To be sure, some analysts say the entire artificial intelligence sector is having its “show me” moment, where sky‑high valuations must be justified with actual returns. While industry leaders like Nvidia, Oracle, Palantir, CoreWeave, and Snowflake continue to show strong revenue growth, the underlying economics, supply chain constraints, and financing structures expose some vulnerabilities that cannot be ignored by technology‑savvy investors.

1. Valuations exceed historical bubble levels

Market indicators flash red. The Buffett Indicator—a measure of total U.S. market capitalization to GDP—has climbed above 200%, surpassing even the peak reached in the dot‑com bubble. The S&P 500’s forward price‑to‑earnings ratio stands at about 23, well above its 10‑year average of 18.7. Yet while bullish sentiment among retail investors remains moderate, the trajectory of the Nasdaq since ChatGPT’s 2022 debut mirrors early dot‑com era gains, suggesting this AI rally could still be in its formative bubble stage.

2. GPU Supply Chain and Compute Economics

AI compute is a function of leading-edge GPUs and high‑bandwidth memory. But despite revenues leaping 19% in 2024, wafer shipments fell 2.4%, illustrating how generative AI chips comprise less than 0.2% of the total wafers sold. Advanced packaging capacity – such as TSMC’s CoWoS – will double from 35,000 wafers per month in 2024 to 70,000 in 2025, but could face near-term bottlenecks due to supply constraints of memory and energy availability. Those bottlenecks feed directly into AI data center economics: A high-end GPU can easily cost tens of thousands of dollars and consume hundreds of watts.

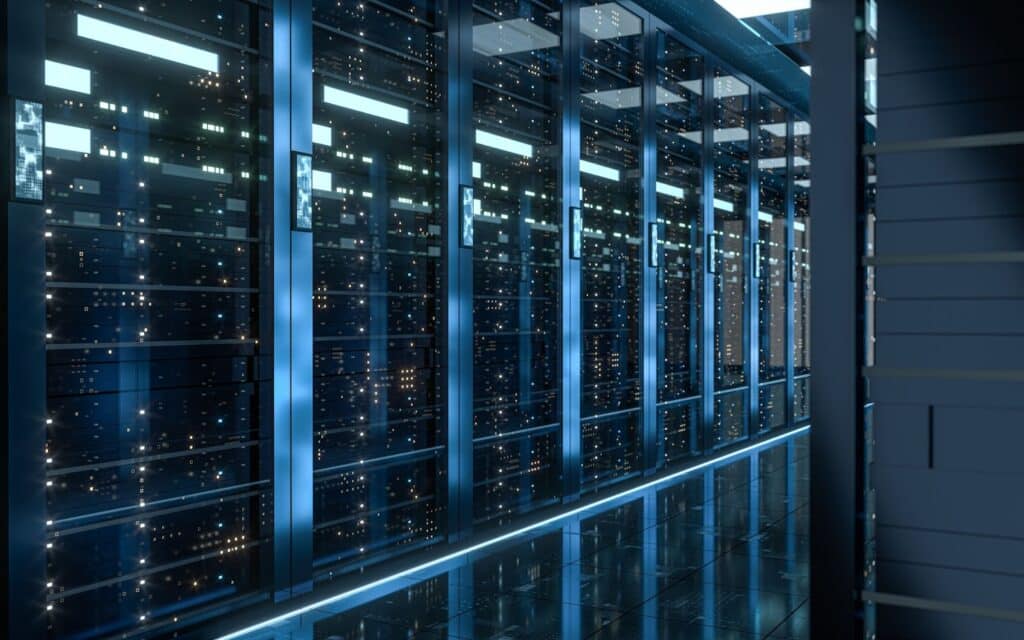

3. Data Centers Expansion and Power Needs

OpenAI’s investment in data centers over eight years puts a number on the scale of the AI infrastructure build‑out: $1.4 trillion. The hyperscalers-Amazon, Google, Meta, and Microsoft-invest an aggregate of about $400 billion in 2025, with many spending half their cash flow on construction. Power demand has been soaring, from hundreds of kilowatts per rack for enterprise edge deployments to hyperscale facilities. Energy grid limitations and sustainability pressures could become critical constraints-particularly as AI inference workloads climb faster than training and start shifting demand toward more distributed compute.

4. Debt‑Financed Growth and Circular Deals

Total debt levels across hyperscaler firms have risen by more than 300% year‑on‑year to $121 billion, with much of the borrowing often obscured via special purpose vehicles. Examples of feedback loops that can artificially inflate demand include Nvidia’s $100 billion stake in OpenAI, which then buys Nvidia chips, and CoreWeave’s stock‑for‑capacity deals with OpenAI. Analyst Paul Kedrosky suggests these structures risk becoming “a house of cards” if true end‑user demand fails to materialize.

5. Semiconductor Market Concentration & Geopolitical Risk

The AI chip supply chain has remained concentrated in key countries, with about 75% of DRAM being fabricated in South Korea, and a few Asian foundries dominating the advanced packaging. The export restrictions on extreme ultraviolet lithography have already slowed China’s ability to produce chips less than 7nm at scale. And climate-driven disruptions, such as Hurricane Helene, which shut down ultra-high-purity quartz mines, illustrate material vulnerabilities. Ongoing US-China trade tensions and proposed tariffs on Mexico and Canada further threaten to complicate sourcing and talent mobility.

6. AI Software Growth Verse ROI Reality

Powered by its Artificial Intelligence platform, Palantir reported a 44% increase in revenue to $1.89 billion for the first half of 2025 and a net income surge of 125%. AI features were the driver behind almost 50% of new Snowflake customer wins in Q2, pushing remaining performance obligations to $6.9 billion.

Yet, according to an MIT study, 95% of 52 organizations reported zero ROI on $30–$40 billion of investments into generative AI. This disconnect between adoption metrics and bottom‑line impact raises questions about sustainability.

7. Innovation Risk and Disruptive Substitutions

History is not short of cautionary parallels. Overbuilding of fiber‑optic networks in the 1990s was followed by breakthroughs that multiplied existing capacity, leaving infrastructure underutilized for years. In AI, rapid advances in semiconductor design or quantum computing might similarly render current data center investments obsolete before they pay off. Emerging chip architectures, domain‑specific silicon, and proliferation of edge AI might shift workloads away from today’s hyperscale GPU‑centric model, stranding capital.

Investors considering AI equities must balance the promise of transformation in the sector with its structural vulnerabilities. High valuations, supply chain fragility, speculative financing, and uncertain ROI provide a complex backdrop in which selectivity and evidencebased allocation should be paramount.