It began with a promise that almost sounded plausible a sleek, updated successor to the MiG-29, “4+++” generation, able to bridge the gap between Russia’s aging fourth-generation fleet and the elusive fifth-generation dream. The MiG-35 was to be the answer for foreign customers in search of capability without having to pay the heavyweight cost of either the Su-35 or Su-57. Instead, it became a cautionary tale in how marketing bravado collides with industrial reality.

From the underwhelming technical upgrades to geopolitical headwinds due to sanctions and war, the fortunes of the MiG-35 have swung swiftly from that of the air show darling to export pariah. Today, only a few airframes exist, most of them assigned to an aerobatic team instead of combat units. For the analyst and enthusiast in the field of defense, the fate of the MiG-35 offers a revealing lens into the Russian aerospace industry under strain, shifting priorities in global fighter procurement, and the unforgiving economics of modern airpower.

1. A Legacy Burdened by the Design Limits of the MiG-29

The MiG-35 inherited all the basic compromises of the MiG-29 small internal fuel capacity, unimpressive sensor and cooling volumes, and tight wiring runs that make future upgrades difficult. Additional external tanks and in-flight refueling probes were added, but these could not change the fact that persistence in modern air combat is a design choice, not a retrofit. As Dr. Andrew Latham mentioned in Defense Priorities, “You can strap on fuel tanks, but you can’t fake persistence in an era when modern air defenses force you to stand off.” This structural inheritance put the MiG-35 at a disadvantage from the outset against longer-range, heavier multirole fighters.

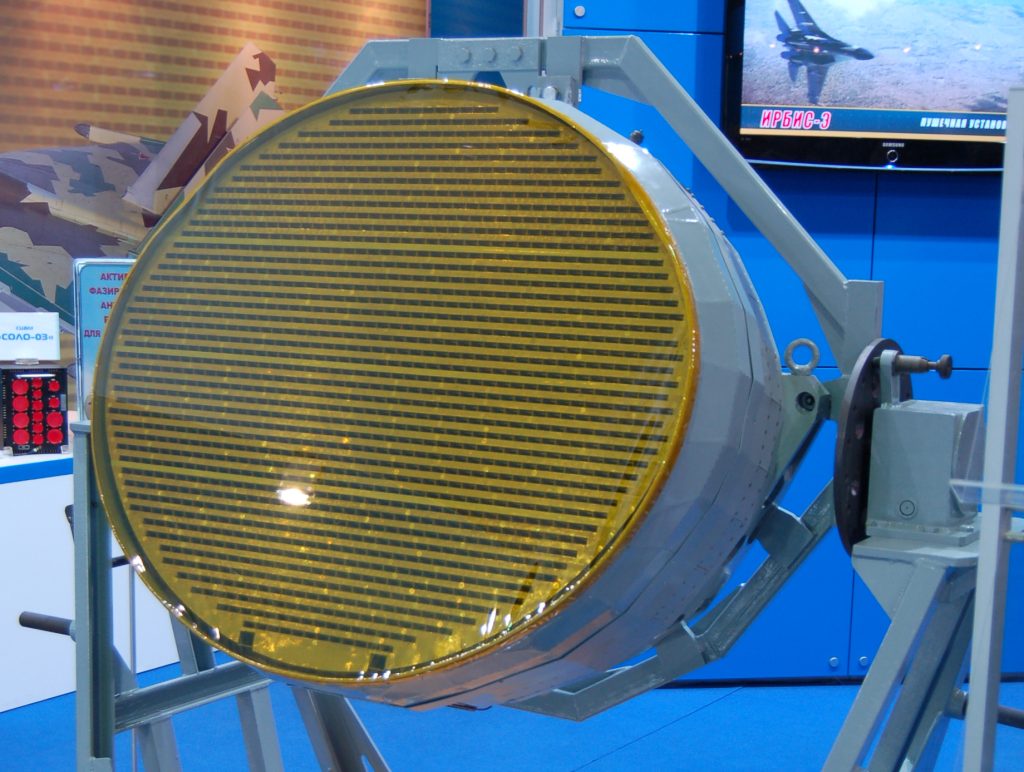

2. AESA Radar: Promises That Never Materialized

Since its 2017 debut, the MiG-35 had been trumpeted as fielding an active electronically scanned array radar so crucial for modern situational awareness and targeting. Delays to integrate that capability, sanctions, and scarcity of microelectronics meant most production aircraft shipped with older PESA radars. Repeated assurances from Moscow that AESA capability was “coming soon” only turned into a credibility trap as potential buyers watched the gap between brochure and reality widen. Without a credible in-service AESA, the jet’s competitive edge eroded before it could be proven.

3. Export Market Rejection Across Continents

India, Malaysia, Argentina, Bangladesh, and Egypt-all of which were considered potential buyers-passed on the MiG-35. Egypt favored the MiG-29M/M2 instead. Southeast Asia cooled on the idea, and even Vietnam-considered a potential replacement market for its aging MiG-21 and Su-22 fleets-remains unlikely to commit. The MiG-35 arrived in a market where customers increasingly buy integrated sensor and sustainment ecosystems rather than just airframes-with a delivery truck but no compelling payload.

4. Lack of a clear role in Russia’s own air force

Frontline Russian Frontal Aviation is dominated by heavier fighters such as the Su-35S and Su-30SM. The MiG-35 never carved out a clear niche, relegating the jet to local air policing and rear-area duties. An order by the VKS in 2017 for 24 aircraft has resulted in only about six operational jets, most of which have been assigned to the Strizhi aerobatic team. Without a strong domestic operational profile, foreign buyers saw little reason to invest.

5. Industrial Strain and Sanctions Pressure

Sweeping Western sanctions have crippled Russia’s aerospace supply chain, cutting off direct access to critical components. “Domestic producers aren’t even close to meeting the needs of the sector,” said Anatoly Gaydansky, Aerocomposite’s chief executive. “The electronic component base is a big problem.” A result has been inflated costs-up 45% to 70%-and production delays, which make the MiG-35 less attractive both at home and abroad.

6. Competing with Platforms

Offering Better Value Other designs offered improved support and defined upgrade paths for potential customers. Competitors-both from the West, such as the F-16 and Gripen, but also Chinese designs-offered more integrated avionics, coherent weapons envelopes, and established sustainment networks. The incremental advantages of the MiG-35 over the MiG-29 were too slight to justify the increased cost and logistical risks in such a context.

7. Battlefield Irrelevance in Modern Doctrine

The war in Ukraine underlined how the tide of combat was shifting toward long-range, networked combat. A platform’s survivability depends on its operating within the dense kill-web of sensors, jammers, and stand-off weapons. Light fighters with short ranges and limited payloads, such as the MiG-35, have been effectively sidestepped in contested airspace. Reports of operational use were on drone-defense sorties near Moscow, not over the high-intensity front line.

8. Political Marginalization within United Aircraft Corporation

With Mikoyan absorbed into United Aircraft Corporation, Sukhoi programs got priority. The Su-34, Su-30, Su-35, and Su-57 took resources and production capacity, making the MiG-35 an underfunded afterthought. Electronics and machine-tool bottlenecks were resolved in favor of high-throughput lines, further starving the MiG-35 program of momentum.

9. Confused Development Path and Variant Uncertainty

Over its marketing life, the MiG-35 was offered in multiple configurations-some with thrust vectoring, some without some carrier-capable, others not. This ambiguity over what the final product would actually look like undermined buyer confidence. The final product amounted to little more than a modernized MiG-29M/M2, boasting nine weapon stations and uprated RD-33MK engines, offering nominal capability gains over existing Fulcrum variants.

10. A Future Overshadowed by Fifth-Generation Rivals

With investments in the Su-57 and the proposed Su-75 Checkmate marking Russia’s fighter future, the MiG-35 risks being a stopgap without a long-term role. As stealth and network integration become baseline requirements, it is increasingly hard to justify new procurements of warmed-over fourth-generation airframes. Barring a radical redesign, the brand will fade into history with other Cold War icons.

The collapse of the MiG-35 reflects not any single misstep but a combination of design inheritance, industrial weakness, shifting doctrine, and geopolitical isolation. In an era where airpower is defined at least as much by sensors, networks, and sustainment as by the airframe itself, the MiG-35 serves as a reminder that yesterday’s solutions cannot be merely repackaged for today’s battlespace. It presents a stark lesson to Russia’s aerospace industry without credible technology delivery, coherent roles, and resilient supply chains, even storied names can find themselves without a future