The White House’s recent industrial policy shift raises an intriguing question: Is it possible for the United States to out-invent China in robotics and at the same time not lose the manufacturing jobs that are needed for a comeback?

1. A National Robotics Strategy in the Making

Commerce Secretary Howard Lutnick has been engaging with CEOs from the robotics industry which could indicate the release of an executive order on robotics as early as next year. The Department of Transportation is setting up a robotics working group, possibly, before the end of the year. Industry leaders have advocated for a national plan to quicken the deployment process, solidify supply chains, and deal with Chinese subsidies as well as the issues of intellectual property. “We are very much into robotics and advanced manufacturing as they are at the core of the critical production that is coming back to the United States,” said the Commerce Department.

2. Humanoids as the Physical Expression of AI

Influential tech people, especially Elon Musk, are leading the idea of humanoid robotics as the logical next step of AI developments. Tesla’s Optimus robot, which Musk referred to as “something like an infinite money glitch,” is expected to be in production next year and its capabilities will range from industrial assembly to surgical operations. Musk estimated “tens of billions” of Optimus units worldwide and argued that they could increase the global economy “by 10 or maybe 100 times.” The concept is consistent with the industry’s presentation of robots as the physical manifestation of AI competitive advantage.

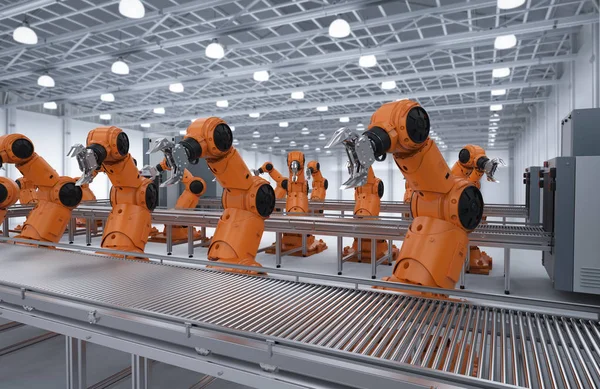

3. Industrial Robotics: Lessons from China’s Scale

China’s path provides a warning and a plan. By the year 2023, it had 1.8 million industrial robots in factories four times as many as the U.S. and it is responsible for 41 percent of the world’s new robot installations. To become the leader in the low- and mid-level markets while at the same time planning for a leap to the humanoid field, China’s “Made in China 2025” program combined subsidies, tax breaks, and the purchase of foreign robotics companies. U.S. decision-makers interpret this as an aggressive move against the domestic manufacturing industry.

4. Standards, Supply Chains, and Deployment Challenges

Industrial robots (IBs) have revolutionized production speed and accuracy, as evidenced by Tesla’s Gigafactory where robotic lines achieve a car assembly in 39.62 seconds. However, their expansive use necessitates strong standards, interaction between systems, and skilled personnel for the integration. Studies on IB deployment in manufacturing reveal that these machines play a part in elevating firms’ performance by decreasing expenses, making better use of resources, and freeing up human capital for new ideas. Such improvements rely on the capacity to solve bottlenecks in the supply of sophisticated components, for which China still depends on imports of up to 90% of certain high-precision parts.

5. AI Infrastructure and Energy Demands

The growth of robotics cannot be separated from the growth of the AI infrastructure. The government’s AI Action Plan advocates for the removal of permit-obstacles that would enable data center building to happen rapidly, thus it supports only those projects that have >100 MW load additions or are beneficial for national security. The data centers that are needed for robotics R&D and AI control units need energy that can be dispatched as baseload be it natural gas, nuclear, or geothermal therefore, energy and automation policies are closely linked. Federal means like PermitAI are there to help speed up the environmental check process, though court actions might be the place where AI-enabled issuing of permits will be contested.

6. Semiconductor Sovereignty as a Robotics Enabler

High-end robots require high-performance chips. The government’s move to put up to $150 million on xLight’s free-electron laser technology for EUV lithography is quite a clear sign of the effort to bring the whole chipmaking locally again. The new technology, if it is the reason behind the energy reduction in the machines that ASML uses, and thus the U.S. gains more control over the critical parts of manufacturing, would be a win-win. While China is expanding its capacity for mature-node at four times the global demand, the U.S. reshoring efforts are preventive measures which, if successful, will ensure that there will not be a dependence issue that could weaken the robotics supply chain.

7. Balancing Automation with Workforce Goals

There is a big tension that exists between automation and the restoration of jobs. Researchers found that the implementation of automation in firms displaces those workers whose work is routine, thus, employment opportunities as well as earnings are likely to go down. On the other hand, industry supporters maintain that robotics is capable of extending human potential, thereby, new jobs in robot design, deployment, and maintenance can emerge. “It’s not man versus machine, but it’s man and machine that will take us into the future,” said Apptronik CEO Jeff Cardenas. The policy problem is how to get automation incentives and workforce development programs to work together so that reshoring can lead to more jobs for humans.

8. Global Market Projections and U.S. Positioning

Goldman Sachs predicts that the market for humanoid robotics can be worth up to $38 billion in 2035. The U.S. investment in robotics is going to be around $2.3 billion in 2025, thus it is twice as much as last year’s, but still, it can’t compare with the heavy state-driven investments by China. To be able to achieve equal footing will require a lot of work in terms of industrial policy coordination, selectively subsidizing R&D, and tactfully buying up to secure the supply chain for components. Trade measures that counteract the Chinese industrial policy might be the main factor determining who will win or lose market shares.

Robotics, AI infrastructure, and semiconductor sovereignty are coming together to mark a crucial point in the U.S. industrial policy. The question is whether this will lead to America’s global leadership or China gaining ground, and the answer largely depends on how well the policy can handle the two side-by-side demands of technological superiority and workforce regeneration.