The weakness was exposed in May 2025. Under Operation Sindoor, the Indian Air Force’s 36 Rafale jets carried out precision bombing deep into enemy lines, but the stress on its shallow fleet was palpable. With squadron numbers already reduced to 31 far short of the approved 42 and to fall further to 29 after September’s retirement of the remaining MiG-21s, the IAF is now insisting on a government-to-government deal with France for 90 Rafale F4 aircraft. This would sidestep the long-running Multi-Role Fighter Aircraft (MRFA) tender and return the force to its original 2007-set 126-aircraft requirement.

1. Strategic Imperative Post-Operation Sindoor

The urgency is because of a shifting balance in the region. Pakistan’s induction of Chinese-supplied J-10Cs equipped with PL-15 long-range missiles, and its reported purchase of 40 J-35A fifth-generation stealth fighters, has put pressure on India’s response time in a two-front war with China. Operation Sindoor proved the reach and accuracy of the Rafale but also showed that without depth in numbers, even cutting-edge platforms cannot maintain high-tempo missions.

2. Rafale F4: A Leap in Capability

The Rafale F4 standard desired by the IAF is a major improvement over the current F3-R configuration. It brings in a more capable Thales RBE2-AA Active Electronically Scanned Array radar, a better SPECTRA electronic warfare suite, and sophisticated networked warfare features. The French F4.3 variant, certified in extensive RAU testing at Istres, has been flight-tested in destroyers, AWACS, MAMBA SAM system, and aerial refuelling multi-domain scenarios, with survivability in contested airspace. The IAF intends to incorporate indigenous Astra Mk-2 beyond visual-range missiles and Rudram anti-radiation missiles, turning the aircraft into a credible Suppression of Enemy Air Defences platform.

3. Technical Edge Over Regional Rivals

Against the Chinese J-10C, the twin-engine redundant Rafale F4 has a better payload capacity and proven multi-role capabilities. Its Meteor missile with over 60 km no-escape zone is in reach competition with PL-15, while its heavy composition of airframe and lower radar cross-section improve survivability. Against the J-35A’s stealth, the Rafale’s sensor fusion of AESA radar, OSF infrared search and track, and SPECTRA EW gives it a multi-spectral detection edge.

4. Make in India: From Buyer to Builder

The proposed agreement is aimed at changing India’s position in the Rafale program from operator to manufacturer. Dassault Aviation has signed an agreement with Tata Advanced Systems Limited to manufacture complete fuselages in Hyderabad the first time such activity will be carried out outside France. The plant, which will produce up to 24 fuselages per year, will cater to Indian and export markets. The Nagpur-based Dassault Reliance Aerospace Limited facility, which is already manufacturing radomes and canopies, stands ready for final assembly.

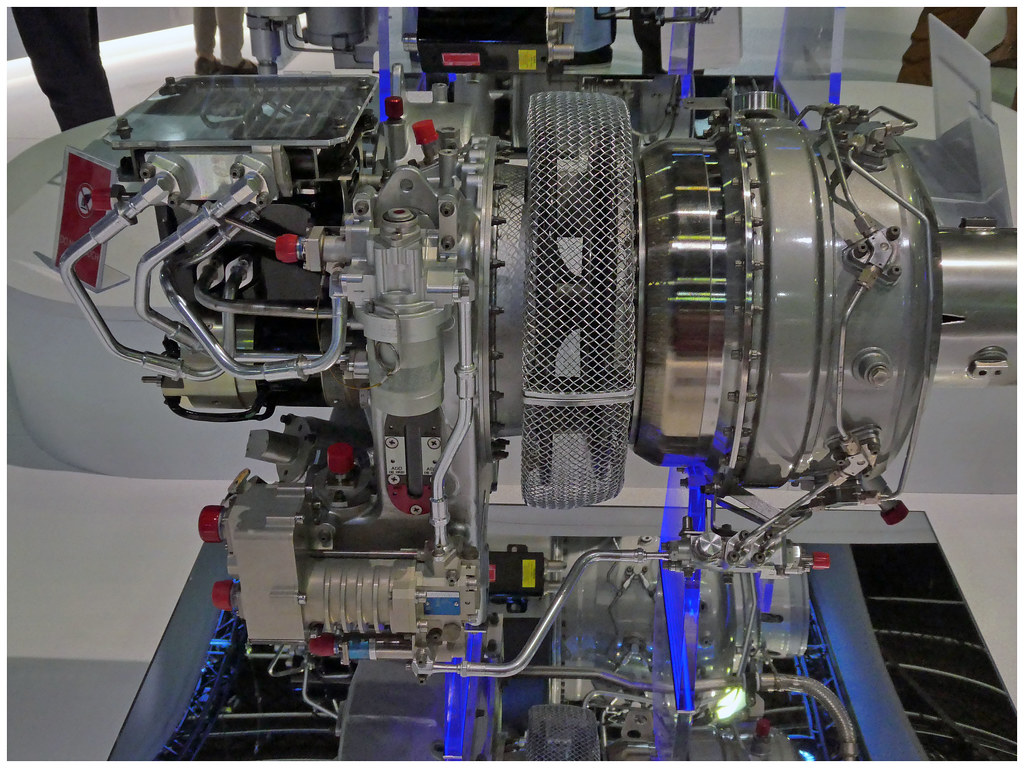

5. Engine Manufacturing and MRO Ecosystem

Safran, the manufacturer of the M88 engines, is setting up Safran Aircraft Engine Services India in Hyderabad for maintenance, repair, and overhaul. The unit will employ 150 people by 2026, with scope to increase to 750, and could produce M88 engines locally if the Rafale order is finalized. This is part of Safran’s overall proposal to co-develop a 110–120 kN thrust engine for India’s Advanced Medium Combat Aircraft based on M88 core technology.

6. Industrial Synergy and Export Potential

The combination of TASL’s fuselage manufacturing, DRAL’s assembly capacity, and Safran’s engine MRO forms a vertically integrated supply chain. Such a system would place India as a secondary production center for Rafales with potential to cater to export orders in future. The model is replicated as it is from France’s own industry base, providing operational readiness and lowering lifecycle cost.

7. Infrastructure and Operational Readiness

IAF’s already existing Rafale bases at Ambala and Hasimara are capable of accommodating more squadrons at full capacity, reducing infrastructure delays. Platform commonality with the 26 due-from-2028 Navy’s Rafale-M jets will reduce training, maintenance, and logistics costs. Ten IAF Rafales currently in service are already being modified to near-F4 standard with mid-air refuelling pods and longer-range software packages.

8. Cost, Timelines, and Challenges

The deal would cost an estimated $27 billion, making it India’s biggest solitary fighter acquisition. Although the G2G mode guarantees sooner induction possibly beginning in 2028 executing TASL’s and DRAL’s capacity growth to match delivery timelines will call for heavy investment. Incorporating Indian weapons requires stern flight testing, and integrating advanced manufacturing methods will be a challenge for the domestic aerospace industry workforce.

9. Lessons from the Battlefield

Operation Sindoor reports, including Pakistani assertions of shooting down Rafales with J-10Cs, have ignited international interest in Chinese-Western technical dynamics. Analysts caution that it is crucial to distinguish platform performance from pilot training and tactical environment. As Douglas Barrie of the International Institute for Strategic Studies noted, Air warfare communities. will be extremely interested to try and get as much ground truth as they can on tactics, techniques, procedures, what kit was used, what worked and what didn’t.

The IAF’s Rafale F4 drive is therefore more than a purchase it is a strategic wager on speed, technology advantage, and industrial change, intended to make India able to maintain air superiority within an ever more contested regional battlespace.