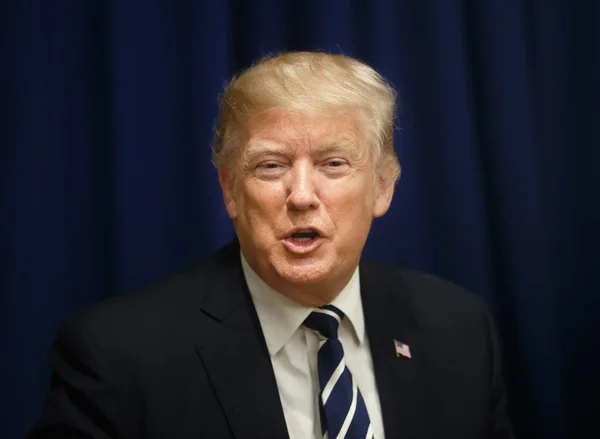

How often does a single sale of a fighter jet threaten to reshape the military balance in the Middle East? Confirmation by President Donald Trump that the U.S. will sell F‑35 stealth fighters to Saudi Arabia sets off a chain of geopolitical calculations, ripples within the defense industry, and debates on regional security.

The move was announced during Saudi Crown Prince Mohammed bin Salman’s high-profile visit to Washington, where the two leaders unveiled a raft of defense, technology, and economic agreements. For Riyadh, the deal represents a long-sought leap in airpower; for Washington, it’s a test of how far to push strategic partnerships without undermining Israel’s long-protected qualitative military edge.

Behind the headlines, the sale intersects with U.S.–China competition, congressional oversight battles, and the future of Gulf security architecture. Here are nine critical dimensions of the deal that defense watchers are tracking closely.

1. A Break with Decades of U.S. Policy

U.S. law has mandated for decades that Israel retain a “qualitative military edge” relative to its neighbors. Until now, Israel was the only state in the Middle East flying the F‑35, and it flies a unique variant with domestically developed sensors and systems. Approving Riyadh’s request for the same fifth‑generation aircraft without insisting on normalization with Israel represents a significant break with precedent.

Israeli officials had warned that, absent a binding offset package, the sale would erode their strategic advantage. Proposals making the rounds in security circles include an additional Israeli F‑35 squadron, expanded missile defense stockpiles, and a formal U.S.–Israel defense pact. To date, none of those commitments have been announced.

2. The Aircraft’s Strategic Value

More than a strike aircraft, the F‑35 is a networked sensor and command platform able to fuse intelligence across domains. Its stealth coatings, advanced radar, and 360‑degree sensor suite enable the aircraft to detect and engage threats well before being detected. This jet is “widely recognized as America’s best and most advanced fighter jet,” said Bradley Bowman of the Foundation for Defense of Democracies.

For Saudi Arabia, the purchase of up to 48 such planes would modernize its air force beyond current F‑15s, Tornados, and Typhoons, offering major increases in capability for countering regional threats-particularly emanating from Iran.

3. Congressional Resistance and Oversight

The sale is likely to face scrutiny on Capitol Hill, with lawmakers of both parties previously opposing arms transfers to Riyadh given the Yemen conflict and the 2018 killing of the journalist Jamal Khashoggi. Senator Bob Menendez urged colleagues to “send a global message you cannot kill journalists with impunity,” while Senator Lindsey Graham warned Riyadh that “there is no space for a strategic relationship” if it continues certain behaviors.

Arms sales could be blocked by Congress, though as in the case of emergency declarations for weapons to Saudi Arabia and the UAE, Trump has proved willing to bypass Congress. Overriding a presidential veto would take a two‑thirds majority, a threshold recent votes have failed to meet.

4. The China Factor

US intelligence agencies have warned that advanced technology could be compromised if Saudi Arabia were to deepen defense ties with China. Similar fears contributed to stalling F‑35 sales to the UAE under both Trump and Biden. The Defense Science Board has previously reported that Chinese cyber operations accessed data from the Joint Strike Fighter program, although US officials stress that constant upgrades mitigate such risks.

Any transfer of F‑35s to Riyadh would require the most stringent end‑use monitoring and technology protection measures to prevent adversary access.

5. Economic and Industrial Stakes

The F‑35 program at Lockheed Martin underpins nearly 300,000 jobs across the United States in 49 states and Puerto Rico. Starting in 2023, each jet costs roughly $77 million, while over 77 years, the projected life‑cycle costs of the larger program are seen as reaching over $2 trillion. Throwing the Saudi order into this-part of a broader investment package reportedly worth $142 billion just for the aircraft themselves-means significant revenue is injected into the U.S. defense industrial base.

But the programme has faced criticism amid delays, cost overruns, and readiness shortfalls-with a mission-capable rate of 55% in 2023, well below targets.

6. Major Non‑NATO Ally Status

The visit was used by Trump to officially classify Saudi Arabia as a Major Non‑NATO Ally, a largely symbolic elevation that confers some military and economic privileges but does not carry any binding security guarantees. Riyadh already enjoyed many of these benefits, including preferential access to U.S. arms sales, but the designation underlines Washington’s intent to deepen defense cooperation.

It was accompanied by what the Prince called a “historic strategic defence agreement” to reinforce deterrence across the Middle East and make it easier for U.S. defence companies to operate in the kingdom.

7. Links to Broader Diplomacy

Past administrations weighed making an F‑35 sale contingent on Saudi normalization with Israel under the Abraham Accords. To date, the crown prince has repeated that Riyadh will join only if there is “a clear path” to a two‑state solution for Palestinians. The fact that Trump has chosen to move forward without such a linkage represents a transactional approach, with deals on defense and economics taking precedence over conditional diplomacy. This divergence from the UAE precedent – in which normalization came with an F‑35 agreement – has led to concerns both in Jerusalem and among some U.S. lawmakers.

8. Regional Security Implications

Introducing F‑35s into Saudi service will disrupt the Gulf’s airpower balance. Israel will retain its numerical and experiential advantage – possibly operating up to 75 F‑35s by the time Riyadh takes delivery of its first – but will have lost the platform’s exclusivity. For Iran, the deal further entrenches a perception of a strengthening US–Saudi security axis. Saudi Arabia has relied upon U.S./British support for maintenance and logistics, and operational effectiveness accordingly would be dependent upon continued Western support.

9. Parallel Technology Agreements

Along with the F‑35 announcement, Washington and Riyadh signed a joint declaration on civil nuclear cooperation, presumably a harbinger of a formal Section 123 agreement. That would provide the U.S. some leverage to influence Saudi nuclear policy and prevent weaponization. An AI memorandum of understanding was also announced, which could include advanced chip sales with safeguards against Chinese access.

These parallel deals suggest that the F‑35 sale is part of a wider strategic package encompassing defense, energy, and emerging technologies. More than a high-value arms deal, a decision to sell F‑35s to Saudi Arabia is a strategic pivot with cascading effects on U.S. policy, Israeli security, Gulf power dynamics, and great‑power competition. Whether the result is to strengthen regional stability or seed new tensions depends on the conditions attached, the safeguards enforced, and diplomatic groundwork laid in parallel.