Within a month, Russia’s Mediterranean stance has transitioned from almost constant submarine presence to zero a deterioration few naval observers anticipated so suddenly. The January 2 departure of the Improved Kilo Class submarine Novorossiysk saw not merely a tactical retreat, but the dismantling of a decades-long maritime policy around Syria’s Tartus port.

For decades, Tartus was Moscow’s sole deepwater anchor in the Mediterranean, a supply line for its ships and a sign of continued clout in the Middle East. The collapse of Bashar al-Assad’s regime has not only threatened that anchor but pushed Russia into a race for substitutes, from Libya’s disputed ports to the remote Red Sea. This listicle analyzes the most significant trends determining Russia’s naval future in the region, incorporating new intelligence, historical background, and the ever-changing alliances characterizing Mediterranean security.

1. Tartus: From Cornerstone to Liability

The Soviet Navy first employed Tartus in 1971, developing it into the 720th Logistics Support Point by the mid-1980s. For Russia, it was the sole Mediterranean port that could receive nuclear submarines and refit warships without having to go back to the Black Sea. That benefit disappeared when Ankara, invoking the Montreux Convention, shut the Turkish Straits to Russian warships following the 2022 invasion of Ukraine. Without Tartus, ships lose their only regional maintenance base, compelling redeployments from remote bases and reducing operational staying power. The symbolic loss is also as hurtful Naval News has termed it a blow to Moscow’s reputation as a great power.

2. The Abrupt Termination of a Ten-Year Mediterranean Submarine Presence

Russia had an overlapping rotation of Kilo-class submarines in the Mediterranean for almost a decade. The Novorossiysk‘s departure out of the Strait of Gibraltar, which was confirmed by the Portuguese Navy on January 4, left the region without a conventional Russian submarine since 2013. Naval analyst Frederik Van Lokeren points out that diesel-electric subs spend a large percentage of their deployment time in port; without Tartus, sustained operations become impossible. One possible substitute, thought to be the Krasnodar, is still behind schedule in the North Sea, reflecting logistical and technical pressures.

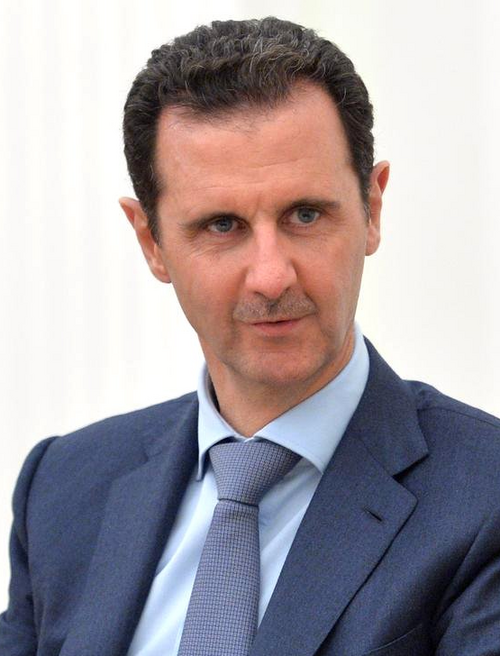

3. Assad’s Fall and the Negotiation Deadlock

The fall of Assad’s regime in the late 2024 broke Moscow’s illusion of permanent basing rights. Deputy Foreign Minister Mikhail Bogdanov’s January negotiations with de facto Syrian leader Ahmed al-Sharaa produced public hopes but private requests return of $2 billion of assets that Moscow will not fulfill. Syrian checks on Russian convoys and port access delays suggest entrenched suspicion. Even a deal, given the new government’s pro-Western orientation and desire to terminate sanctions, makes long-term Russian basing politically vulnerable.

4. Libya as the Contingency Plan

General Khalifa Haftar’s Eastern Libya has emerged as Russia’s fall-back option. Ports at Tobruk, Benghazi, and interior bases such as Maaten al-Sarra are being upgraded to accommodate Africa Corps operations. However, these ports have no dry docks and repair halls to match Tartus, which restricts their use for extended naval deployments. Political risk remains high Haftar has connections with France and other entities that can limit Russian access. As RUSI analysis explains, reliance on a non-pariah partner creates vulnerabilities not found in Syria.

5. Algeria and the Red Sea: Limited Alternatives

Algerian Kilo-class submarine bases might provide limited maintenance assistance, but political tensions regarding Russian activities in Mali prevent a permanent facility. Port Sudan, the other contender, has negotiations stalemated despite decades of trying. Even if successful, its position outside the Suez Canal poses operational lags and telegraphs ship movements to the enemy. These suggestions define the geographic and diplomatic limitations of Russia’s capacity to replace Tartus with an equivalent hub.

6. The Africa Corps Logistics Network

After the rebranding of the Wagner Group, Africa Corps is the Russia’s military-commercial operations hub in the Sahel now. Libyan bases constitute an airbridge that fuels forces in Mali, Niger, Burkina Faso, and the Central African Republic. This network facilitates the smuggling of fuel, weapons, and even migrants, bypassing sanctions and financing Russian operations. But as experts caution, it is legally impossible to formally enshrine these foundations in Libya’s fractured politics, compelling Russia to conduct itself in a ‘stable instability’ that confines its open military application.

7. Strategic Decline in Mediterranean Power Projection

Bryan Clark of the Hudson Institute has noted that Russia has “gone from being a pretty big player in the Med to now being a nonexistent player.” Losing Tartus, topped with Black Sea fleet reverses, undercuts deterrence, intelligence collection, and supporting allies such as Iran. Lacking the warmth of a port, Russia’s Mediterranean squadron formerly able to escort Iranian oil and deliver Kalibr fire now has diminished staying power, tilting the regional naval balance toward NATO.

Russia’s Mediterranean debacle is more than a logistical failure; it is a strategically diminished contraction driven by battlefield defeats in Ukraine, the collapse of Syria’s long-term ally, and the confines of opportunistic pivots to weak states such as Libya. Whether or not Moscow will be able to rescue a stake through makeshift arrangements or other ports is not clear. For military strategists, the developing crisis presents a unique, in-progress case study on how the loss of one base can have ripple effects around worldwide force projection, alliance politics, and naval security.