Could one tanker seizure disrupt global energy markets? The recent seizure by Iran’s Islamic Revolutionary Guard Corps of the Marshall Islands–flagged oil tanker Talara in the Strait of Hormuz has cast a harsh spotlight on renewed concerns about maritime security in one of the most pivotal chokepoints anywhere in the world. This incident, the first such seizure in months, comes against the backdrop of a heightening of regional tensions following the June conflict between Iran, Israel, and the United States.

The Strait of Hormuz carries about a fifth of global seaborne oil trade, and thus any rupture is a matter of urgent geopolitical and economic consequence. History shows that Iran has leveraged confrontation at sea for strategic gain, raising the stakes for regional stability amidst its expanding naval capabilities. Nine key takeaways from the Talara seizure that illustrate a wider strategic outlook include the following.

1. The Talara Seizure: Details and Immediate Impact

The Talara had been en route from Ajman in the UAE to Singapore, carrying a cargo of high-sulfur gasoil, when it was intercepted by three small IRGC boats. They forced it to abruptly change course into Iranian waters. US Central Command confirmed that IRGC forces boarded via helicopter, calling the act “a blatant violation of international law” and warning it undermines freedom of navigation. Cyprus-based Columbia Shipmanagement said it had lost contact with the vessel 20 nautical miles off Khor Fakkan. The incident prompted deployment of a US Navy MQ-4C Triton drone to monitor developments.

2. Legal Justifications and Iranian Claims

Iranian state media quoted IRGC as saying the tanker was “in violation for carrying unauthorized cargo,” but did not provide details. Reports indicated that the cargo was high-sulfur gasoil. Tehran framed the seizure as protection of “national interests and resources” based on a court order. Such justifications mirror past Iranian practices of citing alleged smuggling or legal infractions to detain vessels, often in politically charged contexts.

3. Strategic Importance of the Strait of Hormuz

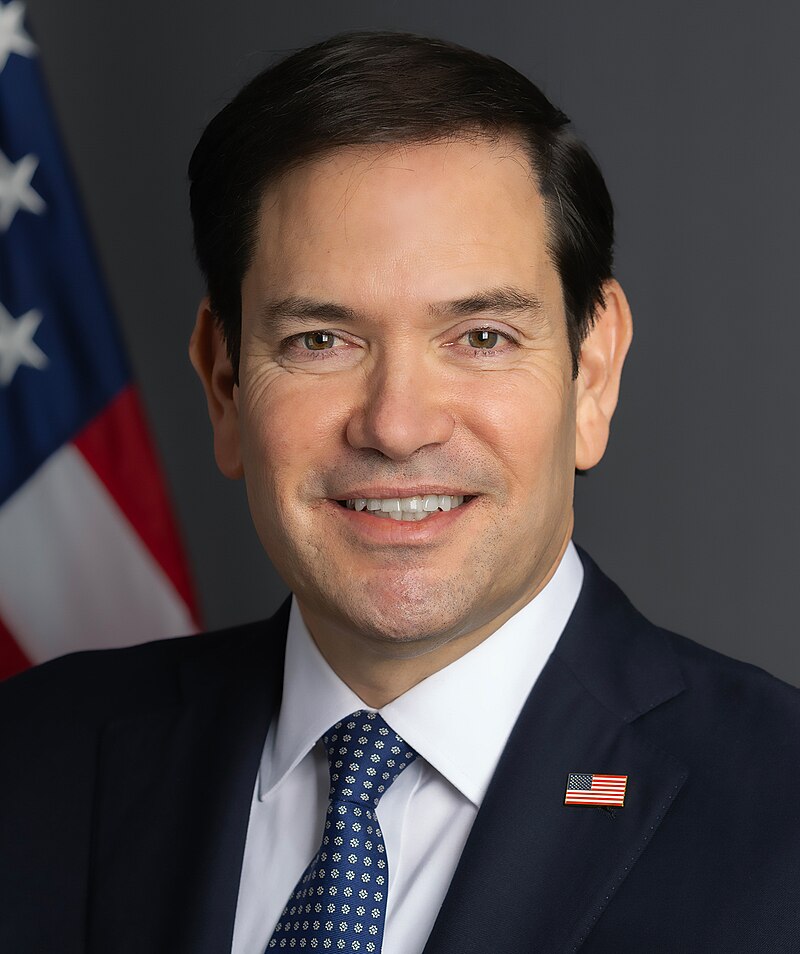

The Strait of Hormuz is only about 33 km wide at its narrowest point, yet it carries 20% of the world’s oil and gas flows. Saudi Arabia alone exports about 6 million barrels of crude daily through it. Any closure would spike oil prices, disrupt trade, and strain economies from China to Japan. Iran has repeatedly threatened to block the strait, a move US officials like Marco Rubio have warned would amount to “economic suicide” for Tehran.

4. Iranian Naval Capabilities and Asymmetric Strategy

It operates everything from hundreds of small, fast boats to converted merchant vessels like the Shahid Mahdavi, capable of launching both drones and missiles from containerized systems. It deploys unmanned surface and underwater vehicles, electronic warfare units, and even laser weapons to harass adversaries. In an asymmetrical approach, it counters conventional naval inferiority while leveraging chokepoint vulnerabilities.

5. Historical Precedent: Operation Praying Mantis

In response to an Iranian mine that had damaged the USS Samuel B. Roberts in April 1988, the US Navy launched Operation Praying Mantis. The one-day battle included the destruction of two Iranian oil platforms and the sinking or crippling of several warships by US forces. This largest US surface naval action since WWII demonstrated overwhelming firepower but also illustrated the risks of rapid escalationa lesson certainly relevant to today’s confrontations.

6. Recent Patterns of Maritime Interference

In the past two years, Iran has attacked or interfered with 15 internationally flagged merchant vessels and seized at least six. The notable cases include capture in April 2024 of a vessel linked to Israel and in May 2023 seizure of the Panama-flagged Niovi. Such incidents usually occur coupled with periods of high political tension, used as leverage during negotiations, or as an act of retaliation against perceived provocations.

7. Global Energy Market Vulnerabilities

Disruptions in the Strait of Hormuz can ripple through global markets. In June 2025, Brent crude rose from $69 to $74 per barrel in a single day amid regional tensions. 84% of crude oil passing through Hormuz goes to Asian markets, with China, India, Japan, and South Korea most exposed. Pipeline alternatives in Saudi Arabia and the UAE offer limited relief, collectively bypassing only about 15% of the strait’s crude flows.

8. Intelligence and Surveillance Responses

Since Talara was seized, US and UK maritime agencies have issued advisories of caution to vessels in the vicinity. The US Navy’s Bahrain-based 5th Fleet is “actively monitoring the situation,” with drones like the MQ-4C Triton providing persistent ISR coverage. These assets are particularly important in monitoring small-boat tactics and possible mining operations in the narrow channel.

9. Diplomatic and Military Balancing Acts

Deterrence remains at the very core of US policy, and yet analysts are similarly skeptical about driving Iran to escalatory moves. Energy Analyst Vandana Hari observed that for Iran, “there’s little to gain and too much to lose by closing Hormuz and alienating Gulf neighbors and China.” The challenge is how to balance military readiness with diplomatic pressure so as to keep shipping lanes open and avoid unintended conflict. The Talara incident shows just how fragile maritime stability in the Strait of Hormuz and wider Gulf really is. The seizure tactics of Iran, rooted in several decades of asymmetric strategy, continue to test international law and naval responses. The clear lesson for policymakers and security professionals is that securing this chokepoint requires not just formidable military capabilities, but also deft diplomacy to prevent localized confrontations from spiraling into global crises.