“Amateurs talk strategy, professionals talk logistics.” This old military adage has never been more relevant than in the case of modern fighter programs like the F-35 Lightning II. The jet’s cutting-edge capabilities are only as good as the sustainment systems that keep it mission-ready, and that’s where the latest $1.61 billion contract for Pratt & Whitney’s F135 engine comes into play.

This award by the U.S. Naval Air Systems Command cements RTX’s Pratt & Whitney as the propulsion backbone of the F-35 program through 2026. It’s not just about turning wrenches, but about global readiness, supply chain precision, and the strategic leverage that comes with controlling the lifeblood of a fifth-generation fleet. The implications stretch way beyond this one single award for defense investors and aerospace professionals.

1. Scope of the Sustainment Package

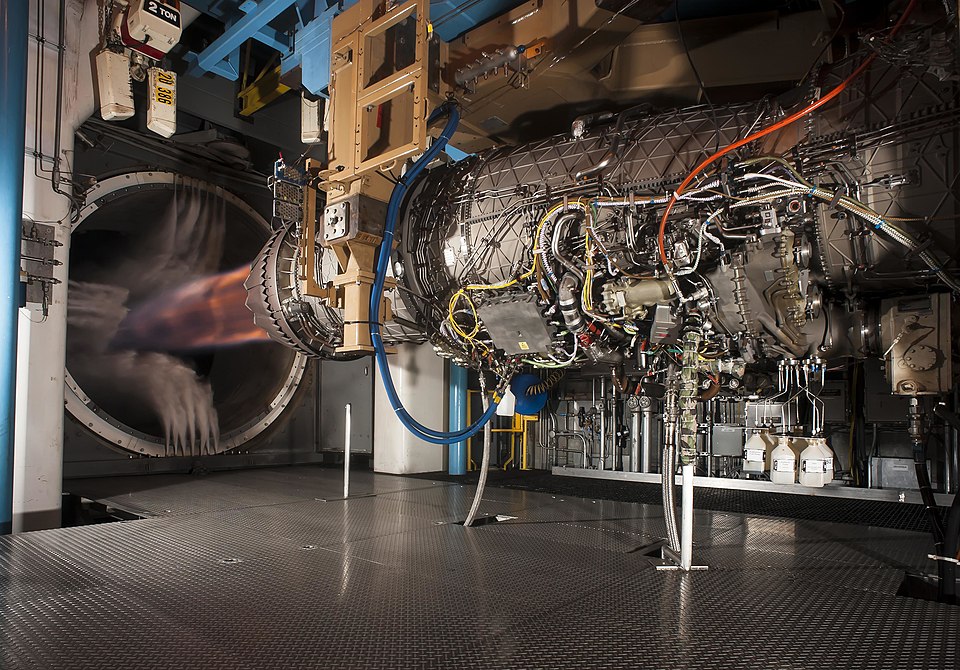

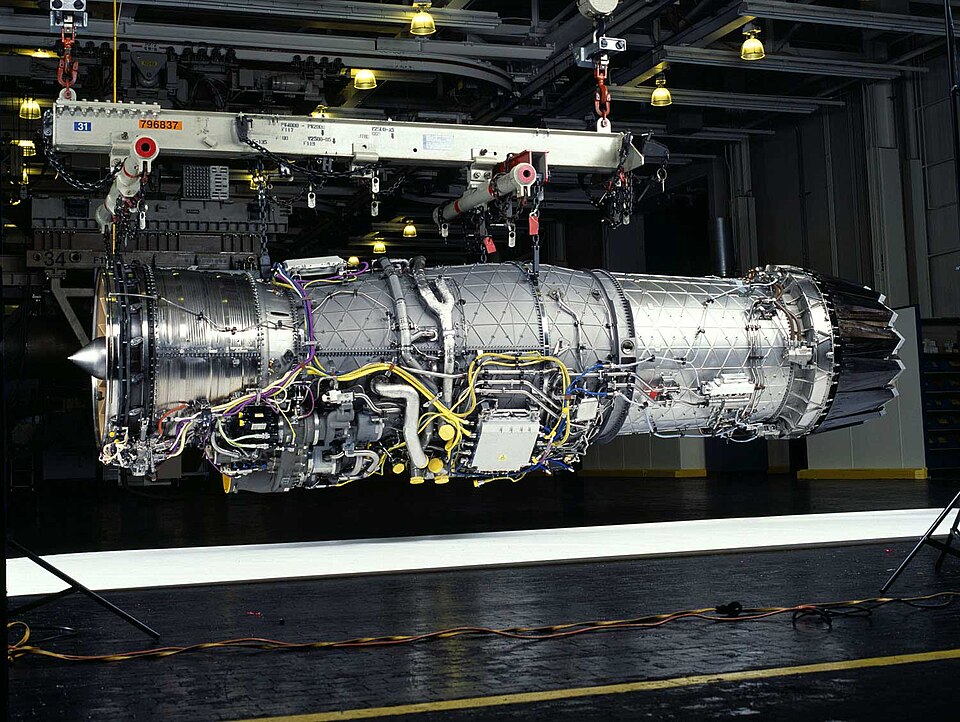

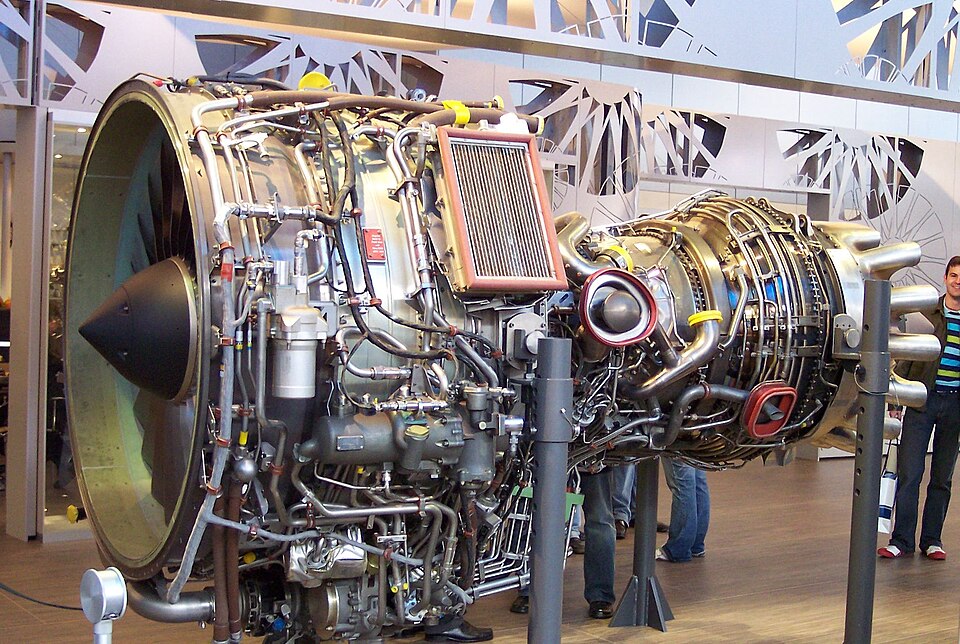

The contract encompasses the full range of services: depot-level maintenance, spare parts procurement, software sustainment, propulsion integration, and engineering upgrades. Pratt & Whitney will be responsible for everything from hot-section replacements to digital health monitoring to ensure peak performance of the F135 engine. This holistic approach minimizes the number of engine removals, keeping more aircraft flying longer-a critical advantage in high-tempo operations.

2. Global Footprint of the F135 Support Network

Pratt & Whitney’s sustainment infrastructure reaches 39 bases, 12 ships, and several global depots, with work distributed between East Hartford, Windsor Locks, and allied nations such as Japan, Norway, and Australia. This globalized maintenance network ensures consistency in standards and rapid parts flow that minimize downtime for a fleet projected to exceed 3,000 aircraft worldwide for F-35 operators ranging from the U.S. Air Force to partner nations.

3. Strategic Value for U.S. Navy and Allies

The Navy avoids fragmentation in logistics and performance baselines by unifying maintenance under one prime contractor. This contract secures interoperability with a common sustainment standard between the U.S. and fleets of allied nations. For partner nations, it provides a hedge against operational gaps by ensuring that their F-35s remain aligned with U.S. readiness levels and upgrade cycles.

4. Positioning for the F135 Engine Core Upgrade

Control of sustainment provides Pratt & Whitney with access to operational data crucial for the upcoming F135 Engine Core Upgrade, which further extends the thrust and cooling for future Block 4 variants of the F-35. This upgrade utilizes the already established sustainment network, offering a cost-effective path by which allies could increase performance, as no new infrastructure would have to be built-a strong selling point when budgets are tight.

5. Market Context: Fighter Demand on the Rise

As geopolitical tensions drive investments in airpower, fighter aircraft markets are set to grow 4.24% CAGR from 2025 to 2030. Increasingly, countries favor multi-role, fifth-generation platforms, which again boosts demand for advanced engines such as F135. With over 7,500 military engines in service with 30 armed forces around the world, RTX will be well-positioned to capture a large share of this growth.

6. Competitive Landscape Among U.S. Primes

With the F-35, Lockheed Martin leads the stealth fighter segment of the industry, whereas Boeing retains strongholds in tankers, maritime patrol, and improved variants of fourth-generation fighters. Northrop Grumman, though not a fighter prime here, is also very relevant to bomber programs such as the B-21 Raider. Each company will have various opportunities to win sustainment and modernization contracts, but Pratt & Whitney’s monopoly on F-35 propulsion confers on RTX unique recurring revenues.

7. Recent Production and Delivery Trends

Lockheed Martin delivered 97 F-35s during the first half of 2025, finally putting a yearlong TR-3 software integration delay behind it. Boeing’s F-15EX deliveries slowed, but the program received a boost with expanded orders. These production rhythms in turn have a direct impact on sustainment demand: higher delivery rates mean more engines enter the maintenance cycle, making long-term contracts such as Pratt & Whitney’s more critical.

8. Financial Implications for RTX

The $1.61 billion award secures a steady cash stream through November 2026, complementing a recent $2.9 billion production contract for new F135 engines. For RTX, sustainment contracts are high-margin and lower-risk revenue compared with new production, providing predictability for investors and underlining the company’s position as an indispensable F-35 partner.

9. Long-Term Strategic Leverage

Beyond the immediate revenue, sustainment dominance gives Pratt & Whitney influence over future fighter propulsion programs. Access to fleet-wide performance data informs design improvements and derivative engines, with potential implications for sixth-generation propulsion solutions. In a defense market where lifecycle costs are driving procurement decisions, that data-driven edge could prove decisive. Pratt & Whitney’s latest sustainment contract is more than a maintenance deal-it’s a strategic anchor in the global F-35 enterprise.

By controlling the propulsion lifeline of the world’s most-widely adopted fifth-generation fighter, RTX secures not just revenue, but influence over the future trajectory of combat aviation. For defense investors and industry watchers, this is a clear signal: in the era of high-tech airpower, sustainment is where long-term advantage is built.