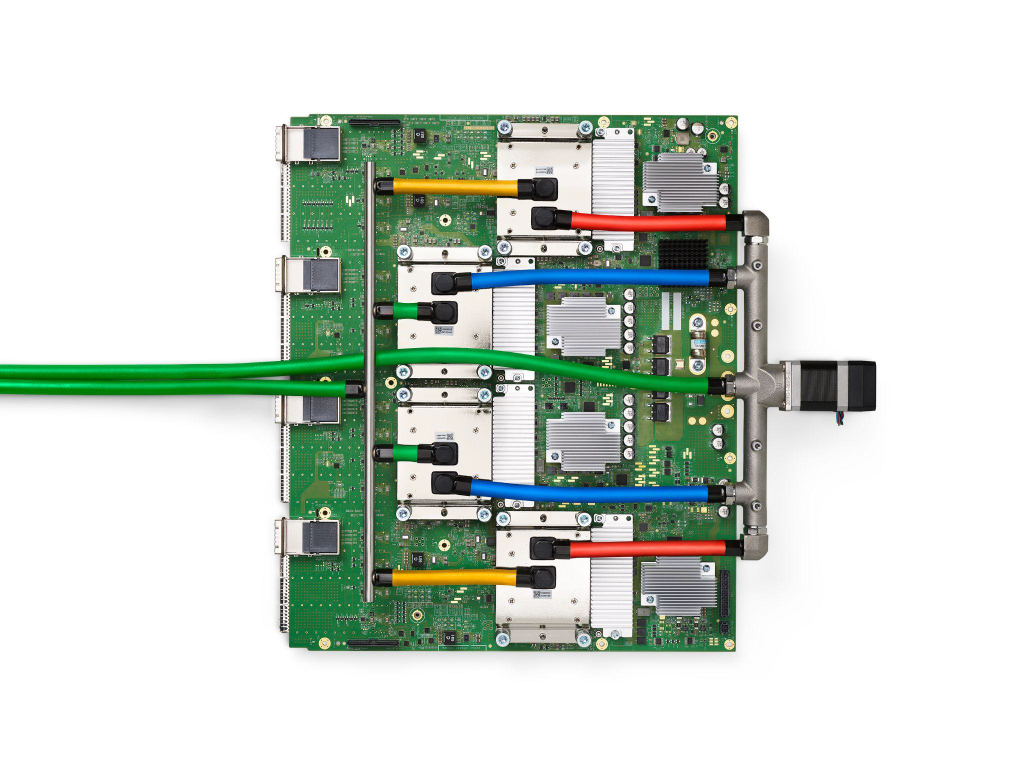

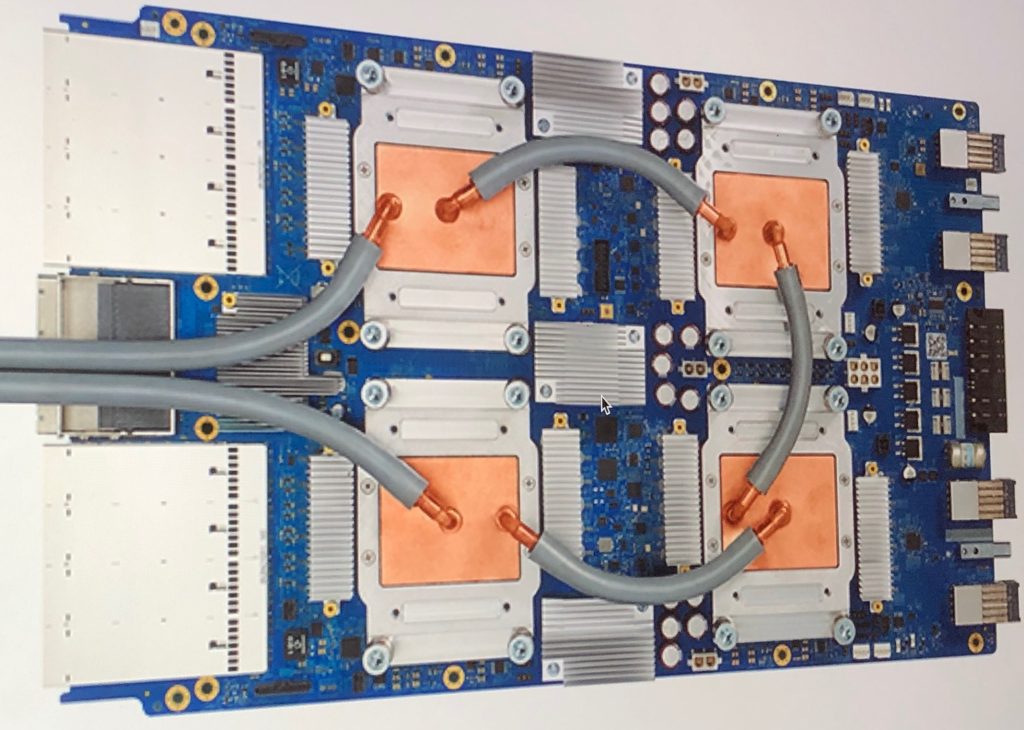

2. TPU Architecture vs. NVIDIA Dependency

Google’s infrastructure advantage is anchored in its Tensor Processing Unit architecture, purpose‑built for AI workloads. The latest Ironwood TPU pods deliver 42.5 exaflops per unit, a tenfold leap over prior generations, and are now being seeded into smaller cloud providers to erode NVIDIA’s pricing power. Microsoft, by contrast, remains heavily reliant on NVIDIA GPUs for Azure AI, with in‑house Maia and Cobalt chips delayed until at least 2027. This leaves Redmond exposed to supply constraints and high costs, with hyperscaler demand for H100, H200, and GB200 GPUs continuing to spike.

image credit to Barlop Business Systems

3. Integration Depth vs. Ecosystem Breadth

In that respect, Copilot’s deep integration into Microsoft 365-Word, Excel, PowerPoint, Outlook, and Teams-remains unparalleled for enterprises locked into the Microsoft stack. It can generate complex Excel formulas, automate PowerPoint builds, and summarize Teams meetings in real time. Gemini’s strength is breadth: it connects Gmail, Docs, Sheets, Meet, and Drive, and through Gemini Enterprise, can bridge into Microsoft 365, Salesforce, and SAP. This cross‑platform reach, combined with multimodal capabilities spanning text, image, audio, and video, positions Gemini as a flexible AI hub for heterogeneous IT environments.

4. Pricing Strategy and Adoption Signals

Google’s decision to bundle Gemini features into standard Workspace subscriptions gives it a cost advantage: Business Standard and Plus users pay nothing additional for core AI capabilities. Microsoft’s $30/user/month Copilot add‑on can nearly double per‑seat costs, creating friction in budget‑sensitive deployments. FirstPageSage market share reports indicate that Gemini is gaining on Copilot quarter over quarter, while enterprise adoption trends suggest strong and growing interest in agentic AI tools that can operate across mixed ecosystems without steep licensing premiums.

5. Infrastructure Execution and the “Big Pause”

Microsoft’s datacenter buildout for OpenAI was once unmatched, with “Fairwater” GPU facilities topping out well above 300MW per building. However, a construction pause in 2024–2025 has ceded that capacity to Oracle, CoreWeave, and Google. Losing the $100B “Stargate” contract to Oracle stripped Microsoft of access to an estimated $150B in gross profit over five years. Azure now rents GPU capacity from neocloud providers; compared to owning the stack outright, this compresses margins. In contrast, steady TPU deployment by Google avoids this margin leak and keeps full control of performance tuning.

6. Enterprise AI Token Economics

Azure Foundry sells “tokens‑as‑a‑service” using OpenAI models, capturing 75% of OpenAI’s Azure AI spend. Yet enterprise token sales remain nascent, and Microsoft’s Foundry marketplace has lowered growth quotas after sales teams missed targets. Google’s token sales via Gemini are also early‑stage, but its massive context window and multimodal agents give it a technical edge in high‑value, long‑form enterprise workloads critical for sectors like legal, finance, and R&D.

7. Real‑World Workflow Comparisons

Side‑by‑side tests showed that Gemini was regularly producing cleaner formatting, richer context integration, and more creative polish on marketing content, coding tasks, and multimodal projects. Copilot did better on structured business writing and data analysis in Excel, though it did worse on diverse file types and large‑scale document ingestion. For image creation, Gemini’s outputs were faster and more commercially viable, while the results using Copilot were more intimate and niche.

8. Strategic Risks and Future Outlook

Microsoft’s path to vertical integration chips, models, and application layers carries execution risks from delayed silicon, missed infrastructure contracts, and over‑reliance on the financial stability of OpenAI. Google’s approach of owning the TPU stack, embedding AI into its core applications, and licensing hardware to third parties disperses risk while accelerating adoption. For enterprise IT leaders, the divergence signals that Gemini may scale faster in heterogeneous environments while the value of Copilot will remain highest in Microsoft‑centric deployments.

The competitive gap between Gemini and Copilot has moved beyond features to architectural control, context capacity, and the ability to execute at hyperscale without sacrificing quality. It’s for this reason that technical underpinnings are what will define which assistant becomes the default in tomorrow’s workflows for the technology-savvy professional right through to the enterprise decision-makers.