Can a $4.8 trillion AI fantasy be constructed without the hands to wire it? Ford CEO Jim Farley’s warning has highlighted a crisis that has the potential to halt America’s AI infrastructure plans before they ever leave the drawing board. “I believe the intent is there but there’s nothing to backfill the ambition,” Farley said to Axios, highlighting the disconnect between record AI investment and the diminishing pool of skilled blue-collar workers to build and run the data centers and factories at its center.

1. The Scale of the AI Infrastructure Build-Out

By 2030, hyperscale and computational data centers will need $6.7 trillion of worldwide capital spending, with the United States accounting for over 40 percent of that spending. The buildings call for precision-engineered power systems, high-density cooling, and resilient mechanical infrastructure projects that can take 1,800 electrician-hours per megawatt of capacity, significantly higher than traditional commercial construction. However CBRE indicates vacancy rates in U.S. primary data center markets a record low 1.6%, a sign that supply is already tightening in response to demand.

2. Skilled Labor Shortages

Farley identifies a shortage of 600,000 factory workers, 500,000 construction workers, and a projected need for 400,000 auto technicians in three years. This shortage is compounded by an aging labor force 25% of construction workers are age 55 or older and the tight immigration policies that have cut the foreign-born workforce by 1.2 million since January, Bureau of Labor Statistics data indicates. In occupations such as drywall installation, immigrants constitute almost 60% of the labor force, so policy changes become a direct influence on project duration and cost.

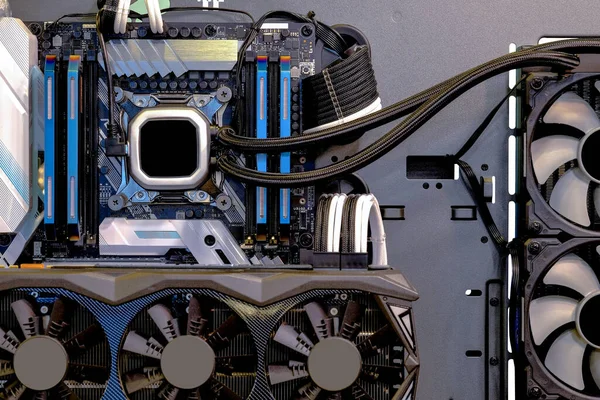

3. High-Tech Requirements of AI Data Centers

In contrast with conventional facilities, AI data centers need redundant, high-voltage electrical distribution, electromagnetic compatibility protection, and precision liquid cooling systems. These are engineering intricacies that demand electricians, HVAC technicians, and commissioning experts skilled in advanced systems integration. Facilities without these competencies expose themselves to commissioning delays that can leave hundreds of millions in idle capital.

4. Automation and AI in Manufacturing

In response to shortages of workers, manufacturers are increasingly relying on AI-driven automation. CloudNC’s CNC programming software, for instance, can reduce programming time for precision parts from 90 minutes to 22 minutes, freeing human operators for more valuable tasks. Honeywell and Caterpillar are investing in AI-enabled robotics and predictive maintenance to move workers away from repetitive, dangerous jobs, although adoption is still patchy only 29% of big manufacturers report that they use AI at the factory floor.

5. Policy and Workforce Development Initiatives

The U.S. Department of Labor has introduced the $30 million Industry-Driven Skills Training Fund, providing up to $8 million per state to ramp up training in in-demand trades. States are expanding registered apprenticeships now over 670,000 nationally with bills focused on technology, electrical, and construction industries. But the CSIS AI Action Plan cautions that the capacity of apprenticeships needs to increase by at least 50% by 2030, calling for instructor corps growth, facility upgrades, and retention incentives in high-cost metropolitan regions.

6. Immigration as a Workforce Lever

Immigrants already make up 73% of the U.S. farm labor force and more than 20% of transportation and construction workers. Analysts contend that relaxing visa quotas for H-2B and H-1B programs would quickly introduce skilled trades into AI infrastructure projects. Without this, demographic depletion will outstrip training pipelines, leaving a window of greatest exposure between 2029 and 2030.

7. State-Level Strategies for AI Infrastructure

Northern Virginia’s “Data Center Alley” illustrates how coordinated policy can align incentives, infrastructure, and workforce readiness, supporting $31 billion in economic output in 2023. Ohio’s STAR Program and partnerships with hyperscalers have quadrupled data center capacity over a decade, backed by transmission build-outs and renewable energy integration. These models hinge on early planning for power, water, and land constraints while embedding workforce development into project timelines.

8. Risks of Inaction

If labor shortages are not addressed, AI infrastructure initiatives will be slowed, costs escalated by wage bidding, and U.S. dominance in the global AI competition undermined. A shortage of electricians alone may halt commissioning timetables, idling gigawatts of GPU capacity. As Farley warned, “How can we reshore all this stuff if we don’t have people to work there?” With no bold action taken, the disparity between AI aspiration and action will grow.

Deploying skilled trades on the scale of previous industrial booms rural electrification, interstate highways will be critical. In the age of AI, the backbone is not silicon and software alone, but the welders, electricians, and technicians who can make the vision a reality.