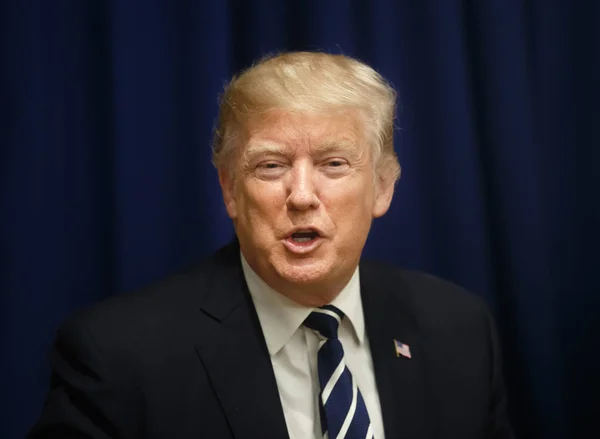

Henrik Stiesdal of Denmark and Britain’s Andrew Garrad were celebrated as the “Godfathers of wind” in a reception hall full of dignitaries and engineers at St. James’s Palace, London, as they received the 2024 Queen Elizabeth Prize for Engineering. Yet their remarks carried a sobering undertone. “We are facing right now, a change of mood,” Garrad told CNBC, warning that the Trump administration’s aggressive rollback of offshore wind projects is symptomatic of a wider political retreat from climate action.

1. Political Hostility and Project Cancellations

Since returning to office, Trump has frozen new leasing and permitting for offshore wind, revoked $679 million in federal funding for infrastructure, and issued stop-work orders on high-profile projects. The moratorium will apply to both onshore and offshore developments, according to federal officials, citing legal inadequacies in permitting. Legislation in July accelerated the phase-out of Biden-era tax incentives, cutting eligibility from 2032 to the end of 2025-a change that eliminates long-term financial certainty for developers.

2. Economic Impact on Industry Leaders

The fallout has brought immediate consequences for some of the biggest players Orsted, the world’s largest operator of offshore wind farms, announced a net loss of 1.7 billion Danish kroner ($261.8 million) in Q3 2025, down sharply from a profit of 5.17 billion kroner a year earlier. Its shares have fallen more than 80% from their 2021 peak, sinking to record lows after the administration ordered work to stop on a nearly complete wind farm. Vestas, Denmark’s leading turbine manufacturer, announced stronger-than-expected quarterly earnings, with operating profit reaching €416 million, but its CEO Henrik Andersen did not deny the “slap” of political pushback in the U.S. market.

3. Engineering Innovations Under Threat

The foundation of modern turbines, now scaled to blades of more than 120 meters and generating up to 16 MW, is three upwind blades with yaw control-the “Danish concept” of Stiesdal. Garrad’s software has de-risked projects for financiers by optimizing array layouts indeed, approximately 70% of all turbines installed in the world have used his software in their design. It is these engineering advances that underpin offshore wind’s ability to deliver reliable, high-capacity power to coastal grids. However, stalled projects risk delaying deployment of next-generation floating turbines designed for deeper waters.

4. Grid Integration and Energy Security

The strategic value of offshore wind is that it will be able to provide gigawatts of electricity in proximity to demand centers, reducing transmission losses and enhancing resilience. Projects such as Revolution Wind, designed to supply 704 MW of electricity to Rhode Island and Connecticut, were sited to correspond with seasonal demand spikes, which happen during the winter months. Its stop-work order-just temporarily lifted-is expected to force greater reliance on fossil fuels, increase regional electricity bills by at least $500 million a year, and heighten the risk of blackouts during extreme cold.

5. Storage and Flexibility Technologies

Such smoothing requires further development of large-scale battery storage or hybrid systems that integrate offshore wind with onshore solar. Accordingly, high-capacity lithium-ion, or emerging 500 Wh/kg Li-S cells being paired with the offshore generation can store excess winter output for use during summer peaks. It is political uncertainty that puts investment into these systems under question and slows down the build-out of flexible renewable-dominated grids.

6. Legal and Regulatory Battles

Non-profit organizations have joined state attorneys general in filing suit to block the funding cuts and permitting freezes. Legal scholars say that while canceling grants takes advantage of discretionary language in federal grants, it is much harder to reverse course on changes to tax incentives. Ongoing litigation on stalled projects will decide whether developers can move forward and recoup sunk costs.

7. Investor Confidence and Supply Chain Stability

Federal hostility sends a chilling signal to investors, which undermines confidence in wind and, more generally, U.S. infrastructure sectors. Supply chains-from blade manufacturing to specialized installation vessels-depend on predictable project pipelines. Vestas’ established U.S. supply network remains operational, but uncertainty discourages expansion and localization of component production, putting higher costs and import dependencies at risk.

8. The Broader Energy Security Debate

Energy experts, including NewClimate’s Gustavo De Vivero, say true energy security encompasses affordability, efficiency, and resilience metrics on which renewables surpass their fossil fuel competitors. Offshore wind could power the U.S. five times over, yet political retrenchment threatens to lock the country into volatile fossil fuel markets. “This isn’t just a wind energy problem,” Garrad underscored, framing the rollback as a dangerous politicization of energy policy.

9. Global Context and Technological Trajectory

Worldwide, wind now supplies more than 8% of electricity, approaching one-third in the UK. Floating turbine technology has opened the way to deeper waters, while ongoing digitalization is boosting predictive maintenance and grid balancing. This policy about-face in the US stands in marked contrast to Europe and Asia, where governments are speeding up offshore deployment to meet climate and energy security goals.

The “Godfathers of wind” have spent decades transforming backyard prototypes into industrial-scale machines capable of reshaping global power systems. Their message is crystal clear political obstruction risks not just climate progress but also the engineering, economic, and security foundations of modern energy infrastructure.