A single budget cycle can turn on its head decades of military-industrial balance. “How are you going to rebuild the Navy when you’re not ordering any ships in 2026? This is not inconsistency anymore, it is camouflaged abandonment,” Republican Senator Dan Sullivan proclaimed, his voice echoing across defense circles as the 2026 U.S. defense budget came with a thud. Behind the record-breaking $960 billion topline is a world of radical cuts, symbolic projects, and technical uncertainty, one that defense engineers and strategists now rush to understand.

1. Budgetary Volatility: Record Sums, Radical Cuts

The 2026 defense budget, touted by President Trump as “the most ambitious reconstruction tool ever allocated to the American military since the fall of the Soviet Union,” is a nominal 15% increase over last year. However, this front-page number conceals a greater structural disarray. The budget’s design discloses contradictions between declared goals and resources mobilized. Major programs Arleigh Burke destroyers, Constellation frigates, and Virginia-class submarines, are noticeably absent, even though they are cornerstones of U.S. naval capability and industrial stability. The outcome is a paradox: more funds, but diminished strategic clarity and production continuity.

2. The F-35A Shock: Engineering and Industrial Aftershocks

Maybe nowhere is the disruption more intense than in the Air Force’s fighter acquisition. The planned 2025 order for F-35As is cut in half, from 48 to just 24 in 2026. This cut not only threatens the industrial viability of the Lockheed Martin-led program but also sets off a cascade of technical and logistical problems. No way the Air Force or the country can afford to reduce the fighter buy rate,” cautioned Doug Birkey, the executive director for the Mitchell Institute for Aerospace Studies.

“The workforce, access to long-lead supply, everything that’s needed for keeping the capability to make [F-35s] and surge [when additional production is needed], you kill it with reductions like this.” The cost per ship increases as economies of scale disappear, and the supply base extending to more than 1,900 companies suffers “whiplash” and uncertainty, eroding today’s readiness and tomorrow’s innovation.

3. Naval Shipbuilding: Capacity Shortfalls and Chinese Momentum

The exclusion of new construction orders for Arleigh Burke destroyers and Constellation frigates in 2026 is more than a procurement glitch; it risks the very existence of the U.S. shipbuilding industrial base. American shipyards, already beset by vintage infrastructure and declining skilled manpower resources, cannot ride out a gap year without shedding jobs or planned slowdowns in production. In contrast, China’s shipyards are building warships at a rate that exceeds U.S. output manyfold, with perhaps 70% of PLAN warships commissioned since 2010 and a shipbuilding capacity estimated at 230 times the U.S. level. The PLAN’s speedy growth in destroyers, frigates, and VLS advanced vertical launch system cells is bridging qualitative and quantitative gaps, threatening to leave the U.S. Navy behind in aggregate VLS firepower by 2027.

4. The Golden Dome: Engineering Ambition or Procurement Mirage?

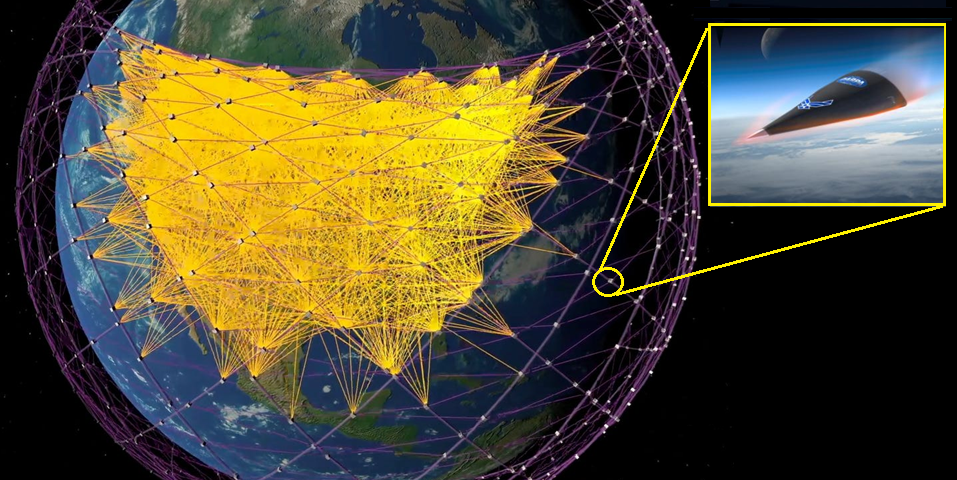

At the center of Trump’s missile defense plan is the Golden Dome missile defense system, a project touted as “the best system ever built,” designed to hit ballistic, hypersonic, and cruise missiles, even those shot from space. The $25 billion down payment is made, dwarfing Congressional Budget Office projections ranging over $500 billion over twenty years. Technical details remain sparse, but the concept involves a layered architecture of space-based sensors, boost-phase interceptors, and advanced command-and-control networks, an engineering challenge reminiscent of the Reagan-era “Star Wars” initiative. “I’m 34 years in this business; I’ve never seen an early estimate that was too high,” said Gen. Chance Saltzman, chief of space operations. The danger: a “military Solyndra effect,” as enormous investment in nascent technology provides little return on operation and drives an arms race to space.

5. Next-Generation Fighters: The F-47 and the Race for Air Superiority

While the old boats get the ax, the administration is doubling down on the Next Generation Air Dominance (NGAD) program, centered on Boeing’s F-47. The F-47 will be the most advanced, most capable, most dangerous plane ever made,” President Trump stated. The aircraft features next-generation stealth, sensor fusion, and a modular design and will have “significantly longer range” than the F-22 and operate with unmanned Collaborative Combat Aircraft (CCAs) (Vox). But the pressure to rush the F-47’s development to operational readiness by 2028 threatens to repeat the rapid development cycles and cost blowouts of the program’s early days, recalling the first bout of F-35 turmoil. The Chinese J-35A and J-20 are not yet operationally equivalent, but American dominance is no longer a given.

6. Hypersonic Weapons: Technical Realities and Strategic Gaps

The budget’s focus on hypersonic missile design and test infrastructure indicates increasing awareness of the PLA’s operational advantage. China’s DF-17 with the DF-ZF hypersonic glide vehicle can travel at Mach 5–10 speeds and hit targets up to 2,500 km away, faster than U.S. current defenses (Vox). The U.S. is still in the testing stage for technologies such as the Long-Range Hypersonic Weapon, with gigantic engineering hurdles to overcome in propulsion, guidance, and heat management. The promise of the Golden Dome to counter such attacks remains, at least so far, more hope than achievement.

7. Engineering Governance: Symbolism Over Structural Coherence

One of the defining characteristics of the 2026 budget is what analysts have dubbed the “symbolic presidentialization” of military planning. Money pours disproportionately to projects related to the administration in power, Golden Dome, F-47, and is squeezed or terminated from foundation programs and legacy system maintenance. This politicization interferes with the engineering and procurement cycles that form the basis of military preparedness. “We no longer know whether to persuade with facts or with slogans,” one program manager whispered. The outcome is a defense industrial base between changing priorities, uncertain financing, and declining confidence in long-term planning.

The total of these industrial and engineering shocks is a military instrument that is still imposing in appearance but growing more fragile on the inside. Pentagon officers themselves complain of “budgetary arbitrariness” and diminishing doctrinal coherence. Through a time of unparalleled geopolitical turbulence and technological velocity, the relative disconnection of strategy and engineering could be a weakness more fundamental than any appropriation reduction or program elimination.