“This is a wake-up call for everybody who has wagered on the car business.” When the world’s biggest auto components maker, Marelli, bankrupted in June 2025, it wasn’t a business story

a ripple that spread out across America’s industrial midsection. Its following collapse fueled by imposition of new 25% tariffs has had industry managers, policymakers, and pundits listening to the elasticity of today’s automotive supply chains.

As the dust settles, the conversation has shifted from short-term survival to long-term transformation. The industry now faces a crossroads: will it double down on old models, or embrace emerging technologies and strategies to build resilience? Here are nine critical developments that are shaping the future of auto supply chains, from digital inventories to blockchain and beyond.

1. Marelli’s Bankruptcy: A Warning Shot for the Industry

Marelli, the premier supplier to Tesla, Stellantis, and Nissan, is the first major auto industry victim to totally fall apart as a direct result of the latest tariffs cycle. Its amply over-$700 million debt and $1.1 billion bailout loan reveal precisely how policy disruption brings down even the greatest giants. Tariffs have “severely affected” import- and export-focused business of Marelli, CEO David Slump says (tariffs have severely affected).

This meltdown is clear economically it’s an indication that the whole value chain can be susceptible to geopolitical quakes, and any firm cannot remain insulated from ripple effects of trade wars throughout the whole world.

2. The Human Cost: Jobs and Communities at Stake

Marelli’s bankruptcy puts thousands of jobs at risk, especially in the Midwest and South, where auto manufacturing remains a pillar of local economies. Entire communities are bracing for layoffs, reduced hours, and shuttered small businesses. As a Michigan community leader put it, “Our town depends on these factories.” The ripple effects extend beyond direct employees, threatening suppliers, diners, and even school funding (communities that rely on Marelli).

Their relations are strained, and the supply chain interdependence and local livelihood interdependence is exposed.

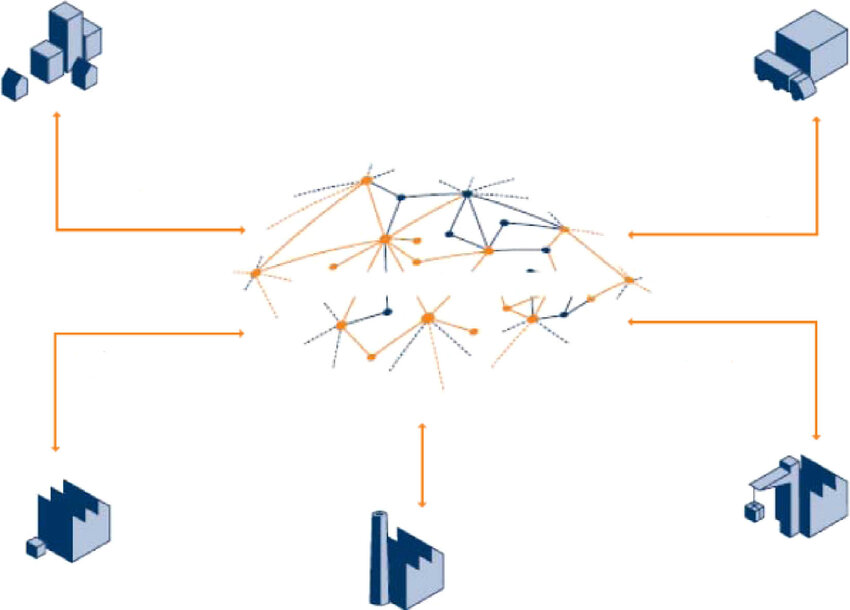

3. Tariffs Revealing Supply Chain Interdependencies

The final thing for Marelli was the necessity of the new 25% tariffs on the arriving auto parts and autos. Executives nonetheless commented, “The tariffs were the last straw.” Relief on rebuy was momentary only but both the sudden cost hike as well as foreign sourcing complexities left companies in a daze (rebate system soon thereafter).

This initiative demonstrates the speed at which trade policy can re-design supply chains, which in turn compels companies to rethink their approach to risk management, pricing capability, and procurement.

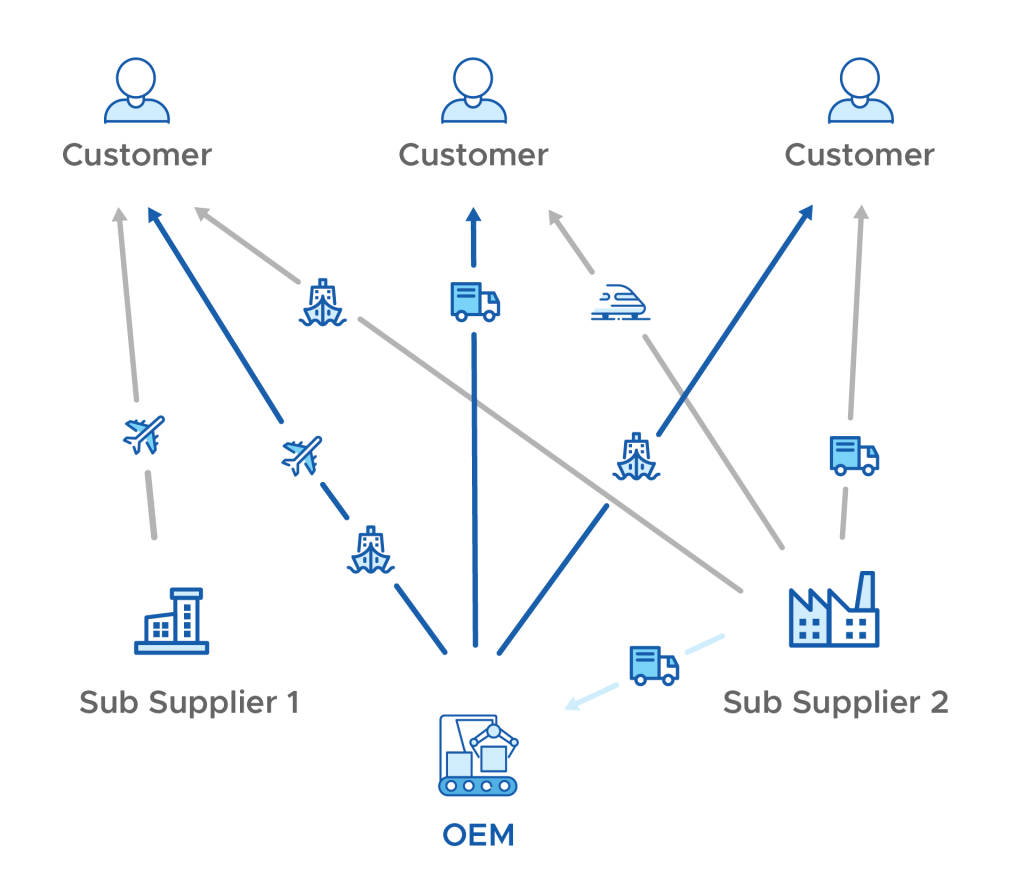

4. 3D Printing and Digital Inventories: New Era for Supply Chains

Automotive original equipment makers (OEMs) are increasingly relying on 3D printing and virtual inventories in an effort to cut their reliance on foreign supply chains. Storing parts in computer form and printing them as needed, companies such as Auto Additive and Autentica cut out lead times and storage expense (automotive 3D printing with digital inventories).

In a publicity stunt, General Motors circumvented 30,000 Chevrolet Tahoes delivery delay by manufacturing 60,000 end-of-run spoiler seals in five weeks using 3D printing, sidestepping conventional bottlenecks. This transition towards localized, on-demand manufacturing is redefining resilience and sustainability in the automotive industry.

5. Blockchain: Tap Transparency and Trust

Blockchain technology is also used to minimize supply risk and maximize transparency. Blockchain permits everyone to track transactions, confirm compliance, and establish trust even for sophisticated, multi-party systems (blockchain permits everyone to track transactions).

In automotive manufacturing, virtual inventories like Autentica on blockchain have application in the use of NFT for intellectual property and authentication of CAD files. As quoted by Autentica CEO Irma Gilbert, “NFTs provide a unique identifier for every file, so the digital asset is locked and can be accessed only as intended by the OEM.”

6. The Need for Local and Adaptive Production

Tariff shock and supply chain responses to the industry have also put the local-for-local manufacturing use case in the spotlight again. OEMs and private equity players are once again considering their global footprint, with some localising production in development initiatives to insulate their business from trade tariffs (preferring a local-for-local footprint).

But then again, as Triton Partners’ Michael Gahleitner hypothesises, “sometimes it is just not possible because it is not cost competitive, then you have to weigh how much pricing power you have and how much risk you are willing to take on.” Tightrope walking on the cost-cut measure and risk fear is top priority when the supply chain strategy is mentioned.

7. AI and Emerging Technology’s Role in Resilience

Technologies like 4.0 that include AI, digital twins, and IoT are offering end-to-end real-time visibility and predictive analytics to supply chain leaders. Gen AI is already being used to perform procurement, demand planning, and scenario analysis, while quantum computing has even more optimization potential (Gen AI is already being used to perform procurement).

They facilitate faster and smarter decision-making to allow companies to stay sensitive to disruption and utilize the maximum potential of the network structure in a situation of uncertainty.

8. Regulation and Insurance Challenges for 3D-Printed Parts

3D printing for repairing vehicles also involves insurance and regulatory concerns. The 3D Printing in Auto Repair Task Force identifies that a regulatory body is needed to confirm on-demand-manufactured parts are meeting satisfactory quality and safety standards (regulatory body need).

Insurers are presented with fewer car downtime hours not paying for poor-quality parts causing higher claims. Rigorous quality controls are required in gaining insurers’ and customers’ confidence with digital manufacturing adding more strength.

9. The Road Ahead: Adaptation, Consolidation, and Policy Debate

Marelli’s bankruptcy is likely just the beginning. Industry surveys show that 66% of experts expect the automotive sector to face significant distress in 2025 (66% of respondents expecting it to be the industry most likely to face significant distress in 2025). The sector is entering a period of consolidation, with competitors poised to fill gaps and smaller firms at risk of being squeezed out.

Policymakers and business leaders are now debating how to balance protectionism, innovation, and job security. The choices made in the coming months will shape the future of American manufacturing for years to come.

Marelli’s fall is more than a cautionary tale it’s a catalyst for transformation. As tariffs and technological disruption converge, the automotive industry is being forced to rethink every link in its supply chain. Those who adjust in their investments in new technologies, nearshoring, and open networks will not only survive but prosper in a new world of flexible, responsive production. The lessons of 2025 are clear: flexibility is no longer an option and the future will belong to those who plan ahead of demand.