In the world of value investing, Warren Buffett’s Berkshire Hathaway has rarely been associated with the chase for cutting-edge technology trends. However, a closer examination of its portfolio reveals an intelligent embracing of artificial intelligence-not via speculative startups but rather through mature, cash-rich companies embedding AI into their core operations. This strategic positioning, anchored by Apple, Alphabet, and American Express, provides a blueprint for how AI can fortify established business models while providing sustainable returns.

1. Apple’s Privacy‑First On‑Device AI

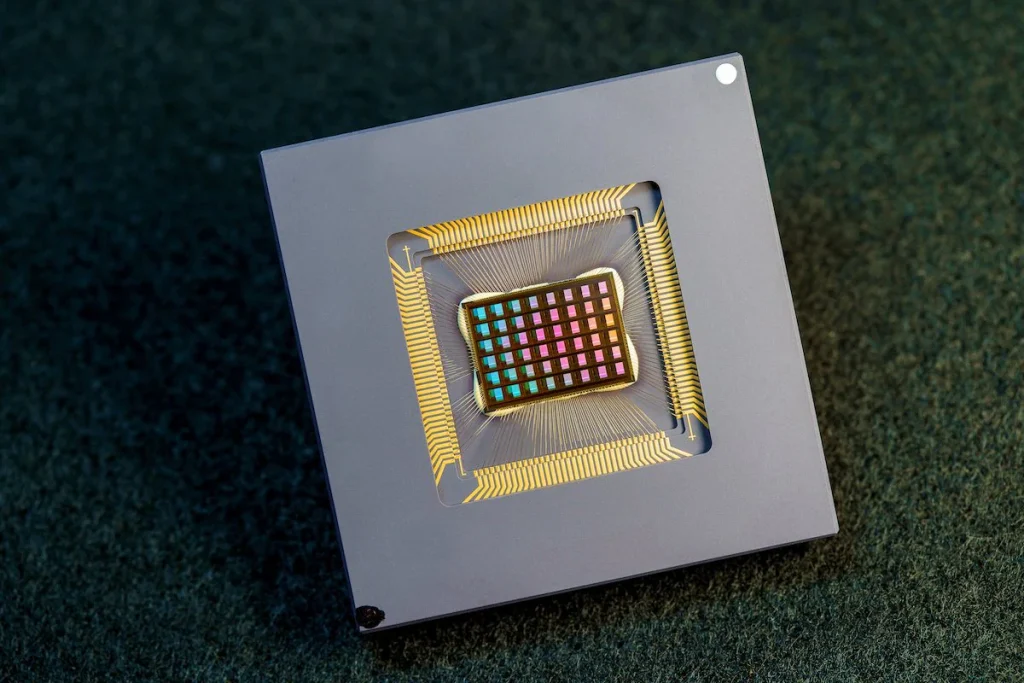

Apple is Berkshire’s largest equity holding, and the company has built a formidable AI capability focused on on-device intelligence. Each of its A-series and M-series chips includes Neural Engines capable of running trillions of operations per second to enable Face ID authentication, Siri’s natural language processing, or advanced computational photography.

The core benefits of edge AI like this approach are low latency, increased privacy by keeping sensitive data locally, and very personalized experiences in the absence of constant cloud connectivity. More technically, Apple can optimize AI workloads for performance and energy efficiency in ways others at least using third-party hardware often can’t because of its vertically integrated hardware-software ecosystem.

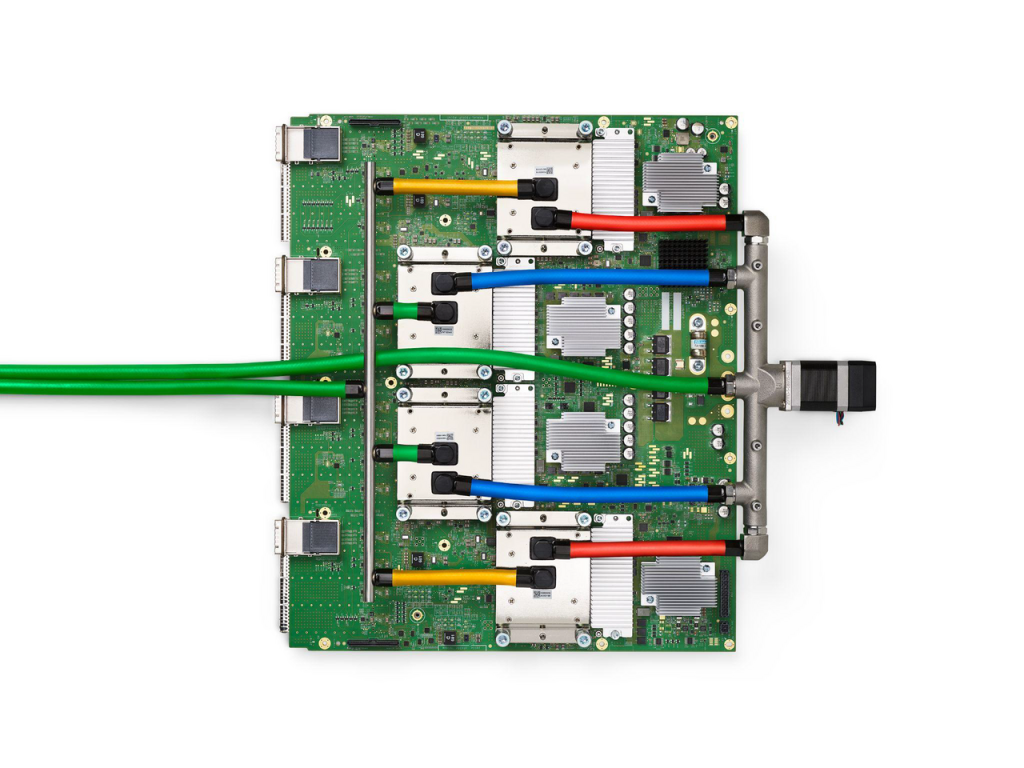

2. Alphabet’s Cloud‑Centric AI Infrastructure

Alphabet is the more recent addition to Berkshire’s stable of holdings and lies at the other end of the AI deployment spectrum. Its AI strategy is underpinned by large-scale cloud infrastructure, leaning on proprietary Tensor Processing Units to train and serve state-of-the-art models, such as Gemini 3. This was exclusively trained on TPUs and not Nvidia GPUs, against which it outperformed benchmarks for coding, multimodal reasoning, and scientific problem-solving. Elastic scalability extends to the AI services in Google Cloud; advanced models should be seamlessly integratable into enterprise workflows. This type of cloud architecture is particularly good at large-scale training and inference. Hence, Alphabet is a foundational player in the “picks and shovels” segment of the AI economy-selling compute power, APIs, and AI tools to other businesses.

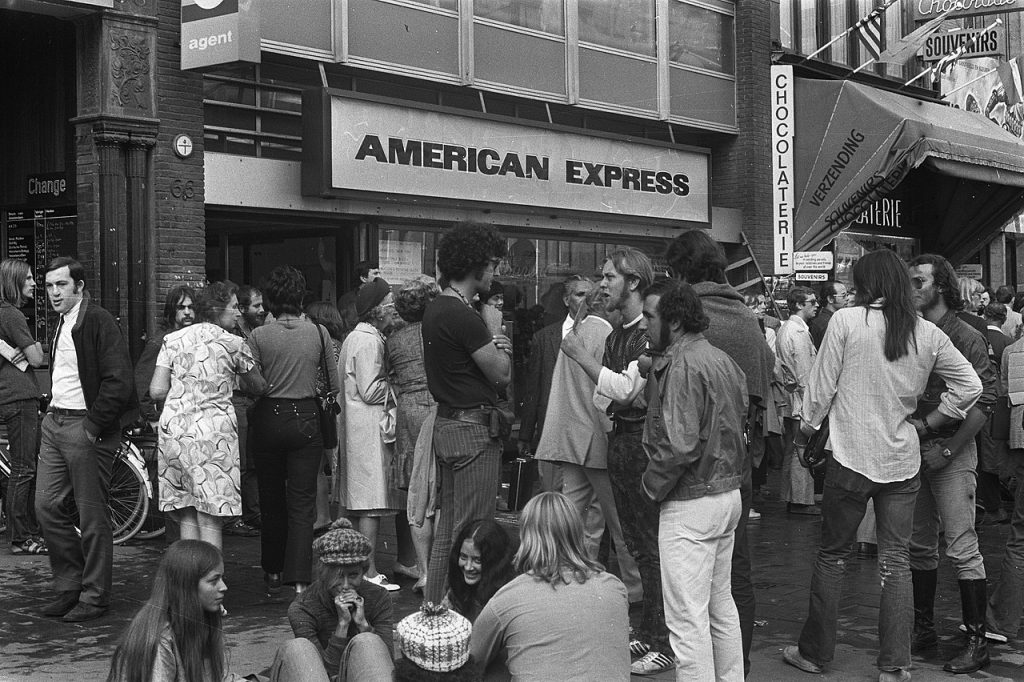

3. American Express’ AI‑Driven Fraud Prevention

AI has turned the wheel of fortune for operational resilience in the financial services sector at American Express, the second-largest holding of Berkshire. With billions of transactions analyzed in real time at under two milliseconds of latency, fraud detection taps into GPU-accelerated long short-term memory (LSTM) networks, complemented with gradient boosting machines. Proprietary “Gen X” makes over 8 billion decisions while ingesting from over $1 trillion of transactions; this keeps fraud rates half that of the industry average. Applying both unsupervised and supervised learning, Amex detects both well-known fraud patterns and emerging threats. It really sets the bar high for AI deployment in regulated high-stake environments.

4. Edge vs Cloud: Strategic Trade‑Offs

Apple’s edge AI features ultra-low latency and privacy compliance, perfect for consumer devices where responsiveness and trust are paramount. Alphabet’s cloud AI boasts unmatched scalability and compute density, both critical for the training of generative models and serving enterprise workloads. These divergent strategies are reflective of relative trade-offs between edge and cloud AI: while the edge excels at autonomy and security, the cloud is dominant in terms of scale and collaborative development. Berkshire’s portfolio effectively hedges these trade-offs by owning leaders in both domains.

5. AI Hardware Moats

The TPU advantage for Alphabet is not just one of speed but also of integration: Custom silicon optimized for tensor operations cuts down on inference costs and allows Alphabet to better tune AI economics. At the same time, Apple’s Neural Engine is set up with the idea of on-device workloads in mind, striking a balance between performance and the need for battery efficiency. These different hardware accelerators develop defensible moats because they lock in performance gains hard for rivals to replicate without similar levels of vertical integration.

6. AI in Credit Risk and Customer Experience

Beyond fraud prevention, American Express uses AI to accelerate commercial credit decisions-shaving cycle times from weeks to seconds-while improving the accuracy of risk models by up to 30%. Its coming NLP-powered app features will predict customer needs contextually-for example, surfacing lounge access information when the cardholder is at an airport-reducing friction and enhancing loyalty. These applications illustrate how AI can concurrently strengthen both risk management and customer engagement.

7. Investment Implications for AI Integration

Berkshire’s AI exposure through its holdings underlines the changing nature of value investing: technology is rapidly becoming an integral component of durable competitive advantage. Apple’s privacy-first edge AI, Alphabet’s scalable cloud AI, and American Express’s operational AI are time-tested business models strengthened by technology. And for investors, the message is plain: AI’s most dependable returns may well spring from incumbents who possess the capital, the data, and the infrastructure to deploy it on a large scale, rather than unproven pure-play AI ventures.

Berkshire Hathaway’s quiet bet on AI is less about chasing hype and more about owning the infrastructure, platforms, and operational systems where AI delivers measurable, defensible value. In so doing, it provides a roadmap for tech-aware investors seeking exposure to AI without abandoning the principles of long-term, fundamentals-driven investing.