How much does a Russian missile really cost? It’s a question that has fueled heated debates among defense analysts, military enthusiasts, and policymakers since the start of the Ukraine war. Figures have often been inflated or underestimated, clouded by speculation and patchy data. Now, newly surfaced procurement documents and production intelligence offer a rare, detailed look at the economics behind Russia’s missile campaign. These revelations slice through years of guesswork and uncover, for the first time, not only the unit prices of systems such as the Kalibr, Kh-101, Iskander, Kinzhal, and Zircon but also the scale of production and industrial machinery that sustains them.

This revelation makes very clear a more profound reality: Russia’s cost structure and manufacturing tempo differ from Western models in fundamental ways that create a perilous imbalance in the cost-exchange ratio of offense versus defense. What follows are seven of the most striking insights to be gleaned from this data, each shedding light on the financial, technical, and strategic dimensions of Russia’s missile operations.

1. Iskander-K and 9M729: From Treaty Breach to Mass Production

The core of the Russian ground-based deep strike capability remains the 9M728 Iskander-K cruise missile, which has a 500-km range and a 480-kg warhead. Between 2024 and 2025, 303 units were ordered for the Novator Design Bureau at approximately $1.5 million each. Rather more controversially, the extended-range 9M729, whose maximum range is over 2,000 km, its deployment helped break the INF Treaty in 2019. In 2025, 95 were contracted for $1.4–$1.8 million apiece, requiring a dedicated Iskander-M1 launcher due to their increased length. Such numbers make it plain that the result of treaty violations is clear production lines, not just political consequences.

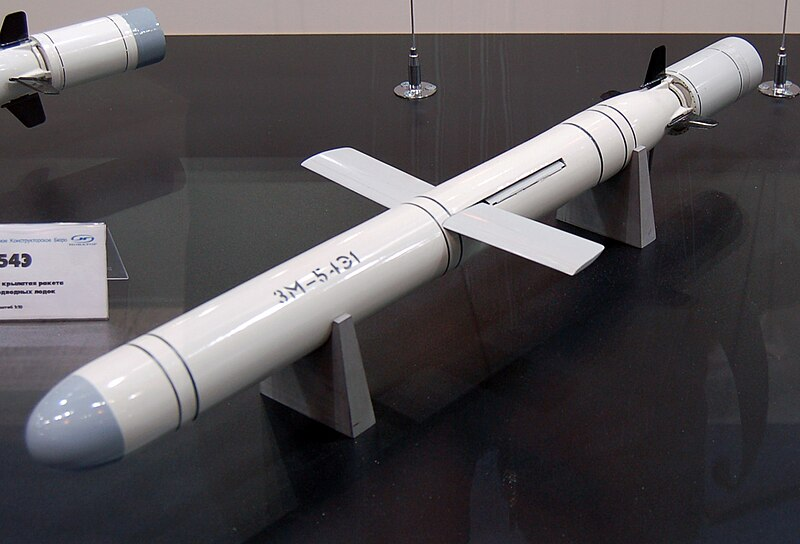

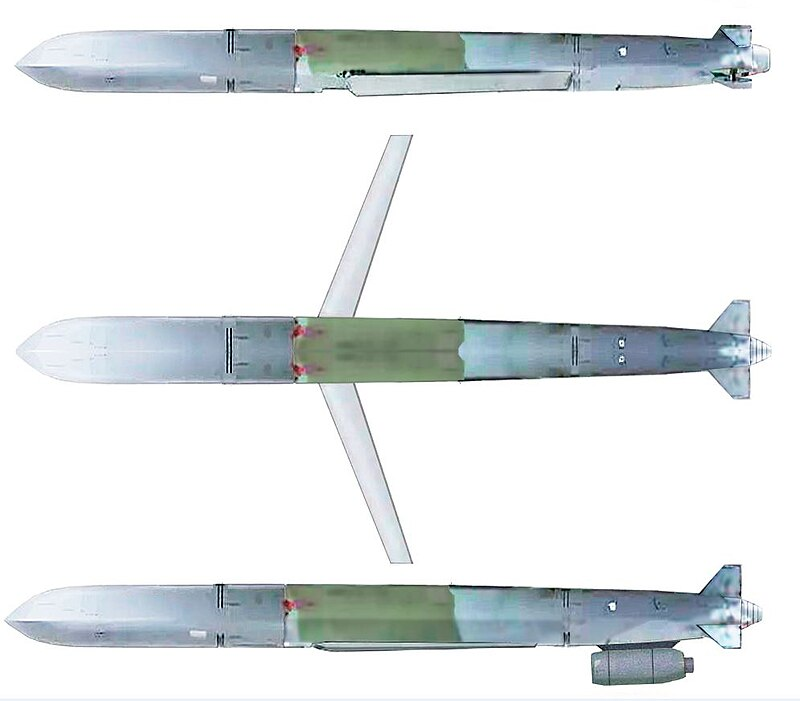

2. Kalibr Variants: Conventional and Nuclear at Sea

From frigates, corvettes, submarines, and Black Sea Fleet vessels, the 3M14 Kalibr has become a familiar name in Russia’s maritime strike doctrine. Contracts place 240 missiles delivered in 2022–2024 and another 450 slated for 2025–2026 at a cost of about $2 million each. There is a nuclear-armed variant, the 3M14S, being produced in a limited batch of 56 units, for which costs rise to $2.3 million because of exchange rate fluctuations. This dual-capable platform epitomizes how Russia seeks to maintain flexibility in the payload while sustaining high-volume production.

3. Kh-101: Stealth, Range, and Electronic Countermeasures

The Kh-101 is Russia’s longest-range air-launched cruise missile, produced by the Raduga Design Bureau, with more than 2,500 km of range, stealth shaping, GLONASS navigation, and infrared decoys. It is deployed on Tu-95MSM and Tu-160 bombers with a 450 kg warhead. In 2024, 525 units were ordered for $2 million each, and in 2025, another 700 units for $2-$2.4 million. Ukrainian analyses have identified that many Kh-101s are manufactured with very outdated Soviet-era electronics, undercutting many claims of its effectiveness. Still, its combination of range, precision, and countermeasures makes it a central pillar of Russia’s strategic strike capability.

4. Iskander-M Ballistic Missiles: Expensive but Hard to Stop

The 9M723 Iskander-M delivers a 500 kg payload up to 500 km and is prized for an ability to evade most classical air defenses. Contracts for 2024–2025 cover 1,202 missiles across several warhead types, with unit costs between $2.4 and $3 million. A small batch of 18 suspected long-range Iskander-1000s was ordered at $2.5 million each. Production has surged up 66% over the past year and newer variants now incorporate radar decoys and unpredictable flight paths, further complicating interception.

5. Kinzhal Hypersonic Missiles: High Speed, High Cost

The 9-S-7760 Kinzhal, which is an air-launched missile fired from MiG-31Ks, reaches Mach 5.5 during midcourse. Contracts filed demonstrate 44 units ordered in 2024 and 144 ordered in 2025, each at $4.5 million. Its titanium penetrating warhead and hypersonic-capable navigation drive the price well above that of standard ballistic missiles. However, its drop in terminal speed has allowed successful Patriot intercepts to be made, revealing that cost and speed do not guarantee invulnerability.

6. Zircon: Hypersonic Anti-Ship and Land Attack

The 3M22 Zircon, developed by NPO Mashinostroyeniya, is a two-stage missile that uses solid fuel and a scramjet; Russian sources claim a 1,000 km range. Tests reportedly reached Mach 8–9, and its plasma cloud can render it invisible to radar. Annual deliveries of 80 units from 2024–2026 are priced at $5.2–$5.6 million each. Despite the technological appeal, combat use in Ukraine has yielded limited results, raising questions about its operational effectiveness relative to its high production cost.

7. Cost-Exchange Imbalance: Russia’s Advantage in Unit Economics

Russian missile production is set within vertically integrated, state-subsidized models that exclude both research amortization and profit margins. That enables systems such as the Iskander-M to be produced for $400,000–$500,000 in some estimates, while a PAC-3 MSE interceptor costs $4 million. In practice, six Iskanders can thus cost Ukraine $48–$72 million or more to intercept, significantly more than Russia’s monthly ballistic production cost. This imbalance, combined with rising output of both missiles and drones, creates a sustained pressure on Ukrainian and NATO-aligned air defenses, threatening long-term strategic stability.

The just-unvealed procurement data makes one thing clear: Russia’s missile arsenal is a function not just of advanced engineering but of economic strategy. In manufacturing high-volume, capable systems at relatively low unit costs, Moscow exploits a cost-exchange advantage that strains the defensive stockpiles in Ukraine and could well challenge NATO in some future confrontation. Understanding these dynamics is essential for framing countermeasures-whether through industrial reform, alternative interception technologies, or preemptive strike capabilities-before this imbalance becomes irreversible.