Ford’s newest foray in Louisville is not just a new model debut it’s a bid to rewrite the playbook on American EV production before Chinese carmakers take the lead for good. The planned $30,000 electric pickup, due in 2027, will be the first to emerge from a reimagined “assembly tree” manufacturing process aimed at reducing complexity, driving down costs, and head-to-head compete with the likes of the Xiaomi SU7.

1. The Chinese Competitive Shockwave

As Ford CEO Jim Farley took a Xiaomi SU7 for a six-month spin, he wasn’t indulging in curiosity he was studying a threat. The SU7 Max with a 101 kWh 800-volt battery pack, 497-mile CLTC range, and 2.78-second 0–62 mph acceleration, costs around $42,200 in China. Even the base model, which costs around $30,400, has acceleration faster than most Porsches, AI-powered driving, and Xiaomi smart home connectivity. Farley called it “fantastic” and admitted, “I don’t want to give it up.” In Europe, Chinese manufacturers now command market share equal to Mercedes-Benz, and in emerging markets, they’re booming on the basis of lower maintenance needs and minimal or no gasoline infrastructure demands.

2. Why Retrofitting Fails

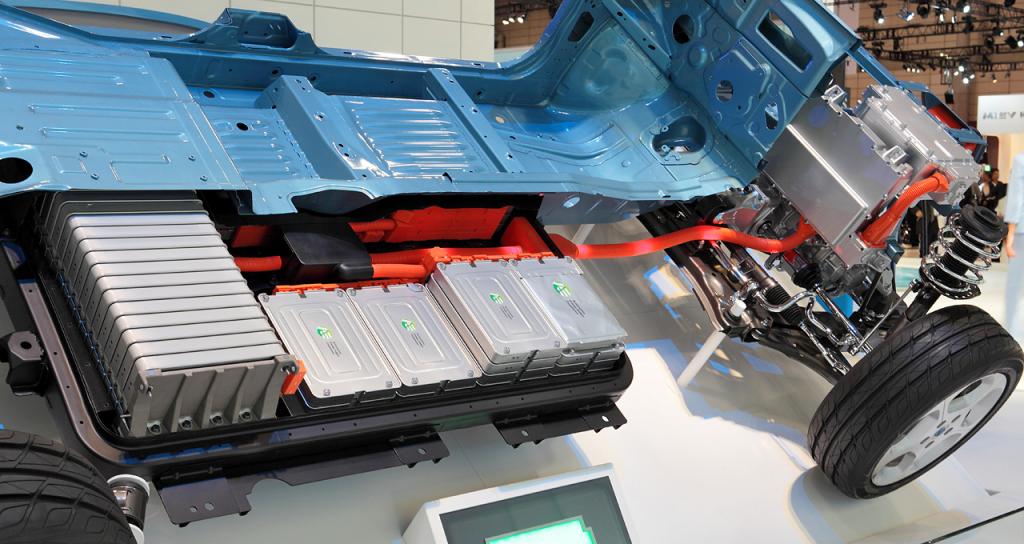

Ford’s current EVs the F-150 Lightning and Mustang Mach-E are built on gas platforms. This “new house renovated” approach requires sacrifice: dual cooling loops, over-wiring, and packaging inefficiencies that increase cost. Dedicated EVs, in turn, like Tesla’s Model 3 or BYD’s Seal, feature battery packs as structural elements, reducing part numbers and build time. The expense penalty is reflected in Ford’s EV division, which posted $2 billion losses during the first half of this year.

3. The ‘Assembly Tree’ Manufacturing Shift

Louisville’s retooled line will forgo the century-old conveyor model for a three-branch “assembly tree” where the battery, front, and rear sections meet. Ford estimates 20% fewer parts, half as many cooling hoses, and up to 15% quicker throughput. Alan Clarke, head of advanced EV development and a former Tesla engineer, stressed, “We’ve had to do hundreds of things to be able to meet this price point.” The concept mirrors process innovations already common in China, where digitalized manufacturing execution systems and robotic automation are standard.

4. Battery Technology as the Decisive Front

China’s lead in EV batteries is entrenched. CATL and FDB collectively supply over half the globe’s output, and 75% of lithium-ion cells globally are produced by Chinese firms. They’re promoting cobalt-free LFP chemistries, sodium-ion cells for low-cost EVs, and even solid-state protos via collaborations such as CASIP. BYD’s 1 MW “flash charging” system can deliver 400 km of range in five minutes well over three times Tesla’s Supercharger. In the US, GM’s new lithium manganese-rich (LMR) chemistry will save costs by leveraging more readily available manganese, but will not be production-ready until 2028.

5. Tariffs and Trade Barriers: A Shield For Now

Currently, Chinese EVs face a 100% US tariff on import, as well as stacked duties on batteries and critical minerals. These safeguards delay entry into the market but do not remove the cost difference Chinese EVs are potentially 20–40% cheaper to produce due to size, vertical integration, and minimum wages of $850/month. Experts warn that if Chinese OEMs establish U.S. plants, as BYD is predicted to do within the current presidential term, they will be able to avoid tariffs while sustaining technology advantages.

6. The Chinese Development Cycle Speed Advantage

Chinese EV makers are 30% faster in launching new models to market compared to conventional car makers. This is because they have in-house control of software, electronics, and batteries, allowing rapid iteration. BYD, for example, makes nearly all parts except glass and tires internally. Western OEMs, by contrast, assemble parts from multiple suppliers, adding cost and slowing development.

7. Export-Oriented Engineering

Ford’s $30K truck is designed for export markets, albeit with undisclosed destinations. This is reacting to the world around us: Chinese EV exports surged 70% in 2023 to $34.1 billion, with 40% going to Europe. BYD alone shipped 242,765 NEVs in 2023, a 334% increase, and is booking eight car carriers to increase capacity.

8. The Gap in Software and User Experience

In China, consumers are appealed to by AI assistants, gigantic infotainment displays, and comforts like in-car karaoke or drone connectivity. The SU7’s 16.1-inch display can be mirrored from a Xiaomi phone, and Nio’s GPT-powered “Nomi” can issue cabin features by voice. American brands have fallen behind in matching the level of digitization witnessed here, prioritizing instead quite more ride and handling characteristics less sought after by Chinese buyers.

9. The Stakes for U.S. Industry

The automobile industry supports 9.7 million American jobs and accounts for up to 3.5% of GDP. Allowing leadership in EVs to fall behind jeopardizes not just market share but the industrial base itself. As Farley explained, “If we lose this, we do not have a future at Ford.” Without cost, speed, and battery performance breakthroughs, even a redesigned assembly line can’t be counted on to keep up with China’s state-subsidized, vertically integrated goliath.